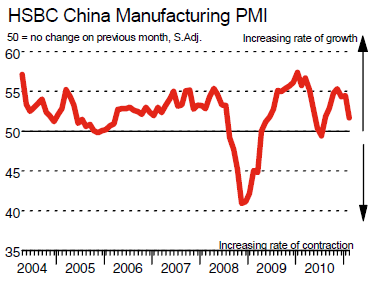

As Our Man suggested last week, now’s a good time to check-in on China and that’s because there have been subtle signs of a slow-down there. This is most clearly seen by looking at the PMI’s; both the manufacturing and services sectors have shown signs of slowing growth.

However, the January-February data is generally given short-shrift by investors as it contains the Chinese New Year and can thus be confusing/distorted depending on when the New Year falls. Thus, it will be interesting to observe February & March’s data to check whether these signs remain -- expect people to be “shocked” if they do.

As Our Man noted some time ago, inflation is the one of the key data points that he’s watching in China. The last 3-4months have shown signs that it has started to pick-up.

At some point, it becomes the variable that forces the government to make the choices that they’ve avoided so far; how much polarization (and potential social unrest) do the Chinese want for their GDP growth, do they really want a consumer-driven economy (i.e. do they really want to pay workers more) rather than an investment-driven one (that they can control), etc.

So far, the signs are that they’re willing to tackle inflation at the cost of growth; we’ve seen yet more reserve ratio hikes (the most recent pushing it to 20%, up from 15.5% in mid-2010) but also mandated wage rises.

China’s new five-year plan: well the headline news that the country will eschew its pursuit of investment-driven growth and encourage consumer spending has certainly excited some. However, colour Our Man a little more skeptical – while targeting a 2-3-percentage point increase in Consumer Spending (as a % of GDP) over 5-years sounds most impressive, it reveals the problems China faces. Why? Consumer spending was a mere 35.1% (in 09) of China’s GDP, the lowest by some distance globally. Should they achieve their aim, and Consumer Spending would still be below the 40% of GDP that it was 5-years ago! And this is before we consider whether China can do this while seeing no drop off in exports but an increase in imports, a rise in wages but no inflation and all this while being better to the environment.

Finally, a couple of random China-related things that I’ve seen over the last couple months that are worth bearing in mind. Firstly, we’ve all seen videos of deserted cities and malls in China (and here’s an in-depth Australian news report that's well worth the 5-10mins) – it’s just another reminder that GDP can be manipulated (build a house, knock it down and rebuild it…2 houses to GDP, but only 1 to wealth/productive stock) and that the quality of GDP matters over time. Secondly, my google crawlers have shown a pick-up of articles like this (“Economic slowdown in China Likely in 2nd Half of 2011”) in the mainstream media. On its own it means nothing, but cumulatively articles like these are worth noticing. Lastly, in the absence of being able to use more complicated instruments (CDS and receiver swaptions), Our Man has focused expressing his Short China thesis through puts on Commodity & Industrial names (see here for explanation). When rumours persist that firms are allowing copper to be used as collateral in financing, well it’s safe to say Our Man feels a little more comfortable about how the dynamics of this would all play out when the worm turns.

Thus, while the exposure to the China theme remains very small, it's also one of the places that's likely to see increased capital over the coming months.

No comments:

Post a Comment