Portfolio Update

May saw very limited changes to the portfolio; largely reflecting Our Man’s belief that over the coming months markets are likely to offer more interesting entry points for some equity names and that the more defensive positions are appropriately sized.

- The NCAV/Absolute value book saw the only change with the position in CNTF exited during the month, after it had been in the portfolio for 1-year after dropping off the NCAV screen. Given the expected nature of this book (a small number of large winners, and a larger number of stocks that contribute flat to negatively) nothing should be read into the contribution of individual stocks within the book. That said, CNTF’s contribution was much appreciated as it fell into the winners category (+133% profit).

Performance Review

May continued the trend of quiet but strange month-to-date performance over the last 6months; February, April and May saw the portfolio’s performance reside almost entirely in the black for the duration of those months, while the fund posted a solitary day when it registered positive month-to-date number during December, January and March. What one should read into that, I don’t know!

Like April, the month was quiet but steadily positive registering a final gain of +0.95% that was enough to move the YTD performance (YTD: +0.57%) out of the red.

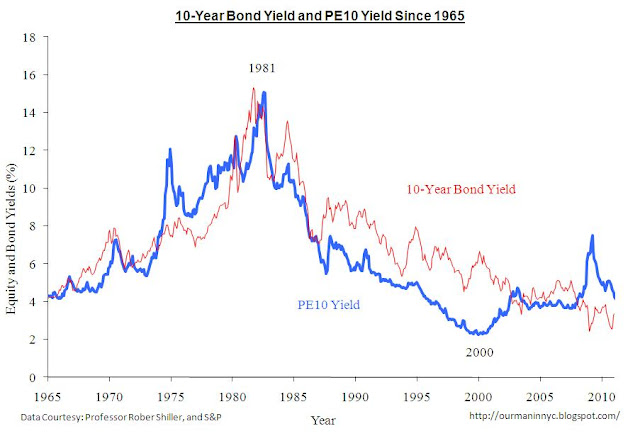

Again, the biggest driver of performance was the Long-end Treasury Book (+119bps) though this should come as little surprise, given it continues to represent the largest capital and risk exposure within the book. A plethora of weaker than expected (but not yet outright negative) data in the US and overseas saw increased risk aversion, from which Treasuries benefited. In particular, the weakness of this data and the related GDP-growth concerns resulted in a decrease in people’s inflation expectations (especially more than a couple of years into future) which helped these long-end bonds. The Bond Funds (+32bps) book again contributed steadily throughout the month.

The Currencies book (+17bps) recouped some of its year-to-date losses during the month. The luster of the ECB’s April rate rise faded during May, as the troubled fiscal state of Greece hit the news once more and debates began over whether there should be another bail-out. These discussions, and the increased uncertainty they brought to the forefront both about the strength of the European economy (and thus the need for future rate rises) and the impact of the bail-out helped weaken the Euro.

The equity-side saw continued mediocre performance. The NCAV book (-3bps) and the Other Equities book (-1bp) were both down in line with the market during the month, while the Short China thesis (-1bp) and Energy Efficiency (-5bps) also produced small negative returns. While the Puts/Hedges book (+4bps) posted a small positive return, almost the entirety of this came from the Silver puts which doubled during the month.

This leaves the Value Equity book (-66bps) which was the main negative contributor during the month though again it's no surprise as it represents the majority of the exposure and risk within the Equity-orientated books. The position in Theravance (THRX), a biotech development company, fell around 6% (or c4% more than the market), largely reflecting the increased risk aversion in the market; it remains a 4.5%+ position and will likely continue to be volatile (to both upside and downside) until it becomes clearer that their products are viable (or not). The position in DragonWave Inc (DRWI) fell almost 19% during the month, though there was nothing to change the thesis during the month. Given that the company disappointed with its quarterly earnings, it’s certainly fair to ask why Our Man is unbothered. The reasoning is simple, the thesis (see

here) is largely unchanged – in essence, more wireless 4G build-outs will happen (only Clearwire, DRWI’s largest customer, has started theirs in earnest) and DRWI, as the cheapest and more efficient option, will be involved (90%+ penetration at Clearwire). Thus rather than worry that the company’s quarterly numbers were disappointing, Our Man takes solace in the fact they continue to add more customers (and do more trials) and build the groundwork to position themselves for when the 4G roll-outs occur in earnest, while winning most of the currently available business. Given the increase in risk aversion, it should not be a surprise that a small company that is break-even/makes a small loss (but is very well capitalized) and whose success depends on future events (i.e. the timing is uncertain) suffers disproportionately during the month. These risks are reflected in the position’s sizing (c1.6%) and in truth, Our Man rather hopes it falls further over the next few months so that he can add to the position at a more attractive price (and with the thesis closer to coming to fruition).

Portfolio (as at 5/31 - all delta and leverage adjusted, as appropriate)

36.2% - Long Treasury Bonds (Aug-29 Bond & TLT, and 50bps premium in TBT Jan-13 puts)

21.7% - Bond Funds (VBIIX, DLTNX and HSTRX)

6.2% - Value Idea Equities (THRX, and DRWI)

3.2% - NCAV Equities

2.6% - Other Equities (NWS, CMTL and SOAP)

0.4% - Energy Efficiency (AXPW)

-0.1% - China-Related Thesis (7bps premium in FCX put)

-1.4% - Hedges/Put Options (13bps premium in S&P Dec-11 puts, 17bps in IWM Jan-12 puts, and 29bps SLV Jan-12 puts)

-6.7% (leverage-adjusted) – Currencies (EUO – Short Euro)

27.7% - Cash

Disclaimer: One of Our Man's lawyery friends felt he should put a disclaimer here noting if he was Long (or Short) a stock/ETF/etc that he talked about during each post...so Our Man has.

Our Man is Long all the stocks/ETFs/puts mentioned in the portfolio section above (in case you didn't realize that)!