Portfolio Update

There were only a couple of changes to the portfolio this month, which slightly reduced the bearish tilt of Our Man’s portfolio.

- Treasury Bonds: The TLT position was halved as month-end approached after 20-30yrs Treasuries tightened back towards their low yields on fears around Europe and the possibility of QE3 in the US.

- Energy Efficiency: The XIDE position was added to near month-end after the company’s stock had started to recover following a sharp fall earlier in the month.

Performance Review

Unsurprisingly, given the portfolio’s large cash hoard, the portfolio did not show much volatility throughout November and ended the month up +0.4% (+8.1% YTD). Unlike recent months, which have been characterized by sharp movements in stocks and bonds, November was a far tamer month and this was reflected in the performance across the portfolio’s buckets.

The main impact to performance came from the NCAV (+20bps), Value Equities (+37) and Energy Efficiency books (-74bps). The NCAV book benefited from a takeover bid for one of the holdings, which will likely be exited in December (assuming no counter-bid is forthcoming). In the Value Equities book, the DRWI position was solid contributor, after the company came to an attractive agreement to buy a business segment from Nokia-Siemens that will have a substantial impact on DRWI’s revenues. However, while Our Man may have been patient waiting for XIDE, in the Energy Efficiency book, to come back to an attractive entry price, he would have been better off waiting a month. The company announced disappointing numbers in November, and was particularly hurt as it also revealed that one of its recycling plants in Portugal had intentionally misstated inventory & production numbers. While the company’s investigation suggests that only this one planted was affected, the stock lost over 1/3 of its value within a couple of days. Our Man added to the position towards the end of the month, as the selling seemed to subside, bringing it up to c1.6%.

Elsewhere, the Treasuries (+17bps) and Bond Funds (+15bps) benefited from a mild tightening in yields and reduced stress in the credit markets, while the uncertainty in Europe and resulting weakness in the Euro helped the Currencies book (+24bps). The China-related thesis (+4bps) benefited from continued concern about weakness in China, while the Other Equities (+1bp) book benefited from a dividend. The Puts/Hedges book (-8bps) suffered as the Dec-11 options burnt through their premium and are now largely worthless.

Portfolio (as at 11/30 - all delta and leverage adjusted, as appropriate)

14.7% - Bond Funds (DLTNX and HSTRX)

5.7% - Value Idea Equities (THRX, and DRWI)

4.8% - Treasury Bonds (TLT)

2.1% - NCAV Equities

1.8% - Energy Efficiency (AXPW, and XIDE)

0.0% - Other Equities (none)

-1.6% - China-Related Thesis (6bps premium in FCX Jan-12 put, and 45bps premium in EWZ Jan-13 puts)

-4.1% - Hedges/Put Options (1bps premium in S&P Dec-11 puts, 86bps in IWM Jan-13 puts, and 18bps SLV Jan-12 puts)

-8.9% - Currencies (EUO – Short Euro)

64.7% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, DLTNX, HSTRX, THRX, DRWI, AXPW, XIDE, FCX puts, EWZ puts, SPY puts, IWM puts, SLV puts, and EUO). He also holds some cash. You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you.

Saturday, December 3

Thursday, November 10

NCAV 2011-3

The third NCAV update of the year has been much delayed, as the screen failed to show up any new names that could be added to the Absolute Value/NCAV bucket portfolio (for information on this bucket, and how it works, read here). However, on new name came up in recent days, passed the qualitative overlay, and was added to the portfolio. It was:

- OPXT (Opnext Inc) which had a market cap of $98mn (vs. a 65% NCAV of $101.5mn at the end of Q3)

While the screen is a valuable tool, a number of names were removed during the simple qualitative overlay;

- As Our Man has discussed previously, Chinese companies (listed in the US) that come up on the screen are currently being excluded due to the number of frauds within their ranks (see DGW, JGBO, Sino-Forest, Longtop Financial, etc for just 4 examples) . Like all screens, Our Man’s NCAV screen is reliant upon the quality of the data going into it and the number of recent Chinese-based frauds listed in the US argues for their exclusion.

- A number of Financial companies were excluded, due to their different definition of Current Assets or the screen mistakenly using Total Assets (instead of Current Assets) to pass them.

- A number of companies were excluded as the data used in the screen was sufficiently dated to be of no great value (i.e. 2010 year-end).

One existing name (TWMC) reappeared on the screen. As such, the final date that this name must be sold by has been extended (here are the rules when NCAV names are sold). Finally, as noted in the recent monthly update, AVTR & IESC, had now spent 366+ days in the portfolio since last appearing in the NCAV screen so were removed from the portfolio.

- OPXT (Opnext Inc) which had a market cap of $98mn (vs. a 65% NCAV of $101.5mn at the end of Q3)

While the screen is a valuable tool, a number of names were removed during the simple qualitative overlay;

- As Our Man has discussed previously, Chinese companies (listed in the US) that come up on the screen are currently being excluded due to the number of frauds within their ranks (see DGW, JGBO, Sino-Forest, Longtop Financial, etc for just 4 examples) . Like all screens, Our Man’s NCAV screen is reliant upon the quality of the data going into it and the number of recent Chinese-based frauds listed in the US argues for their exclusion.

- A number of Financial companies were excluded, due to their different definition of Current Assets or the screen mistakenly using Total Assets (instead of Current Assets) to pass them.

- A number of companies were excluded as the data used in the screen was sufficiently dated to be of no great value (i.e. 2010 year-end).

One existing name (TWMC) reappeared on the screen. As such, the final date that this name must be sold by has been extended (here are the rules when NCAV names are sold). Finally, as noted in the recent monthly update, AVTR & IESC, had now spent 366+ days in the portfolio since last appearing in the NCAV screen so were removed from the portfolio.

Saturday, November 5

October Review

Portfolio Update

As the recent Portfolio Thoughts piece hinted, there were a number of changes to the portfolio in the last few days of October which gave the portfolio a more bearish tone.

- Puts/Hedges: The Jan-12 puts on the Russell 2000 Index (IWM) was sold early in the month, after the Russell (and S&P) bounced off their year-to-date lows. Later in the month, as the market rebounded, Jan-13 puts on the Russell 2000 (IWM) were added to the portfolio and the position in XIV was also sold. The XIV position was a disappointment and negative contributor. It’s clearly not an instrument to be bought early, when things can remain very volatile, and Our Man would have been better off sacrificing some potential upside and selling some of his puts.

- Other Equities: Sold NWS and CMTL, and wrote SOAP down to zero. Our Man was finally able to see the positions in NWS and CMTL at the end of the October. The SOAP position would have been sold too, but it’s value ($1.50) is less than the commission cost of selling it (SOAP essentially liquidated itself back in 2009 and returned all of its cash back to shareholders, leaving just a shell) and thus it was written down to 0, so Our Man doesn’t have to track it any more.

- Energy Efficiency: A c2% position in Exide (XIDE), a lead-acid battery maker, was added to the portfolio. Our Man’s interest in Lead-Acid battery makers is largely due to the need (and regulations) for increased fuel efficiency and the unsuitably of the newer technologies for that purpose. The more alert of you may remember that Our Man discussed missing out on buying XIDE last year; well, the best things come to those who wait and after a wild ride (from $4 to $12 and down again), XIDE is at the same level as it was back then!

- Short China Thesis: A Jan-13put position in the MSCI Brazil Index (EWZ) was added. The index is largely made up of Brazilian raw materials and financials companies. In essence, Our Man views it a ricochet play on a Chinese slowdown, with a helping of local Brazilian financial/credit issues thrown in.

- NCAV: Two stocks were removed from the portfolio (AVTR & IESC) after both had been in the portfolio for >1year since they last passed the screen. There are likely to be a couple of additions to this portfolio in November, so look out for an NCAV update soon!

Performance Review

While the S&P posted its best month in decades, rising by over 10%, the portfolio posted a small loss of -0.9% (YTD: +7.7%). Given the portfolio’s bearish positioning this should not be surprising, and there was very little that drove performance apart from the strong shift away from “safer” assets towards more risky ones during October.

The losses were primarily centred on the 3 books where this bearish tilt is most obvious; Treasury Bonds, China, and Puts/Hedges. The Treasury Book (-38bps) suffered as risk appetite increased during the month, though its substantially reduced size meant the impact on performance was minor when compared to the contributions from the book over the summer. Both the China-related thesis (-48bps) and the Puts/Hedges book (-80bps) are short-biased, and gave up substantially all of their September gains as the market rallied. The Currencies (-33bps) was another negative contributor, as hopes of that Europe’s continued solvency and liquidity issues were being solved rose during the month.

