Portfolio Update

- Uranium: OM made a small tweak to his Uranium exposure, slightly reducing the broader exposure to Uranium Miners (URNM) and replacing it with NuScale Power Corp (SMR). Nuscale is a leading designer of small modular nuclear reactors.

Performance and Review

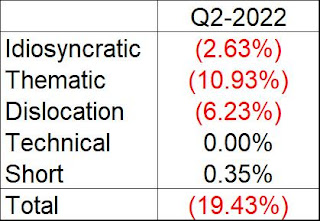

After an exceptional five+ months to start 2022, OM’s portfolio came rudely back to earth during the final three weeks of June. OM’s portfolio fell by -19.4% during the quarter, but three-quarters of that loss came in the final three weeks of June. This resulted in the portfolio under performing both the S&P 500 Total Return (-16.1%) and MSCI World (-14.4%) for the quarter. The strong start to the year, means that OM’s portfolio (-15.8%) is still ahead of those equity indices year-to-date - S&P 500 TR (-20.0%) and MSCI World (-18.5%)

Second Quarter Attribution

Before we look at the myriad of ways OM managed to lose money in Q2, let’s briefly touch on what bucked the trend. Unsurprisingly, the ‘short/hedge’ position in PFIX (+35 bps) – a play on higher medium term interest rates - was profitable as the Fed finally began raising rates and investors began to consider whether inflation was cyclical or structural. The more that inflation proves to be structural, the more likely we see higher medium-term rates. Elsewhere, OM profited from two Energy-adjacent positions - Shipping/Tankers (+274 bps) and the holding in TPL. Shipping/Tankers were a beneficiary of the Ukrainian crisis and the subsequent impact of the transport of crude oil and petroleum products. At the simplest level, Russian crude is going to India/China rather than Europe and Middle Eastern crude is going to Europe – inefficient trade routes resulting in greater ton-miles and demand for tankers. Finally, OM’s exposure to Carbon Credits (+12bps) gained despite all the issues around high energy and electricity prices. OMs exposure is primarily to the EU and California carbon credit markets where Green/ESG policies are a shibboleth, and the least likely to be abandoned even in times of stress.

The losses were broadly driven by some combination of three things:

i. Stocks were down.

ii. That was a choice; short-term pain for (expected) long-term gain.

iii. That was foolish.

Unsurprisingly, with global markets heavily falling most of Our Man’s stocks headed in the same direction; Tech/4th Industrial Revolution (-59bps), Biotech (-64bps), Funds (-156bps) and the position in JOE (together with TPL, forming Idiosyncratic -107bps). Within this group, the longer duration names (Tech/Biotech) and housing-related (JOE) fell more heavily reflecting the weakness of these sectors of the market, while some of the Funds held up slightly better.

The two other large risks that OM has chosen to take are commodity risk and short US dollar risk. The two are of course related, with commodity positions containing an implicit short-dollar relative position. With the US dollar continuing to strengthen during the quarter it was a headwind for OM’s non-US exposure; Brazil (-10bps), Vietnam (-76bps), India (-72bps), Greece (-59bps) and the Cambria Global Value ETF (GVAL, within Funds) all lagged. The first half of the year largely saw commodities rise, despite the dollar increasing. That changed abruptly in early June after the market moved from focusing on inflation to fearing recession, and its potential negative impact on commodity demand. The result was a sharp pullback across the commodity complex, and an even larger one in commodity related equities. OM’s positions in Uranium (-837bps), Tin (-311bps) and Commodities/Mining (-17bps) were hurt by this move. While both Uranium and Tin pulled back the long-term fundamentals of both continue to look good and the volatility comes with the space. With OM’s limited ability to trade the portfolio, position sizing is key - these large quarterly losses were within OM’s risk tolerance for the positions.

The case for nuclear continues to develop as the challenges of energy transition from fossil fuels, and the far longer timeline it will require, become clearer to even politicians. The West is thinking about building new reactors (led by the UK), postponing closures (California) and restarting (Japan) existing ones, as well as considering the security of its uranium supply (e.g. US establishing Strategic Uranium Reserve). These have had an impact on pricing higher up the nuclear fuel chain (SWU prices) as well as long-term contracting prices which are up 50% from last year.

OM believes the case for Tin is even cleaner, with the small changes since OM's last major update all further enhancing the case. As the rest of the market begins to run out of supply, Alphamin Resources (AFMJF) has progressed in 2022 from not only being the lowest cost producer to also being the one with the largest & most attractive undeveloped resource. The company suffered in Q2 after considering its strategic options but not finding a deal to its liking, coupled with a substantial fall in the price of tin. OM was delighted (and took the opportunity to add some in Q3) – the company is debt free and profitable at today’s tin prices, meaning it can fund its development internally. It is by some distance the premier asset in the most strategic metal. If the West has learned anything from the Russia/Ukraine crisis then the large Western mining companies should be potential acquirers, though probability suggest that it will eventually be bought by the Chinese. Hopefully, that day is still a year or two away allowing more of the value to accrete to existing shareholders rather than the eventual acquirer.

Finally, OM managed to throw away a bunch of performance; the crypto positions in GBTC and ETHE cost the majority of the Blockchain’s (-495bps) loss. Why throw away? Well, when OM talked about the position last he made clear the aim was to reduce the size and eventually exit during 2021. Sadly, having a plan is great but failing to execute is not – had he heeded his own advice and exited at the end of 2021, the portfolio would have saved ~500bps. There’s no great excuse (but lots of poor ones) for why he did not – hence that was (at best) foolish! The size of the drops in GBTC/ETHE were so large and dramatic that OM is being judicious about when to exit them, especially given their small size. However, unlike previously – the position will definitely be sold by 2022-end if not well well before. While the crypto positions would still be healthily profitable (500bps+) even if the existing GBTC/ETHE holdings went to zero, this is not a private equity portfolio; the sting of 2022’s profit foolishly thrown away, far outweighs the 25%+ IRR even in that worst case scenario.

Portfolio (as at 06/30/22 - all delta and leverage adjusted, as appropriate)

Dislocations: 43.6%

23.5% - Uranium (URNM, CCJ, NXE, PALAF, DNN, BNNLF, URG and SMR)

16.0% - Shipping/Tankers (STNG, INSW, EURN, TNK and DHT)

4.0% - Greece (GREK & ALBKY)

Thematic: 34.9%

7.3% - Tin (AFMJF, MLXEF and SBWFF)

6.8% - India (IBN, INDA and SMIN)

5.3% - Biotech: 4th Industrial Revolution (IBB & XLB)

4.1% - Blockchain/Crypto (GBTC, ETHE, and OSTK)

3.2% - Tech: 4th Industrial Revolution (JD & WCLD)

3.1% - Vietnam (VNM)

2.7% - Carbon Credits (KRBN)

1.9% - Commodities/Mining (FLMMF)

0.4% - Brazil (EWZ)

Technical: 0.0%

Idiosyncratic: 16.3%

11.1% - Funds (ARTTX, CWS, GVAL, and CAPE)

5.2% - Equities (TPL & JOE)

Shorts/Hedges: 3.7%

3.7% - Higher Medium-Term Rates (PFIX)

Cash: 1.5%

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take it that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.