Portfolio Update

OM made limited changes to the portfolio during the first quarter, as an influx of cash is expected early in the second quarter. Expect a portfolio update when it’s put to work.

- Uranium: OM added a small position in Paladin Energy (PALAF). Paladin was one of the very few successes of the last Uranium bull market, meaning it actually built a mine. Paladin is a mid-tier producer and would be one of the first uranium companies that could bring back capacity if prices rose to more economical levels.

- Tin: OM began a thematic position in Tin! It’s another area of the market that’s seeing constrained supply, but also has the tailwind of attractive demand dynamics (think 5G, EVs, etc.). Expect something more substantial in the coming weeks.

Performance and Review

The first quarter of 2021 proved to be a continuation of the final couple of months for OM’s portfolio, which climbed +21.9%. This handily outpaced the S&P 500 TR (+6.2%) and the MSCI World (Net), which rose +6.1%

The last 15 months have been a strange time for OM’s portfolio; after losing 31% in the first 10 months of 2020, the portfolio has gained 65% in the last five months! However, the power of that initial negative compounding can be seen as the portfolio is only up ~15% over that period. As such, despite handily outperforming the S&P 500 TR and the MSCI World (ND) during the first quarter, the portfolio trails them since the start of 2020.

First Quarter Attribution

The portfolio primarily benefited from its exposure to uranium, cryptocurrencies and energy during the first quarter. Uranium (+749bps) remains the largest position and is benefiting from what Justin Huhn has dubbed the “flywheel effect"; news flow is positive, which is opening the sector up to more investors, which is leading to further positive news flow, which is…and on. We saw confirmation of the West’s changing views with France extending the life of its oldest power plants, the previously anti-nuclear Democrats including nuclear in their clean energy standard, and EU experts saying nuclear qualifies for green investment label. Investors responded by increasingly investing in the sector (e.g. the major ETFs saw significant inflows), which allowed a number of junior uranium miners to raise capital backed by institutional demand. To the surprise of the market (and OM) a number of these junior miners used the proceeds to purchase physical uranium, further tightening supply!

OM’s position in Blockchain/Crypto (+484bps) contributed well a Bitcoin rose strongly at the start of the year. As mentioned last quarter, while digital assets continue to benefit from the increased institutionalization of the ‘asset class’ they also capture the zeitgeist of the moment. Bitcoin, in particular, remains the logical extension of almost everything various market factions currently believe! This will change.

The energy exposure was the most subtle of these, indirectly aiding the positions in Shipping/Tankers (+460bps) and Idiosyncratic equities (+367bps) while more obviously helping the Energy (+94bps) position. In Shipping/Tankers, the rates for oil tankers (which transport crude oil) remain terrible though those for product tankers (which transport petroleum-related products) have improved markedly. There is increased optimism amidst signs that many economies are slowly heading towards reopening in the middle of the year. In Idiosyncratic equities, the position in Texas Pacific Land Corp finally completed its conversion to a corporation from a trust which removes some of the company’s idiosyncrasies and opens it up to a wider shareholder base. However, given its extensive land holdings in West Texas it was also a beneficiary of increased activity in oil/gas markets. Finally, the position in Antero Resources (AR) benefited from the healthy natural gas price, and the good moves the company made throughout 2020.

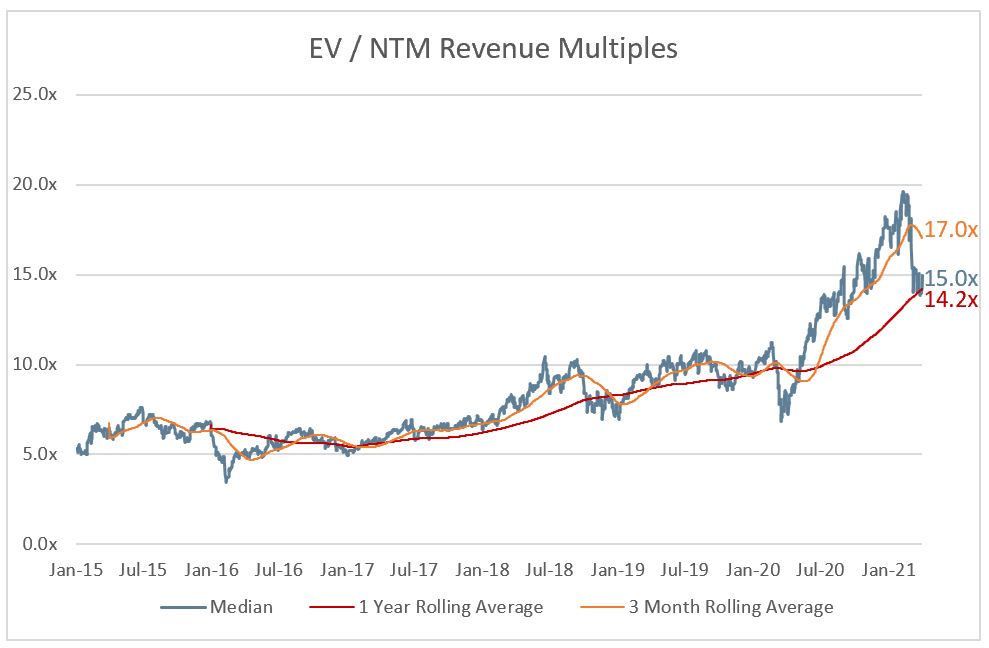

The rest of the portfolio was largely a wash. The Funds (+57bps) participated in the market rally, and India (+15bps), Vietnam (+13bps) and Greece (+14bps) contributed moderate gains. The Technology: 4th Industrial Revolution holdings (-55bps) gave back gains; as the chart below shows, the Software-as-a-Service (“SaaS”) names had become severely over-extended with the median SaaS company trading at 20x NTM Sales! Brazil (-5bps) and Tin (-6bps) were marginal detractors.

Source: Clouded Judgment (a blog all interested in SaaS should follow!)

Portfolio (as at 03/31/21 - all delta and leverage adjusted, as appropriate)

Dislocations: 45.8%

25.7% - Uranium (URNM, CCJ, NXE, PALAF and URG)

14.5% - Shipping/Tankers (STNG, DSSI, EURN, TNK and DHT)

3.5% - Greece (GREK & ALBKY)

1.7% - Energy (AR)

Thematic: 21.3%

9.3% - Blockchain/Crypto (GBTC)

4.9% - Tech: 4th Industrial Revolution (JD & WCLD)

3.2% - Vietnam (VNM)

2.7% - India (INDA)

1.0% - Tin (AFMJF

0.5% - Brazil (EWZ)

Technical: 0.0%

0.0% - OEW Technical positions (DDM, SSO, and QLD)

Idiosyncratic: 17.4%

11.9% - Funds (ARTTX, CWS, GVAL, and CAPE)

5.5% - Equities (TPL)

Shorts/Hedges: 0.0%

Cash: 16.0%

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take it that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.