These losses were partially offset from the performance in the various books that are long equities. The Value Equities (+57bps), Other Equities (+37bps) and NCAV (+15bps) posted decent performance despite the lack of major news flow on their underlying names. The Energy Efficiency book (-12bps) posted a small loss, again on no great news.

Finally, the Bond Funds (+9bps) contributed, largely benefiting from the non-Treasury or non-Bond holdings within the underlying funds' portfolios.

Portfolio (as at 10/31 - all delta and leverage adjusted, as appropriate)

14.6% - Bond Funds (DLTNX and HSTRX)

8.9% - Treasury Bonds (TLT)

5.4% - Value Idea Equities (THRX, and DRWI)

2.1% - Energy Efficiency (AXPW, and XIDE)

1.4% - NCAV Equities

0.0% - Other Equities (none)

-1.9% - China-Related Thesis (11bps premium in FCX Jan-12 put, and 37bps premium in EWZ Jan-13 puts)

-4.6% - Hedges/Put Options (8bps premium in S&P Dec-11 puts, 82bps in IWM Jan-13 puts, and 23bps SLV Jan-12 puts)

-9.0% - Currencies (EUO – Short Euro)

61.5% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, DLTNX, HSTRX, THRX, DRWI, AXPW, XIDE, FCX puts, EWZ puts, SPY puts, IWM puts, SLV puts, and EUO). He also holds some cash. You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you.

As the recent Portfolio Thoughts piece hinted, there were a number of changes to the portfolio in the last few days of October which gave the portfolio a more bearish tone.

- Puts/Hedges: The Jan-12 puts on the Russell 2000 Index (IWM) was sold early in the month, after the Russell (and S&P) bounced off their year-to-date lows. Later in the month, as the market rebounded, Jan-13 puts on the Russell 2000 (IWM) were added to the portfolio and the position in XIV was also sold. The XIV position was a disappointment and negative contributor. It’s clearly not an instrument to be bought early, when things can remain very volatile, and Our Man would have been better off sacrificing some potential upside and selling some of his puts.

- Other Equities: Sold NWS and CMTL, and wrote SOAP down to zero. Our Man was finally able to see the positions in NWS and CMTL at the end of the October. The SOAP position would have been sold too, but it’s value ($1.50) is less than the commission cost of selling it (SOAP essentially liquidated itself back in 2009 and returned all of its cash back to shareholders, leaving just a shell) and thus it was written down to 0, so Our Man doesn’t have to track it any more.

- Energy Efficiency: A c2% position in Exide (XIDE), a lead-acid battery maker, was added to the portfolio. Our Man’s interest in Lead-Acid battery makers is largely due to the need (and regulations) for increased fuel efficiency and the unsuitably of the newer technologies for that purpose. The more alert of you may remember that Our Man discussed missing out on buying XIDE last year; well, the best things come to those who wait and after a wild ride (from $4 to $12 and down again), XIDE is at the same level as it was back then!

- Short China Thesis: A Jan-13put position in the MSCI Brazil Index (EWZ) was added. The index is largely made up of Brazilian raw materials and financials companies. In essence, Our Man views it a ricochet play on a Chinese slowdown, with a helping of local Brazilian financial/credit issues thrown in.

- NCAV: Two stocks were removed from the portfolio (AVTR & IESC) after both had been in the portfolio for >1year since they last passed the screen. There are likely to be a couple of additions to this portfolio in November, so look out for an NCAV update soon!

Performance Review

While the S&P posted its best month in decades, rising by over 10%, the portfolio posted a small loss of -0.9% (YTD: +7.7%). Given the portfolio’s bearish positioning this should not be surprising, and there was very little that drove performance apart from the strong shift away from “safer” assets towards more risky ones during October.

The losses were primarily centred on the 3 books where this bearish tilt is most obvious; Treasury Bonds, China, and Puts/Hedges. The Treasury Book (-38bps) suffered as risk appetite increased during the month, though its substantially reduced size meant the impact on performance was minor when compared to the contributions from the book over the summer. Both the China-related thesis (-48bps) and the Puts/Hedges book (-80bps) are short-biased, and gave up substantially all of their September gains as the market rallied. The Currencies (-33bps) was another negative contributor, as hopes of that Europe’s continued solvency and liquidity issues were being solved rose during the month.

These losses were partially offset from the performance in the various books that are long equities. The Value Equities (+57bps), Other Equities (+37bps) and NCAV (+15bps) posted decent performance despite the lack of major news flow on their underlying names. The Energy Efficiency book (-12bps) posted a small loss, again on no great news.

Finally, the Bond Funds (+9bps) contributed, largely benefiting from the non-Treasury or non-Bond holdings within the underlying funds' portfolios.

Portfolio (as at 10/31 - all delta and leverage adjusted, as appropriate)

14.6% - Bond Funds (DLTNX and HSTRX)

8.9% - Treasury Bonds (TLT)

5.4% - Value Idea Equities (THRX, and DRWI)

2.1% - Energy Efficiency (AXPW, and XIDE)

1.4% - NCAV Equities

0.0% - Other Equities (none)

-1.9% - China-Related Thesis (11bps premium in FCX Jan-12 put, and 37bps premium in EWZ Jan-13 puts)

-4.6% - Hedges/Put Options (8bps premium in S&P Dec-11 puts, 82bps in IWM Jan-13 puts, and 23bps SLV Jan-12 puts)

-9.0% - Currencies (EUO – Short Euro)

61.5% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, DLTNX, HSTRX, THRX, DRWI, AXPW, XIDE, FCX puts, EWZ puts, SPY puts, IWM puts, SLV puts, and EUO). He also holds some cash. You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you.

Thursday, October 27

After Half-Term Ponderings: Portfolio Thoughts

In the last post, Our Man discussed what he thought of the world and the factors that were a part of that decision. While opinion is important, it’s how it’s executed within a portfolio that determines success; so, as promised, let’s have a look at what this all means for Our Man’s portfolio.

Since early August the market had largely been pinned in a range between 1,120 and 1,220 and as we came into October, Our Man’s hope was that it might tumble in the low 1000’s before a combination of oversold stocks and some “positive” news flow would spark a rally. However, while the S&P did dip beneath 1,100 for a few days, it rallied far sooner than Our Man expected, and thus he only eased out some of the existing puts (IWM) early in this rally.

The rally has broken out of the top-end of the 1,120 to 1,220 range (reaching 1,280+ today) but Our Man remains of the belief that it’s a bear market rally, that’s being driven by a number of issues including:

- a European solution that’s full of leverage and hope but short on specifics;

- a solid but unspectacular Q3 Earnings (and the subsequent cries of “see, companies are fine”);

- a blind belief that China’s problems are behind it; and

- a focus on decent US macro coincident data (e.g. Q3 US GDP, +2.5%) but the ignorance of weak leading data.

Like all bear market rallies, Our Man expects it to end on good news (think TARP being approved back in 2008), and thus is predominantly looking for opportunities to roll some of the existing puts (i.e. sell the SPY puts that expire in Dec-11 with a strike at 100, and use the funds to help partially fund Dec-12 puts with a 100 strike) and add more puts/hedges as the market rallies to broaden out the Puts/Hedges portfolio and fully reflect his bearishness.

Thus, while the portfolio has a small bearish tilt to it at the moment, it’s likely to have a far more pronounced bearish tone in the coming months. So, what will OM be buying puts on to express his bearishness?

- Market indices

This is the broadest hedges that OM is looking at. They are predominantly broad US Indices, with strikes 20-25% out of the money (i.e. the market would need to fall this amount, before the puts would be profitable, if held till expiration). These would likely be on the IWM (Russell 2000) and SPY (S&P 500)

- Consumer Discretionary, especially high-end

The era of easy credit in the US, especially since the 1990’s, has managed to fuel a number of major bubbles. Most of the obvious ones, the Tech and the Housing bubbles, have burst but another remains; the US consumer. Like the Housing bubble (“House prices don’t fall nationally”) the US consumer has its own little tagline; “don’t bet against the US consumer”. What’s more the stocks in this space, especially at the high-end, have benefited from a boost from Emerging Markets consumers and investors’ extrapolation of how large this impact will be in coming years. This has resulted in the stocks comfortably out-performing the market (e.g. XLY – the S&P Consumer Discretionary ETF) and a number reaching all-time highs. With Our Man’s thoughts on deleveraging (if you’re saving, you’re not spending….and if you’re unemployed, you’re spending on staples not discretionary items) and skepticism on the China consumer story, it’s not a surprise that Consumer Discretionary is an area that falls into the nexus of things he’s looking at. Our Man’s focus is on the ETFs in the space (e.g. the aforementioned XLY) and especially some high-end retailers (e.g. TIF – Tiffany’s).

