As some of you may have noticed, despite the attempted rallies, the markets have not been a pretty sight this month! No doubt, if you’ve had the misfortune of watching the terrible talking heads you’ve no doubt heard it’s all the politicians fault (debt-ceiling muppetry), or S&P’s (how dare they downgrade the US from AAA), or the Europeans (call that a plan for dealing with Greece, Ireland and Portugal and Spain and err Italy), or companies (how dare they say things aren’t as rosy as the talking heads would like) or just the whole world (damn the whole globe for a global slow-down!). As you know, Our Man believes that markets are far more of a Bak-Tang-Wisenfeld sandpile and when they’re in a “critical state” it only takes one stray grain of sand landing in the wrong spot to bring it all down; thus, there’s little point blaming the particular grain of sand whether it’s European, Global, political, economic or company fundamentals!

Given that, here’s some graphs showing you why (or perhaps, that) we’re in a critical state!

1) Valuation

Look, the CAPE (or Shiller PE10) isn’t perfect and certainly isn’t useful as a timing device but it does provide the single best (and historically tested) look at valuation on a long-term basis. Forget what you hear about markets being cheap (especially when it’s drivel like based on analyst-projected operating earnings) and suck it up…equity markets have been expensive by historical standards for well over a decade! If CAPE isn’t your long-term valuation measure of choice, how about Tobin’s Q or Market Cap-to-GDP (Buffet's favourite, apparently).

2) Corporate Fundamentals

(Graph courtesy of Bill Hester, Hussman Funds)

If you want to buy stocks that are not only expensive but whose profit margins are close to their all time highs, then that’s your prerogative. It’s certainly possible that margins improve and we see record highs, but is that really something you want to bet on.

3) Signs of Economic Slowdown

Sure, this is just a PMI graph for China and it’s barely crossed into the recessionary (<50) readings but pick a major economy, and this and the leading indicators all look the same. So far that’s over-valued stocks, with near peak margins and signs of global economies cooling…doesn’t exactly sound like a recipe for success.

4) US Economic Data is pretty either

There’s no great way of telling how the economy is doing in real-time, but the Chicago Fed’s National Activity Index is a good start (I’d also point you in the direction of the Philly Fed’s ADS Index . You’ll notice that they’re not telling a happy tale at the moment with both so far above, but flirting with, recession-like levels (and noticeably worse than 2010’s dalliances).

5) Italian yields have seen better days

The ECB's buying of Italian and Spanish bonds this week has clearly helped lower their yields from the danger levels seen last week, but the risk is that it's coming at the cost of putting France into the firing line. With the Italian’s having 120% Debt-to-GDP, will France and Germany risk their AAA status (which is vital to the EFSF) to buy Italy time for reform and austerity? Perhaps, will it work out as well(!) as buying Greece time by bailing it out last year has? Probably, and that's what should worry you!

6) The Charts

(Courtesy of OEW/Elliott Wave lives on)

Look, Our Man will never profess to be a technical analyst, or to fully appreciate its wares, but he does have a small crush on Objective Elliot Wave analysis, what with its relation to behavioural theory and market psychology and all. It’s not perfect but given OEW's track record, when it flips from a bull market to bear market (and vice versa) then Our Man thinks you should at least listen (especially since they’ve been suggesting the bull market might be ending since May, with increasing conviction through July).

In conclusion, these are the little things that make a market interesting. They have been on the brink of a “critical state” for a while now so blaming any one thing is foolish. Our Man didn’t own much equity before and he sure as hell won’t be using this correction to load-up, and instead will only be nibbling at the odd thing that becomes exceptionally cheap under the security blanket that his puts offer. What'd it take for OM to load-up? Well, a good starting point to thinking about having a reasonable equity position would be when valuations were cheap (i.e. CAPE under historical mean) and margins were small; and Our Man would "fill his boots" should he ever see a CAPE near its historical lows and margins near theirs (but we're talking an S&P of c400 for that to happen, so don't hold your breath). As for everyone else (in the whole wide world), they make their own decisions and that’s what makes a market!

