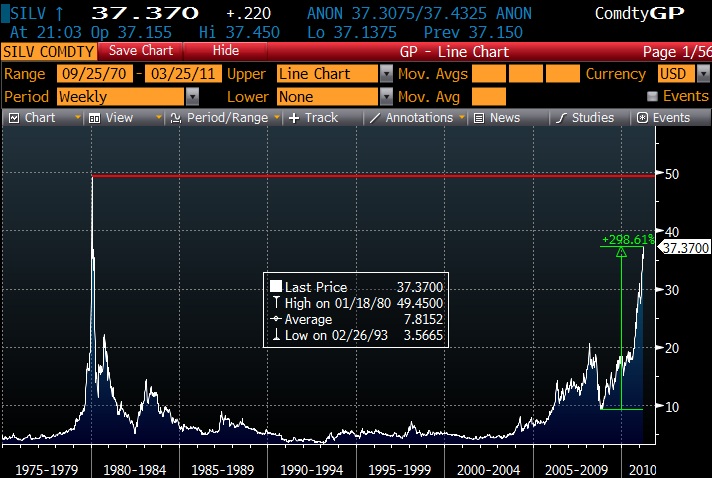

It seems like just a few days ago that Our Man was pointing in the direction of Silver’s chart and suggesting a bubble might be brewing (see here). As if to confirm that it was a parabolic move, Silver moved from c$37 back in late March to brush with the $50-level last week, a move of 35%+ in around 5-weeks! To put these moves into some context here are some charts on Silver and the various instruments one can play it through. Firstly, the same long-term weekly close graph that Our Man showed last time – note the nominal all-time high back in 1979** when the Hunt Brothers tried to corner the market.

Now, here’s a Bloomberg screen showing what Silver has done over the last 12months. Notice how it started to rise following the rumours of QE2 in August, and how also rampant the move has been.

Finally, here’s a chart showing the premium to NAV of the Sprott Physical Silver Trust (PSLV) for the month of April.

This trust holds all of its assets in physical silver, thus the chart shows how much people were willing to pay ABOVE the price of silver for a guarantee (or as close to one as possible) that it was held in physical form. As you can see, even though silver had moved 179%+ since August…investors were willing to pay 15-25% above the spot price (or the ETF) in order to buy into Sprott Physical Silver Trust. Think about that for a moment – not only are people willing to buy silver after it has risen 150%+ in well under a year, but they’re also prepared to pay an addition 15-25% premium on top of its price to do so. Not only does it suggest they’re keen to buy silver, it also suggests that they don’t believe that SLV (the Silver ETF run by Blackrock), or other similar instruments, that claims to hold their Silver in physical form (since SLV, as an ETF, trades almost exactly at its NAV). To be proven right, these investors either need a continued rally in silver or SLV (or other instruments) to be fraudulent (or at least people to fear that they may be) in their claims of holding physical silver.

This kind of sentiment, coupled with the final surge towards $50 over the Easter weekend, proved too tempting for Our Man; while he definitely missed the perfect entry point, a small put position (25bps of risk initially) on the SLV ETF was added to the portfolio on Easter Monday. Since then, Silver (and SLV) has been all over the place – falling then bouncing following Bernanke’s press conference, before falling heavily over the last few days.

Interestingly, the fall is being attributed to Comex increasing its margin requirements for Silver with some (various silver bugs) claiming such a move is a conspiracy to crush the metal price! Frankly, Our Man finds that idea somewhat amusing and another possible sign of the bubblemania that surrounds silver. Thankfully, the excellent Kid Dynamite explained the situation far more eruditely than Our Man’s clumsy drafts. Simply put (i) the CME acts as the central clearing-house and so takes the risk of investors not meeting margin calls and (ii) it sets it margin requirements in dollar (not % of contract value) terms. What this means is that as a futures contract value increases (i.e. as Silver goes up by 150%+ in 8 months) the exchange should require greater $ margin in order to cover the same percentage of an in investor’s potential losses. This is further exacerbated when the volatility of the price increases, as this means bigger swings in price, and thus a sensible exchange should increase its margin in order to cover these larger swings (and reduce its risk of an investor not meeting margin calls). Apparently, however, this is lost on some…and it’s just an evil conspiracy.

(** Keep this in mind, when you read the next Chartology)

(** Keep this in mind, when you read the next Chartology)

No comments:

Post a Comment