- China-Thesis

I’m sure you don’t want Our Man to repeat his thoughts on China, though if you do then I’d go here, then here and finally here. Things like recent (and largely ignored) Bank recapitalizations/bailouts and inflation at c6% (before any possible ECB/Fed/etc quantitative easing) help Our Man remain a skeptic. The ways he’s looking to play it haven’t changed much either and the focus remains on the commodity-related companies and countries (e.g. Brazil and Australia). Additionally, some of the above-mentioned plays on consumer spending (which will be in the Puts/Hedges book) will be strongly correlated to the China thesis.

So, now that we know where Our Man will be looking to build up his bearish exposure, all that remains is how large will this exposure be and when will he do it. Unfortunately, that’s not a simple answer as the price of the put options (once you know the strike price and expiry) depends on many things including the time to expiry, implied volatility and the current price of the underlying instrument. Thus the best explanation is to say that if everything goes as Our Man’s hoping (a small pull-back, followed by a rise to new highs during November) he’ll be looking to build up the positions over the next month until the portfolio has 250-400bps of risk. Should the market continue to rally into 2012 and Our Man retain his bearishness, he’ll likely add another 100bps or so of risk to the portfolio. In this way, Our Man will have defined risk (a maximum loss of 4-5% of his capital, by the end of 2012) should his expectations of significant declines prove mistaken, but retain significant short exposure to the market in the meantime. Given this likely significant negative exposure, Our Man may take the opportunity to partially offset this by adding to some the existing themes in the book including Energy Efficiency (through battery or LED companies), Value (if he can find compelling opportunities, or if the existing positions warrant being added to) and potentially finally starting investing his Water theme.

Since early August the market had largely been pinned in a range between 1,120 and 1,220 and as we came into October, Our Man’s hope was that it might tumble in the low 1000’s before a combination of oversold stocks and some “positive” news flow would spark a rally. However, while the S&P did dip beneath 1,100 for a few days, it rallied far sooner than Our Man expected, and thus he only eased out some of the existing puts (IWM) early in this rally.

The rally has broken out of the top-end of the 1,120 to 1,220 range (reaching 1,280+ today) but Our Man remains of the belief that it’s a bear market rally, that’s being driven by a number of issues including:

- a European solution that’s full of leverage and hope but short on specifics;

- a solid but unspectacular Q3 Earnings (and the subsequent cries of “see, companies are fine”);

- a blind belief that China’s problems are behind it; and

- a focus on decent US macro coincident data (e.g. Q3 US GDP, +2.5%) but the ignorance of weak leading data.

Like all bear market rallies, Our Man expects it to end on good news (think TARP being approved back in 2008), and thus is predominantly looking for opportunities to roll some of the existing puts (i.e. sell the SPY puts that expire in Dec-11 with a strike at 100, and use the funds to help partially fund Dec-12 puts with a 100 strike) and add more puts/hedges as the market rallies to broaden out the Puts/Hedges portfolio and fully reflect his bearishness.

Thus, while the portfolio has a small bearish tilt to it at the moment, it’s likely to have a far more pronounced bearish tone in the coming months. So, what will OM be buying puts on to express his bearishness?

- Market indices

This is the broadest hedges that OM is looking at. They are predominantly broad US Indices, with strikes 20-25% out of the money (i.e. the market would need to fall this amount, before the puts would be profitable, if held till expiration). These would likely be on the IWM (Russell 2000) and SPY (S&P 500)

- Consumer Discretionary, especially high-end

The era of easy credit in the US, especially since the 1990’s, has managed to fuel a number of major bubbles. Most of the obvious ones, the Tech and the Housing bubbles, have burst but another remains; the US consumer. Like the Housing bubble (“House prices don’t fall nationally”) the US consumer has its own little tagline; “don’t bet against the US consumer”. What’s more the stocks in this space, especially at the high-end, have benefited from a boost from Emerging Markets consumers and investors’ extrapolation of how large this impact will be in coming years. This has resulted in the stocks comfortably out-performing the market (e.g. XLY – the S&P Consumer Discretionary ETF) and a number reaching all-time highs. With Our Man’s thoughts on deleveraging (if you’re saving, you’re not spending….and if you’re unemployed, you’re spending on staples not discretionary items) and skepticism on the China consumer story, it’s not a surprise that Consumer Discretionary is an area that falls into the nexus of things he’s looking at. Our Man’s focus is on the ETFs in the space (e.g. the aforementioned XLY) and especially some high-end retailers (e.g. TIF – Tiffany’s).

- China-Thesis

I’m sure you don’t want Our Man to repeat his thoughts on China, though if you do then I’d go here, then here and finally here. Things like recent (and largely ignored) Bank recapitalizations/bailouts and inflation at c6% (before any possible ECB/Fed/etc quantitative easing) help Our Man remain a skeptic. The ways he’s looking to play it haven’t changed much either and the focus remains on the commodity-related companies and countries (e.g. Brazil and Australia). Additionally, some of the above-mentioned plays on consumer spending (which will be in the Puts/Hedges book) will be strongly correlated to the China thesis.

So, now that we know where Our Man will be looking to build up his bearish exposure, all that remains is how large will this exposure be and when will he do it. Unfortunately, that’s not a simple answer as the price of the put options (once you know the strike price and expiry) depends on many things including the time to expiry, implied volatility and the current price of the underlying instrument. Thus the best explanation is to say that if everything goes as Our Man’s hoping (a small pull-back, followed by a rise to new highs during November) he’ll be looking to build up the positions over the next month until the portfolio has 250-400bps of risk. Should the market continue to rally into 2012 and Our Man retain his bearishness, he’ll likely add another 100bps or so of risk to the portfolio. In this way, Our Man will have defined risk (a maximum loss of 4-5% of his capital, by the end of 2012) should his expectations of significant declines prove mistaken, but retain significant short exposure to the market in the meantime. Given this likely significant negative exposure, Our Man may take the opportunity to partially offset this by adding to some the existing themes in the book including Energy Efficiency (through battery or LED companies), Value (if he can find compelling opportunities, or if the existing positions warrant being added to) and potentially finally starting investing his Water theme.

Tuesday, October 18

After Half-Term Ponderings: Where Our Man stands

Our Man has raised a lot of cash in the portfolio over the last couple of months, largely as a result of the exiting most of his Treasury Bond positions as yields fell sharply (and prices rose). This, of course, leads to the question…what’s he going to do with it? To get to the bottom of this, it would help to know what Our Man’s baseline macro views and expectations are as well as where and when he’s looking to take some risk.

While there has been positive news in recent weeks, it has done little to diminish Our Man’s bearish mindset. Unfortunately, despite the talk and the plans, Our Man believes we’ve reached the point where the size of the problems we face is beyond the scope of the politicians and central bankers to solve. As regular readers will know, Our Man believes we’re in a balance sheet recession; there are no simple and easy solutions to a debt-driven crisis. Thus while the talk is about just how massive and impressive the latest European bailout plan is, to Our Man it is merely reminiscent of Paulson’s bazooka talk in the Summer of 2008. The mere idea of leveraging Germany, France et al’s commitments to the bailout fund fails to acknowledge the simple premise that this is not a liquidity issue but a solvency one, and that the problem of excess debt cannot be solved by the issuance of (and increase in) more debt. So, while more banks will be bailed out (without debt holders being haircut) and there’s the possibility of QE3 from the FED or some minor stimulus program in the US, once more the moves will only solve an imaginary counter-factual (if we’d not done this, then things would be worse) without encroaching on the real world issues.

For equity investors, the long-term impact of the steady increase in leverage (especially since the 1980’s at the household level) has helped smooth economic cycles and led to numerous distortions in the market. Furthermore, whenever the economy slows down, politicians & central bankers have become accustomed to using measures that foster an increase in debt (think lowering interest rates so you can refinance your home, or take out a loan, more easily) as their policy of choice. The problem now is that despite record low interest rates and ample liquidity (thanks to the Fed’s rate cuts, Quantitative Easing, Operation Twist, etc) loan growth continues to be stagnant; there is no demand! This lack of demand and the deleveraging, through both default and increased saving (i.e. reduced consumption), is something that equity investors should pay attention to.

