When Our Man was growing up in the leafy yet mean suburbs of London during the late 80’s and early 90’s, the most popular idiom floating around was “only fools and horses”. The idiom was a shortened form of an old saying ("only fools and horses work") and represented the philosophy of life that those people who do not look for an easy way of earning a living are fools. The idiom was enshrined within popular culture through the eponymous TV, which was (of course) one of Our Man’s favourites!

“Only Fools and Horses” followed the capers of Derek “Del Boy” Trotter, a fast-talking cockney trader who lived in a council flat in a high-rise tower block (‘Nelson Mandela House’, no less) in Peckham (South London), and his (nice but slightly clueless younger brother) Rodney as they try to get rich…quickly. It goes without saying that their futile schemes, mainly involving trading in various low-quality and/or black market goods (think Russian camcorders, luminous yellow paint, and the like), regularly backfire but this doesn’t dim their hopes with Del Boy often proclaiming that by “this time next year we’ll be millionaires”. Only Fools and Horses succeeded by capturing the ethos of Thatcherite Britain where the ideals of capitalism and deregulation meant that there was hope that anyone with the right product, skills or luck could be a millionaire by this time next year.

Fittingly, Only Fools and Horses saw its viewership peak (c24mn people in the UK, a viewership that in US-terms would be similar to that seen for final episode of M*A*S*H) for a Christmas Special in 1996, as Thatcherism was on the brink of being rejected at the ballot box. So why’s Our Man talking about a long-since defunct TV sitcom? Well, other than to introduce you, my long-suffering readers, to some fine British Comedy (I mean, how can you not love this), Only Fools and Horses has been strangely newsworthy in recent weeks. Firstly, with the sad passing of John Sullivan (the creator and writer) and then with the news that the Royal Wedding, after 15years, has finally knocked that Christmas-96 episode out of the Top 10 largest UK audiences ever.

However, thinking about Only Fools and Horses also led Our Man to cast his mind back to the other idiom of Thatcherite Britain; “as safe as houses”. While the phrase had been around a long-time (representing the strength of UK housing as an investment since at least the 1950’s, if not well before), it gained broad appeal during the 1980's spurred by the Thatcherism-defining Housing Act of 1980. The Act brought the opportunity of home-ownership to millions as it gave council house tenants (such as those living in ‘Nelson Mandela House’) the right to buy their dwelling, and is credited with helping drive the home ownership rate in the UK from 55% in 1980 to 64% just 7 years later.

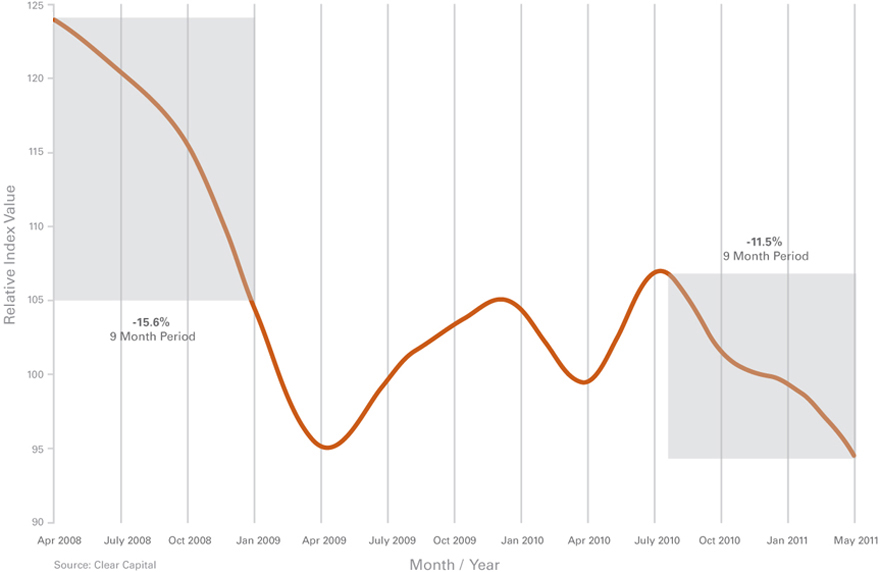

Unfortunately, in the last few years, we’ve seen that “as safe as houses” has proved to be an inadequate motif for the risks of home-ownership both in the UK and the US. Furthermore in recent weeks, after ill-conceived government efforts to prop up real estate have largely faded, prices have largely started to fall through their 2009 lows; let’s hope it is just a temporary phenomenon and that the impact on the economy (and by extension) is more “contained” this time.

Sunday, May 15

Subscribe to:

Post Comments (Atom)

As the price falls away....the debt strays behind. Someone will pay it, the debtor, the lender or you and me by way of the government or government induced inflation.

ReplyDeleteI wish that I could get a feel for how the CDS markets were positioned for collateral and if these "weapons of mass destruction" are still to be feared?

The housing market here in CDN has not seemed to notice that things are bad to the south or that significant portions of our GDP and employment numbers are supported by the construction industry. The question for us, up here, may well be, is our population expansion really supporting the building boom or is it the numerous friends/coworkers of mine that own 2 or more houses/condos???

Buy the dip.......maybe later.

Indeed. It's one of the sad ironies of this financial crisis; the universal solution to debt problems is seen as taking on more debt. As you say, eventually someone has to bear the cost of this and the governments, in their wisdom, have deemed that it won't be the private lenders (be they Banks, or those who lend to the banks).

ReplyDelete