Since Our Man is heading off (with Mrs OM) on his holidays tomorrow, he thought he’d leave with you with something to ponder in his absence. Sadly, it’s not some bright new revelation that he’s going to ask you to ponder…but one strongly related to something he discussed in this blog’s early days.

How long does it take for the financial patterns to become so culturally ingrained, that investors can’t help but slavishly adhere to them?

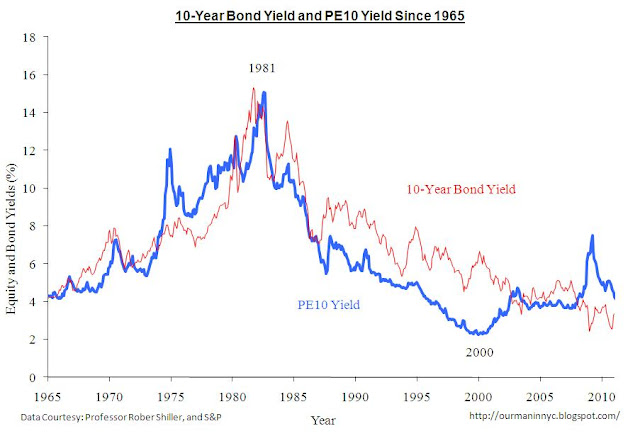

Well, if Our Man had to guess (and he does, else this post wouldn’t be much use otherwise), he would wager a maximum of 30-40years. Why? Well, that seems to be the length of time it takes for a full financial cycle to run its course. The graph below shows the most recent full cycle for bond and equity yields.

Bond and equity yields moved largely in lock-step between the mid-60’s and the end of the tech bubble (in 2000). This lead to the traditional bond yields fall and equity prices rise (i.e. equity yields fall) argument that has become a mantra, and underpins the “given where the 10yr is equities are cheap” argument. However, over recent years they’ve started to diverge. What if this religious belief in the lock-step move of bond & equity yield has ill-prepared the equities are cheap crowd? After all, their rationale makes logical sense (equities and bonds compete for a share of the investment portfolio) and the historical data, especially since the bull market of 1981-200, seems to back up their case.

And what if the sharp bond yield rises of the 70’s have ill-prepared the bond vigilantes for what comes next? They know what happens when inflation gets out of control – and it must do with the FED printing like crazy, right?

Why would they both be getting misled – as with everything, perhaps we should look at the whole picture…

Will the relationship exist should using interest rates loses its primary role (due to a zero-interest rate policy) and effectiveness as monetary tool. What if bond and equity yields decouple like we’ve seen in Japan? (Our Man does have certain expectations…)

What of the carefully nurtured “bond yields down, stock prices up” financial religion then?

No comments:

Post a Comment