In the longer-term, as Our Man has mentioned before, with interest rates losing their potency (now we’re stuck at 0% rates) and demand stagnant, it becomes less likely that policy makers will be able to smooth the economic cycle. As such, we should expect the choppier growth of recent years rather than the consistent economic cycles we’ve become accustomed to. Furthermore, the disinflationary tendencies of a balance sheet recession mean that pricing power is likely to be more curtailed (no demand means it’s harder to push price increases through). Combining these factors, means that over time Our Man is expecting stocks to exhibit greater cyclicality (as the magnitude of the cycles becomes more pronounced) and also to exhibit greater volatility (as the cycles become less smooth and more choppy). These are, of course, the enemies of the buy-and-hold and value-driven investor. The volatility affects the investor’s ability to hold his position from point A to point B, and means that the flight-path becomes as important as the destination. The increased cyclicality will lead to a derating of equities as a greater risk premium should be introduced by investors to account for the more cyclical nature of equities but also due to investors’ long-term expectations proving overly ambitious (due to the deflationary/disinflationary environment limiting pricing power).

In the short-run, none of this would matter if stocks were at low valuations and margins were at or near cyclical lows. Sadly, as the recent Chartology posts showed, neither is the case. Now, certainly the use CAPE (or Shiller P/E’s) isn’t flawless, but like other long-term measures of valuation (e.g. Tobin’s Q), it does have a strong historical track record of long-term success. So why does Our Man use the CAPE? Well, it’s cyclically-adjusted…the Earnings part of the equation has been smoothed for a cycle, meaning the margins are those that reflect a full cycle (not a point in time) and that the figure takes into account the write-offs that inevitably come from the irrational exuberance of the peak. Bear these factors in mind, when you next hear a Wall Street talking head say the market is cheap based on forward earnings (or even more egregiously forward operating earnings, which pretend we live in a fairytale world and ignore all the write-offs/etc). Not only is the analyst assuming that the margins (currently at a record high) will persist at their current level infinitely, they’re not even using the actual earnings but their projections of the future which they then compare to a historical norm (i.e. the market’s average Price-to-(trailing) Earnings, or PE, is 15)!

So, in short; the underlying major issues are not being tackled by the politicians/central bankers, equities are going to be more cyclical & volatile (and thus de-rated, or trade at lower multiples) in the future, and they’re also currently trading at high valuations at a time when they have close to record high margins. I think it is clear that Our Man’s bearishness remains undimmed. However, with the increased cash and limited exposure in the portfolio, this bearish is not currently being expressed in any major way. When will that change? How will he express it? Those, my friends, are questions for the next post.

While there has been positive news in recent weeks, it has done little to diminish Our Man’s bearish mindset. Unfortunately, despite the talk and the plans, Our Man believes we’ve reached the point where the size of the problems we face is beyond the scope of the politicians and central bankers to solve. As regular readers will know, Our Man believes we’re in a balance sheet recession; there are no simple and easy solutions to a debt-driven crisis. Thus while the talk is about just how massive and impressive the latest European bailout plan is, to Our Man it is merely reminiscent of Paulson’s bazooka talk in the Summer of 2008. The mere idea of leveraging Germany, France et al’s commitments to the bailout fund fails to acknowledge the simple premise that this is not a liquidity issue but a solvency one, and that the problem of excess debt cannot be solved by the issuance of (and increase in) more debt. So, while more banks will be bailed out (without debt holders being haircut) and there’s the possibility of QE3 from the FED or some minor stimulus program in the US, once more the moves will only solve an imaginary counter-factual (if we’d not done this, then things would be worse) without encroaching on the real world issues.

For equity investors, the long-term impact of the steady increase in leverage (especially since the 1980’s at the household level) has helped smooth economic cycles and led to numerous distortions in the market. Furthermore, whenever the economy slows down, politicians & central bankers have become accustomed to using measures that foster an increase in debt (think lowering interest rates so you can refinance your home, or take out a loan, more easily) as their policy of choice. The problem now is that despite record low interest rates and ample liquidity (thanks to the Fed’s rate cuts, Quantitative Easing, Operation Twist, etc) loan growth continues to be stagnant; there is no demand! This lack of demand and the deleveraging, through both default and increased saving (i.e. reduced consumption), is something that equity investors should pay attention to.

In the longer-term, as Our Man has mentioned before, with interest rates losing their potency (now we’re stuck at 0% rates) and demand stagnant, it becomes less likely that policy makers will be able to smooth the economic cycle. As such, we should expect the choppier growth of recent years rather than the consistent economic cycles we’ve become accustomed to. Furthermore, the disinflationary tendencies of a balance sheet recession mean that pricing power is likely to be more curtailed (no demand means it’s harder to push price increases through). Combining these factors, means that over time Our Man is expecting stocks to exhibit greater cyclicality (as the magnitude of the cycles becomes more pronounced) and also to exhibit greater volatility (as the cycles become less smooth and more choppy). These are, of course, the enemies of the buy-and-hold and value-driven investor. The volatility affects the investor’s ability to hold his position from point A to point B, and means that the flight-path becomes as important as the destination. The increased cyclicality will lead to a derating of equities as a greater risk premium should be introduced by investors to account for the more cyclical nature of equities but also due to investors’ long-term expectations proving overly ambitious (due to the deflationary/disinflationary environment limiting pricing power).

In the short-run, none of this would matter if stocks were at low valuations and margins were at or near cyclical lows. Sadly, as the recent Chartology posts showed, neither is the case. Now, certainly the use CAPE (or Shiller P/E’s) isn’t flawless, but like other long-term measures of valuation (e.g. Tobin’s Q), it does have a strong historical track record of long-term success. So why does Our Man use the CAPE? Well, it’s cyclically-adjusted…the Earnings part of the equation has been smoothed for a cycle, meaning the margins are those that reflect a full cycle (not a point in time) and that the figure takes into account the write-offs that inevitably come from the irrational exuberance of the peak. Bear these factors in mind, when you next hear a Wall Street talking head say the market is cheap based on forward earnings (or even more egregiously forward operating earnings, which pretend we live in a fairytale world and ignore all the write-offs/etc). Not only is the analyst assuming that the margins (currently at a record high) will persist at their current level infinitely, they’re not even using the actual earnings but their projections of the future which they then compare to a historical norm (i.e. the market’s average Price-to-(trailing) Earnings, or PE, is 15)!

So, in short; the underlying major issues are not being tackled by the politicians/central bankers, equities are going to be more cyclical & volatile (and thus de-rated, or trade at lower multiples) in the future, and they’re also currently trading at high valuations at a time when they have close to record high margins. I think it is clear that Our Man’s bearishness remains undimmed. However, with the increased cash and limited exposure in the portfolio, this bearish is not currently being expressed in any major way. When will that change? How will he express it? Those, my friends, are questions for the next post.

Monday, October 3

September Review

Portfolio Update

After Our Man’s comments a couple of months ago on the lack of portfolio activity, it goes without saying that September saw yet more activity! The following change was made during the course of the month:

- Treasury Bonds: With the volatility in the markets lasting into September, there continued to be a move towards “safe” assets during the month. Once more, US Treasury bonds proved to be a “safe asset” in the eyes of investors, and as a result of being and largely under-owned and speculation that the Fed may enact “Operation Twist” (and thus become a buyer of long-end Treasury bonds) we saw further falls in Treasury Yields (and rise Treasury bond prices!). This move was exaggerated when the Fed initiated “Operation Twist” (essentially buying longer-term Treasuries, and selling some of their shorter duration debt) at a larger size than the market expected. While Our Man still thinks yields at the long-end of the curve could fall further and find new lows, the risk-reward became substantially less attractive after the Fed’s intervention (and the subsequent sharp decline in yields) and Our Man exited the majority of the Treasury Bond positions (specifically, the TBT puts and ½ the TLT position).

Performance Review

As regular readers will know, Our Man hasn’t exactly been a buyer of the markets in recent times (and has almost zero faith in QE to improve the economy in any sustainable way), and thus the portfolio has very controlled exposure. Given this and the sharp decline in Treasury yields (described above), September proved to be another good month for the portfolio, +4.5% for the month (YTD: +8.7%).

Unsurprisingly, September’s performance was again predominantly driven by the Treasury Bond book (+372bps) which benefited from the continued “flight to quality” and resultant collapse in Treasury yields. The Bond Funds (-7ps), also benefited from this fall in US Treasury Bond yields but the gains were offset by their exposure to (non-Treasury) credit and precious metals.

The Equity books largely suffered throughout the month, as their small/micro-cap bias meant that these ‘riskier’ stocks were largely discarded by investors in the ‘flight to quality’. The NCAV (-40bps) book was the most severely impacted, falling almost 20%, as the stocks within it are largely micro-cap and barely profitable; thus amongst the most risky types of investment out there. While the Value Equities (-43bps) book fell in-line with the market, this disguises the weak performance of DRWI (which cost almost 60bps). While they key components DRWI’s fundamental story is unchanged, the stock fell heavily due to its small-size, lack of profitability and concern as to whether it would reach its break-even goals in early-2012. While last month’s addition to the position is longer-term in intent, it’s worth noting that the stock now trades noticeably below the price at which Our Man added! The Other Equities (-13bps) and Energy Efficiency (-1bp) book performed broadly in-line with the markets. Against this negative performance, the Puts/Hedges book (+71bps) performed well, with a number of the put positions now being at or close to the money. Once more the XIV investment was a negative contributor to the Puts/Hedges book; now that Our Man has held the position >30days, expect it to be sold in the coming months!

The Short China book (+48bps) was a strong contributor during the month, as uncertainty over a global slowdown and concerns over a potential China hard-landing saw copper prices (and related equities) fall during the month. This puts the book into positive territory for the year (and indeed means it is flat since its inception), the probability remains that Our Man will likely add to the book and position it more aggressively for 2012 on any significant rally.

The Currencies book (+62bps, also putting it in positive territory for 2011) was the other strong contributor during September, as the Euro fell following continued concerns over Greece’s debt and contagion both to other sovereigns (especially Spain and Italy) as well as the regions Banks. While there are a number of rumors of potential fixes to the sovereign debt issues, so far none seem to offer real solutions as they largely propose increasing debt (or adding leverage to the vehicle to buyout troubled countries debt).

The changes to the portfolio over August and September have resulted in the bearish tilt slowly being reduced, and a substantial increase in Our Man’s cash horde! It would only be fair to explain to you, what he’s anticipating in the markets and how he intends to spend it…but that’s the topic of a future blog post!

Portfolio (as at 9/30 - all delta and leverage adjusted, as appropriate)

14.4% - Bond Funds (DLTNX and HSTRX)

9.2% - Treasury Bonds (TLT)

4.7% - Value Idea Equities (THRX, and DRWI)

2.2% - Other Equities (NWS, CMTL and SOAP)

1.8% - NCAV Equities

0.3% - Energy Efficiency (AXPW)

-1.8% - China-Related Thesis (58bps premium in FCX put)

-6.2% - Hedges/Put Options (55bps premium in S&P Dec-11 puts, 70bps in IWM Jan-12 puts, and 62bps SLV Jan-12 puts, all offset by a position in XIV)

-9.6% - Currencies (EUO – Short Euro)

59.2% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, TBT puts, DLTNX, HSTRX, THRX, DRWI, NWS, CMTL, SOAP, AXPW, FCX puts, SPY puts, IWM puts, SLV puts, XIV and EUO). He also holds some cash.

After Our Man’s comments a couple of months ago on the lack of portfolio activity, it goes without saying that September saw yet more activity! The following change was made during the course of the month:

- Treasury Bonds: With the volatility in the markets lasting into September, there continued to be a move towards “safe” assets during the month. Once more, US Treasury bonds proved to be a “safe asset” in the eyes of investors, and as a result of being and largely under-owned and speculation that the Fed may enact “Operation Twist” (and thus become a buyer of long-end Treasury bonds) we saw further falls in Treasury Yields (and rise Treasury bond prices!). This move was exaggerated when the Fed initiated “Operation Twist” (essentially buying longer-term Treasuries, and selling some of their shorter duration debt) at a larger size than the market expected. While Our Man still thinks yields at the long-end of the curve could fall further and find new lows, the risk-reward became substantially less attractive after the Fed’s intervention (and the subsequent sharp decline in yields) and Our Man exited the majority of the Treasury Bond positions (specifically, the TBT puts and ½ the TLT position).

Performance Review

As regular readers will know, Our Man hasn’t exactly been a buyer of the markets in recent times (and has almost zero faith in QE to improve the economy in any sustainable way), and thus the portfolio has very controlled exposure. Given this and the sharp decline in Treasury yields (described above), September proved to be another good month for the portfolio, +4.5% for the month (YTD: +8.7%).

Unsurprisingly, September’s performance was again predominantly driven by the Treasury Bond book (+372bps) which benefited from the continued “flight to quality” and resultant collapse in Treasury yields. The Bond Funds (-7ps), also benefited from this fall in US Treasury Bond yields but the gains were offset by their exposure to (non-Treasury) credit and precious metals.

The Equity books largely suffered throughout the month, as their small/micro-cap bias meant that these ‘riskier’ stocks were largely discarded by investors in the ‘flight to quality’. The NCAV (-40bps) book was the most severely impacted, falling almost 20%, as the stocks within it are largely micro-cap and barely profitable; thus amongst the most risky types of investment out there. While the Value Equities (-43bps) book fell in-line with the market, this disguises the weak performance of DRWI (which cost almost 60bps). While they key components DRWI’s fundamental story is unchanged, the stock fell heavily due to its small-size, lack of profitability and concern as to whether it would reach its break-even goals in early-2012. While last month’s addition to the position is longer-term in intent, it’s worth noting that the stock now trades noticeably below the price at which Our Man added! The Other Equities (-13bps) and Energy Efficiency (-1bp) book performed broadly in-line with the markets. Against this negative performance, the Puts/Hedges book (+71bps) performed well, with a number of the put positions now being at or close to the money. Once more the XIV investment was a negative contributor to the Puts/Hedges book; now that Our Man has held the position >30days, expect it to be sold in the coming months!

The Short China book (+48bps) was a strong contributor during the month, as uncertainty over a global slowdown and concerns over a potential China hard-landing saw copper prices (and related equities) fall during the month. This puts the book into positive territory for the year (and indeed means it is flat since its inception), the probability remains that Our Man will likely add to the book and position it more aggressively for 2012 on any significant rally.

The Currencies book (+62bps, also putting it in positive territory for 2011) was the other strong contributor during September, as the Euro fell following continued concerns over Greece’s debt and contagion both to other sovereigns (especially Spain and Italy) as well as the regions Banks. While there are a number of rumors of potential fixes to the sovereign debt issues, so far none seem to offer real solutions as they largely propose increasing debt (or adding leverage to the vehicle to buyout troubled countries debt).

The changes to the portfolio over August and September have resulted in the bearish tilt slowly being reduced, and a substantial increase in Our Man’s cash horde! It would only be fair to explain to you, what he’s anticipating in the markets and how he intends to spend it…but that’s the topic of a future blog post!

Portfolio (as at 9/30 - all delta and leverage adjusted, as appropriate)

14.4% - Bond Funds (DLTNX and HSTRX)

9.2% - Treasury Bonds (TLT)

4.7% - Value Idea Equities (THRX, and DRWI)

2.2% - Other Equities (NWS, CMTL and SOAP)

1.8% - NCAV Equities

0.3% - Energy Efficiency (AXPW)

-1.8% - China-Related Thesis (58bps premium in FCX put)

-6.2% - Hedges/Put Options (55bps premium in S&P Dec-11 puts, 70bps in IWM Jan-12 puts, and 62bps SLV Jan-12 puts, all offset by a position in XIV)

-9.6% - Currencies (EUO – Short Euro)

59.2% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, TBT puts, DLTNX, HSTRX, THRX, DRWI, NWS, CMTL, SOAP, AXPW, FCX puts, SPY puts, IWM puts, SLV puts, XIV and EUO). He also holds some cash.

Tuesday, September 20

Things from my Google Reader: Sep-11 Edition

With Europe deciding what to do with Greece, and with the Fed about to try their latest unconventional policy to get the economy going (or at least the markets up), what better time to (largely) look away from finance and see what’s been in Our Man’s google reader recently! As usual, I’ve put the finance ones at the top and the non-finance (more interesting?) ones at the bottom.

- Short-termism and the risk of another financial crisis

An article penned by Sheila Bair as she left the chairmanship of the FDIC, where she appears to have been one of the few people, in power, who possessed any common sense and didn’t want to bail out the banks. Her “exit” interview is well worth a read too. (Sheila Bair, Washington Post)

- Is the SEC covering up Wall Street crimes?

