Given the all the news flow on alternative energy over the last couple of years, and the successful IPO of A123 Systems and the upcoming IPO of Tesla Motors, why would Our Man be expressing his interest (again) in the boring old Lead Acid battery companies that they’re likely to put out of business?

The simplest place to start is probably a simple thought experiment – think about all the times you’ve driven your car, how many times have you had battery problems? I’m guessing that the answer’s not many, irrespective of whether it’s hot, cold, snowy, sunny, rainy, etc. That’s the standard that we’ve come to expect from our car batteries. Now, think about your cell-phone or laptop and how many times you have had battery problems – I suspect it’s a whole lot more often. Yet, people seem to have pre-determined that updated versions of the same technology will be able to meet the standards we’re accustomed to at a price we can afford. The key here is my use of predetermined, as it seems to me that the overwhelming consensus (by industry, the government and the market) is that it has been decided that Lithium-Ion is the future of vehicular power, and such stocks should trade on that. To Our Man’s mind, that such a decision appears to have been made before the race is run is interesting but the fact that the market is already pricing it as a fait accompli into stocks is enticing! Is there a cheap option to be had for people’s assumption proving wrong or overly optimistic?

Overview

Currently, the major US Lithium Ion (“Li-Ion”) battery companies have barely any sales (e.g. A123’s revenue last Q was $25mm, with a negative gross margin) but significant market caps based on the expectation of the key role that they will play in our vehicular future. The major Li-Ion battery companies that I’ll be referring to are A123 Systems and ENER1 Inc, though I’m sure electric vehicle manufacturers like Tesla and Fisker will get a mention.

However, given the horrendous history of Lead-Acid battery companies and the seeming lack of innovation in lead-acid batteries, it’s easy to see why a new technology seems attractive. As such, current lead-acid batteries are a commodity product and though the industry is dominated by a small number of players, they have no real pricing power. I also feel the consensus ignores the obvious question; why should Lead-Acid batteries have seen any innovation until recently? After all, they do what they’re supposed to well and they do it cheaply.

Electric Vehicles – Li-Ion’s future

When I mention Li-Ion being our vehicular future, it is because of their use in Hybrid Electric Vehicles (“HEVs”. While this may bring images of battery powered cars to the forefront of our minds, there are in fact four primary classes of HEVs:

1. Micro Hybrids – Do not use an electric motor to drive the vehicle, instead use battery to:

• Stop/Start the Internal Combustion Engine (“ICE”)

• Power accessories (e.g. air conditioning, etc) when the ICE is off

• Uses energy from braking to recharge the battery

2. Mild Hybrids – Uses the battery for everything that a micro hybrid does plus:

• The electric motor is integrated into the ICE to boost power during acceleration

3. Full Hybrid – Uses the battery for everything that a micro hybrid does plus:

• The electric motor is separate from the ICE and is powerful enough to drive the vehicle. Typically, use the electric motor to launch from stop and start the ICE when needed, using both for acceleration

4a. Parallel Plug-in Hybrid: Same as full hybrid, but with a bigger battery pack that increases the Electric range, which means less reliance on the ICE.

4b. Series Plug-in Hybrid: Electric Vehicle that runs on battery power for 10-40miles then uses a small ICE to drive the power-train.

You’ll note that the first 3 classes of car are available today, with the 4th class being the much discussed Plug-in Hybrid Electric Vehicle (“PHEV”) for which the Nissan’s Leaf and GM’s Volt are hoping to be standard bearers. Furthermore, despite the press attention, hybrid cars (in all their forms) make up an exceptionally small part of the current car market.

Historic Annual Hybrid Car Sales

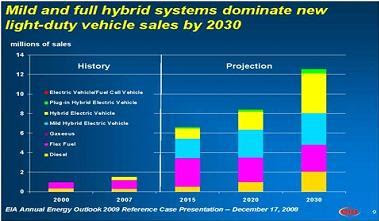

While this is expected to change, going forwards, despite all the attention on PHEVs they are not anticipated to make up a noticeable portion of car sales in the next 20years, with the majority of hybrid sales falling into the micro/mild hybrid category. While I’m using Energy Information Administration and DOE projections below, the projections from private consultants (e.g. Frost & Sullivan, etc) is similar.

Expected Hybrid Vehicle Market Size (Energy Information Administration/DOE)

Thus, it seems to me that in the medium-term Lead Acid (and any upgrades to it) only needs to be competitive in terms of power and cost in micro/mild hybrids rather than be able to power an electric vehicle tomorrow. For those who think Li-Ion is the battery of the future, I think you’ll be somewhat surprised by the results.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment