After a very quiet Q1, OM made a number of changes to the portfolio during April with the catalyst being an influx of cash into the portfolio, aka OM’s retirement account, after he changed jobs. Given this, and the portfolio’s strong run over the last ~6mos what better time for a broad update.

In the recent post on Tin, OM mentioned that the largest core theme across the portfolio is things where supply is limited and where there is increasing demand. This is not a sudden change, and regular readers will know this is a core concept and risk that OM has talked about since the Mid-2020 Portfolio Update. Today, OM’s exposure to it has increased to over half the portfolio from ~38% in mid-2020, driven by the positions in Uranium, Shipping/Tankers, Tin, and Energy. This theme is also related to a lesser extent with both the Equities and Blockchain positions.

Positions (size order, all sizing is as of April 30th)

Dislocation - Uranium: 28.0% NAV

The first few months of 2021 have seen a steady stream of positive news flow and catalysts in the Uranium market. Most surprisingly, we saw a step shift in attitudes in the West where nuclear power had gone from being on its way out to finding new support as part of a green energy future. France extended the life of its existing nuclear plants and the EU is poised to declare nuclear as a green investment. The turnaround in the US was even sharper, with the White House backing subsidies for nuclear power plants to help meet its green goals. Meanwhile, the developing world continues to build nuclear power plants, most notably in both China and India.

Two major uranium mines, the Ranger Mine in Australia and the COMINAK mine in Niger have closed in 2021. Though the closure of these mines had been long flagged, it further reminds investors of the supply issues in uranium. Supply was also tightened in an unconventional way. A number of junior mining companies raised capital from the markets with the specific intent to use it to purchase physical uranium! The difficulty that they faced, and the delayed delivery schedules, reflect the paucity of supply especially as the two largest global miners (Cameco and Kazataprom) are also purchasing uranium as a result of reduced production due to COVID-19.

Finally, Sprott Asset Management – a large well-known player in commodity circles – announced the acquisition of Uranium Participation Corp and the establishment of the Sprott Physical Uranium Trust (“SPUT”). Sprott will be listing SPUT in New York, where hit has 4 other listed physical metals trusts, and will be marketing it with the ability to raise capital at market prices to purchase more physical uranium! Most importantly all of these things are happening as utilities are approaching the time when they need to start contracting to meet their future uranium needs.

Uranium stocks have run strongly over the last 6+ months, and in some cases are comfortably ahead of the fundamentals. However, OM’s belief is that we’re still in the early stages of this bull market and that the volatility should be weathered.

The majority of OM’s holding is in URNM, a well-constructed uranium ETF. Additionally, OM holds about 25% of his exposure split between CCJ (the largest western producer) and NXE (which owns the single best uranium asset globally). The balance is split between four junior miners (PALAF, URG, BNNLF and DNM) who are in various stages of production.

Dislocation – Shipping/Tankers: 12.9% NAV

Not much new to report on tankers; rates are between bad and dreadful but as the world moves towards reopening and normality the demand for oil is increasing. The order book remains exceptionally low, especially for product tankers, and with steel prices increasing there is added incentive for owners to scrap old tankers. OM's position is reasonably evenly spread across five shipping names (EURN, STNG, TNK, DHT and INSW, which replaces DSSI as the companies are merging). This combination gives OM a little more exposure to product tankers (which carry petroleum products, such as gasoline, diesel fuel, etc.) than crude oil tankers.

Theme – Blockchain: 12.2% NAV

The volatility in digital assets over the first four months of the year has seen the two listed closed-end trusts move from trading at premiums to their value to trading at discounts to NAV. OM took advantage of this by retaining the same direct exposure to digital assets but broadening it by adding a smaller position in ETHE (Grayscale Ethereum Trust) after it fell from trading at a healthy premium to a small discount. To compensate for his new position, the existing position in GBTC (Grayscale Bitcoin Trust) was reduced.

While digital assets have, and will likely continue to be, exceptionally volatile it works in both directions meaning that the management of position sizes really matters. As a reminder, OM’s approach to digital assets in this portfolio reflects a shorter-term public market view of the investments rather than any longer-term opinion on the digital assets. To this end, the portfolio construction reflects (i) a broad band of exposure to these assets (currently 6-10%), (ii) that this band will both be reduced and narrowed during 2021, and (iii) OM wants to capture the broad upward trend but also be diligent about taking profits (i.e. think something similar to a trailing stop once the position grows beyond the upper band). So far, it has worked reasonably well with OM having crystallized so much profit that even if GBTC and ETHE fell to $0 tomorrow, it would still have been a healthily profitable investment.

OM also re-entered his position in OSTK; the broad concept is similar to OM’s original write-up but the changes in management have had a material impact. Though the share price is much higher than when OM originally exited, the business prospects for the retail business have improved markedly and there is significantly less uncertainty around the digital assets. The core online retail business is better managed and took advantage of the shifts due to COVID. It has grown significantly and unlike many online retail businesses it is profitable! Overstock’s array of investments in digital portfolio companies is also now being professionally managed after a transaction with Pelion Venture Partners. The deal allows Overstock to participate in most of the upside, while also retaining direct stakes in certain of the companies (most notably tZERO, a SEC and FINRA regulated trading platform for digital assets!)