It would be funny, if there hadn’t been a major economic meltdown and market crash that took place while (amongst many other things) the regulators were asleep at the wheel. While it’s not apparent to all, capitalism requires good strong regulation to avoid merely turning into cronyism. (Matt Taibbi, Rolling Stone)

- The Future of Light is LED

As you know, Our Man has a small exposure to Energy Efficiency which is currently focused on battery technology. However, one of the other areas that is interesting is LED technology; while LEDs have taken over in phones, computers and now TVs, the ultimate hope is that LED technology will be used in lightbulbs. Here’s a good primer on LEDs. (Dan Koeppel, Wired)

- Why Software is Eating the World

The initial leaps forward in technology were as the result of hardware (e.g. a PC you could use at home, a mobile phone, etc) but the real transformation has come from the impact of software. If you want think further on the subject, John Hempton’s (Bronte Capital) post is a great place to start. (Marc Andreesen, Wall Street Journal)

- Enter the Cyber-dragon

With software and computer technology becoming so important, it shouldn’t be a surprise that both corporate and national espionage (and warfare) is shifting to take place online. (Michael Joseph Gross, Vanity Fair)

- Getting Bin-Laden

A look behind Seal Team Six’s mission. (Nicholas Schmidle, New Yorker)

Apple Section:

- How Apple Works: Inside the world’s biggest startup

Apple has been one of the success stories of the 2000’s, with its entrepreneurial enterprise and innovation being rewarded on both Main Street and Wall Street. Here’s Fortune’s view of how the company works. (Adam Lashinsky, Fortune magazine)

- Creation Myth

It might never have been, but for the kindness (and foolishness) of others. How Xerox unwittingly (and perhaps incompetently) failed to realize what it had already created/invented, and gave Apple a glimpse of the future. “If Xerox had known what it had and had taken advantage of its real opportunities,” Jobs said, years later, “it could have been as big as I.B.M. plus Microsoft plus Xerox combined—and the largest high-technology company in the world.” (Malcolm Gladwell, New Yorker)

- Steve Jobs’ Commencement Address at Stanford (2005)

Wherein he touches on a number of stories that helped mould him as a person. (Steve Jobs, YouTube)

- Short-termism and the risk of another financial crisis

An article penned by Sheila Bair as she left the chairmanship of the FDIC, where she appears to have been one of the few people, in power, who possessed any common sense and didn’t want to bail out the banks. Her “exit” interview is well worth a read too. (Sheila Bair, Washington Post)

- Is the SEC covering up Wall Street crimes?

It would be funny, if there hadn’t been a major economic meltdown and market crash that took place while (amongst many other things) the regulators were asleep at the wheel. While it’s not apparent to all, capitalism requires good strong regulation to avoid merely turning into cronyism. (Matt Taibbi, Rolling Stone)

- The Future of Light is LED

As you know, Our Man has a small exposure to Energy Efficiency which is currently focused on battery technology. However, one of the other areas that is interesting is LED technology; while LEDs have taken over in phones, computers and now TVs, the ultimate hope is that LED technology will be used in lightbulbs. Here’s a good primer on LEDs. (Dan Koeppel, Wired)

- Why Software is Eating the World

The initial leaps forward in technology were as the result of hardware (e.g. a PC you could use at home, a mobile phone, etc) but the real transformation has come from the impact of software. If you want think further on the subject, John Hempton’s (Bronte Capital) post is a great place to start. (Marc Andreesen, Wall Street Journal)

- Enter the Cyber-dragon

With software and computer technology becoming so important, it shouldn’t be a surprise that both corporate and national espionage (and warfare) is shifting to take place online. (Michael Joseph Gross, Vanity Fair)

- Getting Bin-Laden

A look behind Seal Team Six’s mission. (Nicholas Schmidle, New Yorker)

Apple Section:

- How Apple Works: Inside the world’s biggest startup

Apple has been one of the success stories of the 2000’s, with its entrepreneurial enterprise and innovation being rewarded on both Main Street and Wall Street. Here’s Fortune’s view of how the company works. (Adam Lashinsky, Fortune magazine)

- Creation Myth

It might never have been, but for the kindness (and foolishness) of others. How Xerox unwittingly (and perhaps incompetently) failed to realize what it had already created/invented, and gave Apple a glimpse of the future. “If Xerox had known what it had and had taken advantage of its real opportunities,” Jobs said, years later, “it could have been as big as I.B.M. plus Microsoft plus Xerox combined—and the largest high-technology company in the world.” (Malcolm Gladwell, New Yorker)

- Steve Jobs’ Commencement Address at Stanford (2005)

Wherein he touches on a number of stories that helped mould him as a person. (Steve Jobs, YouTube)

Monday, September 5

August Review

Portfolio Update

After Our Man’s recent comments on the lack of portfolio activity, it goes without saying that August proved to be one of the portfolio’s busiest months! The following changes were made during the course of the month, and are listed in chronological order:

- NCAV: The position in LAB (now under ticker COWN) was sold during the month, as a result of COWN’s takeover of LAB, which completed while Our Man was on vacation. Due to incompetence, Our Man didn’t sell the position before the takeover closed, and as the ticker symbol changed (as LAB became part of COWN), he was forced to wait before selling it.

- Currency: Our Man increased the Short position in the Euro (i.e. a bet on the US dollar strengthening versus the Euro) by around 1/3 in the early part of the month. While the Euro has remained resilient despite the sovereign debt concerns (centred on the PIIGS countries) and has been bolstered by countries (especially China) buying French and German bonds, Our Man is wagering that this resilience will not last. The price of this transaction was slightly above the August-end price, and as such this additional exposure cost a small amount of money in August.

- Value Equity: Our Man doubled the DRWI position during August, as the stock suffered heavily. This move was only possible due to the undersized nature of the position (it was c1% before being doubled) and the attractive entry price, especially given the company’s fundamentals were unchanged. While the entry price for this additional exposure was well above DRWI’s lows for the month, it was also below the month-end price and hence contributed positively.

- Bond Funds: When Our Man added DLTNX to the portfolio, back in January, he said it was a medium-term replacement for VBIIX. The sharp fall in US Treasury Bond yields, provided an opportunity to exit the VBIIX position at an attractive price (though well-below the highs of the month).

- Put/Hedges: The start of August was exceptionally volatile, and as a result Our Man’s index puts (on SPY and IWM) saw both their implied volatility increase and their delta. Given the speed of the move, in the middle of the month, Our Man despite suspecting the market was headed much lower was worried about the possibility of a short-term (1-3month) sharp rally in the markets and so sought to hedge this (and the likely resultant fall in medium-term volatility) out. He did so through taking a position in XIV, which is a complicated instrument that seeks to perform the opposite of short-term futures on the CBOE Options Volatility Index, or VIX. In essence, it is profitable when markets start calming down (i.e. being less volatile) AND people expect them to remain at these calmer (less volatile) levels. As you know, August did not calm down (and we certainly seem to have no expectations of reduced volatility) and thus the position suffered heavily (20-25%) in the second half of the month. The only good news was that its size was limited (to an initial 2% NAV), and it remains to be seen/is up for debate whether Our Man was merely early or foolishly crossed one of his own risk tenets (see number 6).

- Treasury Bonds: The volatility in the market resulted in a large move towards “safe” assets during August. Despite all the naysayers, and an S&P downgrade, US Treasury bonds proved to be both a safe asset and largely under-owned, resulting in a large fall in Treasury Yields (and rise in price of Treasury bonds!). With Treasury Bonds representing the largest part of the portfolio, Our Man took advantage of this to sell his Aug-29 US Treasury bond (at a 2.87% yield to maturity). While Our Man still thinks yields, especially at the long-end of the curve (i.e. the furthest into the future, such as bonds maturing in 20-30yrs time) may continue to fall, the risk-reward is less attractive at this point.

Performance Review

As regular readers will know, Our Man has not been a buyer of the recent market rally and isn’t much of a fan of QE2, and thus his portfolio has had a slight bearish tilt to it. This tilt was fully visible during August, with the portfolio up +4.2% for the month (YTD: +4.1%). Despite the positive performance, the portfolio was not immune from the market’s volatility and saw its 2 best days (+1.5% on 8/4 and 8/8) and its worst day (-1.4% on 8/11) since inception.

Unsurprisingly, August’s performance was driven entirely by the Treasury Bond book (+436bps) and the Bond Funds (+45bps), which both benefited from the large decline in US Treasury Bond yields.

The Equity books, on the other hand proved to be a mixed bag. Other Equities (+12bps) performed admirably, despite the market, while the NCAV book (-24bps) underperformed, hampered by its micro-cap makeup and falling over 8%. The Puts/Hedges book (-6bps) was disappointingly down for the month, though this was entirely the result of a c40bp negative contribution of the XIV investment. The Value Equities book (-42bps) was also negative for the month; DRWI’s performance (+1bp) was helped by the additional investment in mid-month while THRX (-42bps) was not so fortunate.

The Short China book (+6bps) benefited slightly during the month, though with uncertainty over a global slowdown yet to fully spread to copper prices it struggled to contribute significantly. The Energy Thesis book (-5bps) and Currencies book (-5bps) were small negative contributors.

With the adjustments to the portfolio, the make-up is somewhat changed compared to recent months. While the most noticeable difference is the increase in cash, the portfolio retains a smaller bearish tilt and should not suffer heavily in a market rally. This reflects Our Man’s concern that the FED, much like the drunken gambler who keeps losing, will not view the economic uncertainty/weakness as reflection of their abject failure with QE2 but as a sign that they did not bet big enough in QE2. If circumstances (in Europe) do not overwhelm them first, Our Man expects to hear more and more about QE3 (most likely under another guise, Operation Twist, or the like) as the coming weeks progress, and the market to rally on expectations of its announcement. Expect Our Man to further add to the puts/hedge book should this come to pass…

Portfolio (as at 8/31 - all delta and leverage adjusted, as appropriate)

25.4% - Treasury Bonds (TLT, and 158bps premium in TBT Jan-13 puts)

15.2% - Bond Funds (DLTNX and HSTRX)

5.2% - Value Idea Equities (THRX, and DRWI)

2.4% - Other Equities (NWS, CMTL and SOAP)

2.2% - NCAV Equities

0.3% - Energy Efficiency (AXPW)

-0.6% - China-Related Thesis (15bps premium in FCX put)

-4.2% - Hedges/Put Options (34bps premium in S&P Dec-11 puts, 37bps in IWM Jan-12 puts, and 15bps SLV Jan-12 puts, all offset by a position in XIV)

-8.5% - Currencies (EUO – Short Euro)

49.2% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, TBT puts, DLTNX, HSTRX, THRX, DRWI, NWS, CMTL, SOAP, AXPW, FCX puts, SPY puts, IWM puts, SLV puts, XIV and EUO). He also holds some cash.

After Our Man’s recent comments on the lack of portfolio activity, it goes without saying that August proved to be one of the portfolio’s busiest months! The following changes were made during the course of the month, and are listed in chronological order:

- NCAV: The position in LAB (now under ticker COWN) was sold during the month, as a result of COWN’s takeover of LAB, which completed while Our Man was on vacation. Due to incompetence, Our Man didn’t sell the position before the takeover closed, and as the ticker symbol changed (as LAB became part of COWN), he was forced to wait before selling it.

- Currency: Our Man increased the Short position in the Euro (i.e. a bet on the US dollar strengthening versus the Euro) by around 1/3 in the early part of the month. While the Euro has remained resilient despite the sovereign debt concerns (centred on the PIIGS countries) and has been bolstered by countries (especially China) buying French and German bonds, Our Man is wagering that this resilience will not last. The price of this transaction was slightly above the August-end price, and as such this additional exposure cost a small amount of money in August.

- Value Equity: Our Man doubled the DRWI position during August, as the stock suffered heavily. This move was only possible due to the undersized nature of the position (it was c1% before being doubled) and the attractive entry price, especially given the company’s fundamentals were unchanged. While the entry price for this additional exposure was well above DRWI’s lows for the month, it was also below the month-end price and hence contributed positively.

- Bond Funds: When Our Man added DLTNX to the portfolio, back in January, he said it was a medium-term replacement for VBIIX. The sharp fall in US Treasury Bond yields, provided an opportunity to exit the VBIIX position at an attractive price (though well-below the highs of the month).

- Put/Hedges: The start of August was exceptionally volatile, and as a result Our Man’s index puts (on SPY and IWM) saw both their implied volatility increase and their delta. Given the speed of the move, in the middle of the month, Our Man despite suspecting the market was headed much lower was worried about the possibility of a short-term (1-3month) sharp rally in the markets and so sought to hedge this (and the likely resultant fall in medium-term volatility) out. He did so through taking a position in XIV, which is a complicated instrument that seeks to perform the opposite of short-term futures on the CBOE Options Volatility Index, or VIX. In essence, it is profitable when markets start calming down (i.e. being less volatile) AND people expect them to remain at these calmer (less volatile) levels. As you know, August did not calm down (and we certainly seem to have no expectations of reduced volatility) and thus the position suffered heavily (20-25%) in the second half of the month. The only good news was that its size was limited (to an initial 2% NAV), and it remains to be seen/is up for debate whether Our Man was merely early or foolishly crossed one of his own risk tenets (see number 6).

- Treasury Bonds: The volatility in the market resulted in a large move towards “safe” assets during August. Despite all the naysayers, and an S&P downgrade, US Treasury bonds proved to be both a safe asset and largely under-owned, resulting in a large fall in Treasury Yields (and rise in price of Treasury bonds!). With Treasury Bonds representing the largest part of the portfolio, Our Man took advantage of this to sell his Aug-29 US Treasury bond (at a 2.87% yield to maturity). While Our Man still thinks yields, especially at the long-end of the curve (i.e. the furthest into the future, such as bonds maturing in 20-30yrs time) may continue to fall, the risk-reward is less attractive at this point.

Performance Review

As regular readers will know, Our Man has not been a buyer of the recent market rally and isn’t much of a fan of QE2, and thus his portfolio has had a slight bearish tilt to it. This tilt was fully visible during August, with the portfolio up +4.2% for the month (YTD: +4.1%). Despite the positive performance, the portfolio was not immune from the market’s volatility and saw its 2 best days (+1.5% on 8/4 and 8/8) and its worst day (-1.4% on 8/11) since inception.

Unsurprisingly, August’s performance was driven entirely by the Treasury Bond book (+436bps) and the Bond Funds (+45bps), which both benefited from the large decline in US Treasury Bond yields.

The Equity books, on the other hand proved to be a mixed bag. Other Equities (+12bps) performed admirably, despite the market, while the NCAV book (-24bps) underperformed, hampered by its micro-cap makeup and falling over 8%. The Puts/Hedges book (-6bps) was disappointingly down for the month, though this was entirely the result of a c40bp negative contribution of the XIV investment. The Value Equities book (-42bps) was also negative for the month; DRWI’s performance (+1bp) was helped by the additional investment in mid-month while THRX (-42bps) was not so fortunate.

The Short China book (+6bps) benefited slightly during the month, though with uncertainty over a global slowdown yet to fully spread to copper prices it struggled to contribute significantly. The Energy Thesis book (-5bps) and Currencies book (-5bps) were small negative contributors.

With the adjustments to the portfolio, the make-up is somewhat changed compared to recent months. While the most noticeable difference is the increase in cash, the portfolio retains a smaller bearish tilt and should not suffer heavily in a market rally. This reflects Our Man’s concern that the FED, much like the drunken gambler who keeps losing, will not view the economic uncertainty/weakness as reflection of their abject failure with QE2 but as a sign that they did not bet big enough in QE2. If circumstances (in Europe) do not overwhelm them first, Our Man expects to hear more and more about QE3 (most likely under another guise, Operation Twist, or the like) as the coming weeks progress, and the market to rally on expectations of its announcement. Expect Our Man to further add to the puts/hedge book should this come to pass…

Portfolio (as at 8/31 - all delta and leverage adjusted, as appropriate)

25.4% - Treasury Bonds (TLT, and 158bps premium in TBT Jan-13 puts)

15.2% - Bond Funds (DLTNX and HSTRX)

5.2% - Value Idea Equities (THRX, and DRWI)

2.4% - Other Equities (NWS, CMTL and SOAP)

2.2% - NCAV Equities

0.3% - Energy Efficiency (AXPW)

-0.6% - China-Related Thesis (15bps premium in FCX put)

-4.2% - Hedges/Put Options (34bps premium in S&P Dec-11 puts, 37bps in IWM Jan-12 puts, and 15bps SLV Jan-12 puts, all offset by a position in XIV)

-8.5% - Currencies (EUO – Short Euro)

49.2% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (TLT, TBT puts, DLTNX, HSTRX, THRX, DRWI, NWS, CMTL, SOAP, AXPW, FCX puts, SPY puts, IWM puts, SLV puts, XIV and EUO). He also holds some cash.

Thursday, August 11

Chartology: U-G-L-Y, You ain’t got no alibi!