Equities - Funds: 12.6% NAV

No changes.

Theme - 4th Industrial Revolution: 8.6% NAV

One of the things that has become apparent over the last year is that the future is arriving quickly; both in terms of technology and biotech. On the technology side, much of what OM wrote last June still holds true; the thesis for SaaS (part I and part II) is largely unchanged and the pandemic has hastened the transition to cloud services. However, the median SaaS company trades at 14x its revenues over the next 12M - something that is hard to justify. As such, the exposure to technology has continued to slowly shrink and is now ~5%.

After five years of not doing a whole lot, biotechnology finally broke out in 2020 and surpassed its 2015 highs. The genomics revolution began in April 2003 when the Human Genome Project – an international scientific research project seeking to determine the DNA sequence of the entire euchromatic human genome – was declared complete. It took a leap forwards around 10-years ago with the emergence of CRISPR, and the ability to sequence and edit genomes. The cost of this sequencing and editing has fallen significantly over the last decade. While there are many legitimate debates and questions about the mRNA vaccines (Pfizer and Moderna) and their approval process, these vaccines are also clear beneficiaries of much of this work over the last decade and the first of their ilk. This coupled with the speedier approval process and renewed interest in the space, means OM has taken a small position (~4%) through the biotech etfs.

Themes – Vietnam, India and Brazil: 7.7% NAV

Unsurprisingly, given the very long-term horizon it is unchanged from when OM wrote about it 18 month ago.

Dislocation - Greece: 4.9% NAV

Following New Democracy’s impressive win in the 2019 Greek elections, things were looking up for Greece. New Democracy inherited an economy that was rebounding and OM’s expectation was that a business-friendly government would help change the narrative around its recovery and draw investor interest. The new government started well by persuading the EU to allow Greece to cut taxes and making reforms in order to reduce the primary surplus that the Greek government was mandated to run. However, the arrival of COVID overshadowed all of Greece’s progress and dealt PM Mitsotakis’ government an abysmal economic hand. The signs of the new government’s competence remain; it has managed the crisis better than most of Europe, and recently submitted a detailed national recovery plan to the EU that has already drawn positive initial evaluations.

Idiosyncratic - Equities: 3.8%

OM holds a couple of small real estate related positions.

Texas Pacific Land Corp (TPL) was a publicly traded land trust, with land in the Permian basin that benefits primarily from oil & gas royalties from the drilling/pipelines/etc. on its land and from a smaller but growing water business. The trust was historically self-liquidating, using its excess cash to buy back shares, but finally converted itself to a C corporation earlier in 2021.

The St. Joe Company (JOE) owns approximately 175K acres in the Florida Panhandle. The stock was a hedge fund battle ground a half decade ago, with bulls arguing it traded for a fraction of its future value and bears saying the land just wasn’t worth much (and there would be limited future value, as nothing significant would be built). They were both kinda right but on different time horizons - the bears in the short-term, the bulls in the longer-term – and the stock has gone sideways for much of the last decade. Today, the population in the Panhandle has hit critical mass and JOE is now benefiting from the broader infrastructure on its land and increased building (at attractive prices). COVID has further sped up the trend.

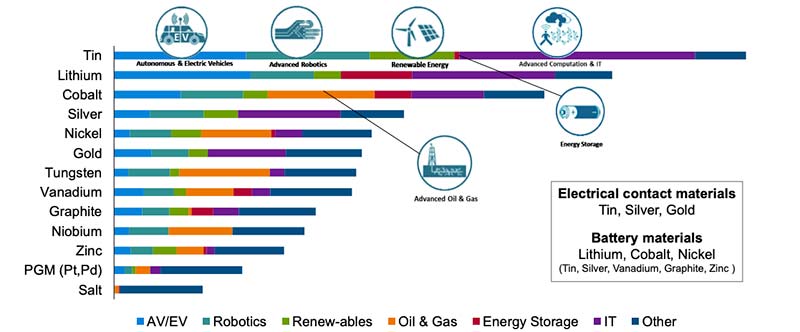

Theme – Tin: 3.1% NAV

OM recently wrote about Tin, and has subsequently continued to add to the position in Alphamin Resources (AFMJF) that makes up the vast majority of the tin exposure.

Theme - Energy: 2.4% NAV

OM has dipped his toe in Energy, through positions in two natural gas plays (AR and SD) who have both managed their businesses well during the turbulent times. Longer-term, OM remains interested in the offshore oil services sector but has no current positions.

Cash: <5% NAV

Disclaimer:

Nothing above represents a recommendation in any way, shape or form so

please don’t even think of trying to take it that way. For added

clarity, while Our Man is invested in all of the securities mentioned

that’s a terrible reason for anyone else to do so. Our Man also holds

some cash and a few other securities (of negligible value). You should

not buy any of these securities because Our Man has mentioned them, but

should do your own work and decide what’s best for you given your own

circumstances/risk tolerance/etc.