As some of you may have noticed, despite the attempted rallies, the markets have not been a pretty sight this month! No doubt, if you’ve had the misfortune of watching the terrible talking heads you’ve no doubt heard it’s all the politicians fault (debt-ceiling muppetry), or S&P’s (how dare they downgrade the US from AAA), or the Europeans (call that a plan for dealing with Greece, Ireland and Portugal and Spain and err Italy), or companies (how dare they say things aren’t as rosy as the talking heads would like) or just the whole world (damn the whole globe for a global slow-down!). As you know, Our Man believes that markets are far more of a Bak-Tang-Wisenfeld sandpile and when they’re in a “critical state” it only takes one stray grain of sand landing in the wrong spot to bring it all down; thus, there’s little point blaming the particular grain of sand whether it’s European, Global, political, economic or company fundamentals!

Given that, here’s some graphs showing you why (or perhaps, that) we’re in a critical state!

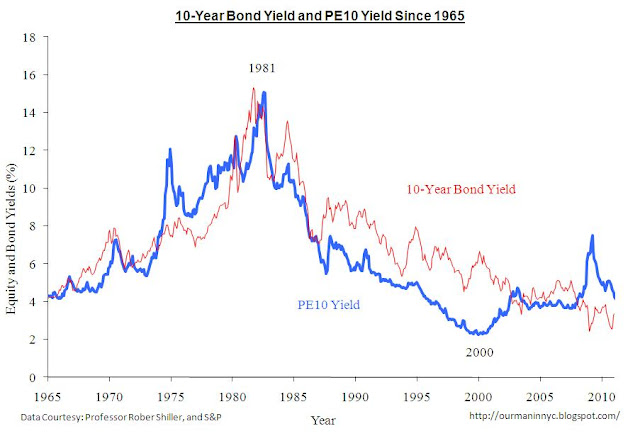

1) Valuation

Look, the CAPE (or Shiller PE10) isn’t perfect and certainly isn’t useful as a timing device but it does provide the single best (and historically tested) look at valuation on a long-term basis. Forget what you hear about markets being cheap (especially when it’s drivel like based on analyst-projected operating earnings) and suck it up…equity markets have been expensive by historical standards for well over a decade! If CAPE isn’t your long-term valuation measure of choice, how about Tobin’s Q or Market Cap-to-GDP (Buffet's favourite, apparently).

2) Corporate Fundamentals

(Graph courtesy of Bill Hester, Hussman Funds)

If you want to buy stocks that are not only expensive but whose profit margins are close to their all time highs, then that’s your prerogative. It’s certainly possible that margins improve and we see record highs, but is that really something you want to bet on.

3) Signs of Economic Slowdown

Sure, this is just a PMI graph for China and it’s barely crossed into the recessionary (<50) readings but pick a major economy, and this and the leading indicators all look the same. So far that’s over-valued stocks, with near peak margins and signs of global economies cooling…doesn’t exactly sound like a recipe for success.

4) US Economic Data is pretty either

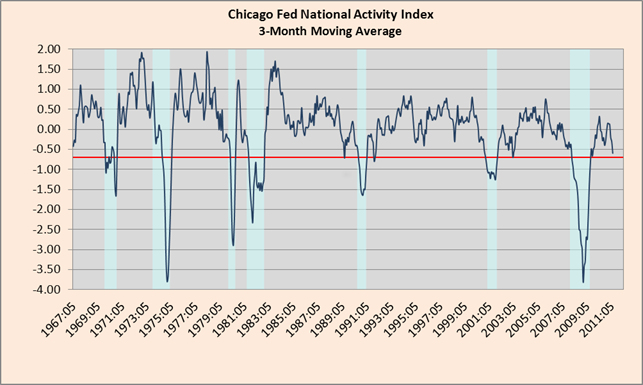

There’s no great way of telling how the economy is doing in real-time, but the Chicago Fed’s National Activity Index is a good start (I’d also point you in the direction of the Philly Fed’s ADS Index . You’ll notice that they’re not telling a happy tale at the moment with both so far above, but flirting with, recession-like levels (and noticeably worse than 2010’s dalliances).

5) Italian yields have seen better days

The ECB's buying of Italian and Spanish bonds this week has clearly helped lower their yields from the danger levels seen last week, but the risk is that it's coming at the cost of putting France into the firing line. With the Italian’s having 120% Debt-to-GDP, will France and Germany risk their AAA status (which is vital to the EFSF) to buy Italy time for reform and austerity? Perhaps, will it work out as well(!) as buying Greece time by bailing it out last year has? Probably, and that's what should worry you!

6) The Charts

(Courtesy of OEW/Elliott Wave lives on)

Look, Our Man will never profess to be a technical analyst, or to fully appreciate its wares, but he does have a small crush on Objective Elliot Wave analysis, what with its relation to behavioural theory and market psychology and all. It’s not perfect but given OEW's track record, when it flips from a bull market to bear market (and vice versa) then Our Man thinks you should at least listen (especially since they’ve been suggesting the bull market might be ending since May, with increasing conviction through July).

In conclusion, these are the little things that make a market interesting. They have been on the brink of a “critical state” for a while now so blaming any one thing is foolish. Our Man didn’t own much equity before and he sure as hell won’t be using this correction to load-up, and instead will only be nibbling at the odd thing that becomes exceptionally cheap under the security blanket that his puts offer. What'd it take for OM to load-up? Well, a good starting point to thinking about having a reasonable equity position would be when valuations were cheap (i.e. CAPE under historical mean) and margins were small; and Our Man would "fill his boots" should he ever see a CAPE near its historical lows and margins near theirs (but we're talking an S&P of c400 for that to happen, so don't hold your breath). As for everyone else (in the whole wide world), they make their own decisions and that’s what makes a market!

Special Bonus Chart: That downgrade…

It didn’t seem to cause any immediate spike in Japanese yields! Interestingly, US yields have also collapsed post-downgrade…not exactly what the talking heads had in mind! Apparently, inflation (and inflation expectations) & GDP growth (and growth expectations) have more impact on what bond investors do and where yields trade than an S&P rating. Colour me shocked!

Given that, here’s some graphs showing you why (or perhaps, that) we’re in a critical state!

1) Valuation

Look, the CAPE (or Shiller PE10) isn’t perfect and certainly isn’t useful as a timing device but it does provide the single best (and historically tested) look at valuation on a long-term basis. Forget what you hear about markets being cheap (especially when it’s drivel like based on analyst-projected operating earnings) and suck it up…equity markets have been expensive by historical standards for well over a decade! If CAPE isn’t your long-term valuation measure of choice, how about Tobin’s Q or Market Cap-to-GDP (Buffet's favourite, apparently).

2) Corporate Fundamentals

(Graph courtesy of Bill Hester, Hussman Funds)

If you want to buy stocks that are not only expensive but whose profit margins are close to their all time highs, then that’s your prerogative. It’s certainly possible that margins improve and we see record highs, but is that really something you want to bet on.

3) Signs of Economic Slowdown

Sure, this is just a PMI graph for China and it’s barely crossed into the recessionary (<50) readings but pick a major economy, and this and the leading indicators all look the same. So far that’s over-valued stocks, with near peak margins and signs of global economies cooling…doesn’t exactly sound like a recipe for success.

4) US Economic Data is pretty either

There’s no great way of telling how the economy is doing in real-time, but the Chicago Fed’s National Activity Index is a good start (I’d also point you in the direction of the Philly Fed’s ADS Index . You’ll notice that they’re not telling a happy tale at the moment with both so far above, but flirting with, recession-like levels (and noticeably worse than 2010’s dalliances).

5) Italian yields have seen better days

The ECB's buying of Italian and Spanish bonds this week has clearly helped lower their yields from the danger levels seen last week, but the risk is that it's coming at the cost of putting France into the firing line. With the Italian’s having 120% Debt-to-GDP, will France and Germany risk their AAA status (which is vital to the EFSF) to buy Italy time for reform and austerity? Perhaps, will it work out as well(!) as buying Greece time by bailing it out last year has? Probably, and that's what should worry you!

6) The Charts

(Courtesy of OEW/Elliott Wave lives on)

Look, Our Man will never profess to be a technical analyst, or to fully appreciate its wares, but he does have a small crush on Objective Elliot Wave analysis, what with its relation to behavioural theory and market psychology and all. It’s not perfect but given OEW's track record, when it flips from a bull market to bear market (and vice versa) then Our Man thinks you should at least listen (especially since they’ve been suggesting the bull market might be ending since May, with increasing conviction through July).