Special Bonus Chart: That downgrade…

It didn’t seem to cause any immediate spike in Japanese yields! Interestingly, US yields have also collapsed post-downgrade…not exactly what the talking heads had in mind! Apparently, inflation (and inflation expectations) & GDP growth (and growth expectations) have more impact on what bond investors do and where yields trade than an S&P rating. Colour me shocked!

Thursday, August 11

Wednesday, August 3

July Review

Portfolio Update

There were no changes to the portfolio during July.

Performance Review

After positive performance on each of the first 8 trading days of July had safely ensconced the book well into positive territory, the portfolio bounced around to ultimately end near the mid-point between its intra-month high and low. The result was a strong July, with the portfolio finishing +1.4% for the month bringing the year-to-date performance (-0.1%) to the brink of flat.

After positive performance on each of the first 8 trading days of July had safely ensconced the book well into positive territory, the portfolio bounced around to ultimately end near the mid-point between its intra-month high and low. The result was a strong July, with the portfolio finishing +1.4% for the month bringing the year-to-date performance (-0.1%) to the brink of flat.

With all the words spent discussing US default as the debt-ceiling debate intensified into month-end, it would be reasonable to think that the L Treasury Bonds book would have suffered. This thought would have been mistaken, as the book drove performance (+159bps) largely on the back of a seemingly continual stream of disappointing economic data. The Bond Funds book (+42bps) also contributed strongly.

The Equity books were somewhat disappointing. The NCAV book (+2bps), which has underperformed so far this year, largely weathered the storm while the limited size of the Short China (-1bp) and Energy Efficiency (-1bp) books meaning that they had no real impact on the portfolio. Disappointingly, both the Other Equities (-17bps) and the Put/Hedges (-13bps) books suffered more than might have been expected, with the Silver puts largely responsible for the latter’s performance. The Value Equity book (-37bps) was again the worst performing book, with both positions suffering from their longer-term thesis as risk aversion increased. While we remain in a risk-off period both THRX and DRWI are likely to continue their struggles in the coming months, with neither likely to have a major catalyst till late-2011/early-2012. Given their limited size in the portfolio, while the volatility makes for uncomfortable month-to-month performance, it is a risk that the portfolio can comfortably underwrite and there are likely to be opportunities to add to both names at attractive prices in the days and weeks ahead.

The portfolio’s Currency exposure (+4bps) was positive, despite the latest European bailout. My opinion is largely unchanged; today’s situation bears a certain analogue to the failure of Credit-Anstalt (in 1931) and the dominoes that subsequently toppled due to the poor handling of the issues of the day. I believe that we are continuing to witness the slow-motion toppling of dominoes, resulting from too much debt (i.e. debt beyond a level that can realistically expect to be repaid). It was started by the US subprime crisis but has now spread its epicenter to European sovereigns fanned by a global unwillingness to accept failure (especially of banks), to force bondholders to accept their investment risk (i.e. default), and a refusal to treat the source of the crisis (too much debt which means more debt is not the solution) rather than the symptoms (liquidity issues). Europe’s single currency experiment (removing the option of devaluation, for the weak) and its bureaucratic structure are amongst the reasons that the ricochet has bounced there first.

Portfolio (as at 6/30 - all delta and leverage adjusted, as appropriate)

36.9% - Treasury Bonds (Aug-29 Bond & TLT, and 76bps premium in TBT Jan-13 puts)

22.1% - Bond Funds (VBIIX, DLTNX and HSTRX)

5.0% - Value Idea Equities (THRX, and DRWI)

3.0% - NCAV Equities

2.4% - Other Equities (NWS, CMTL and SOAP)

36.9% - Treasury Bonds (Aug-29 Bond & TLT, and 76bps premium in TBT Jan-13 puts)

22.1% - Bond Funds (VBIIX, DLTNX and HSTRX)

5.0% - Value Idea Equities (THRX, and DRWI)

3.0% - NCAV Equities

2.4% - Other Equities (NWS, CMTL and SOAP)

0.3% - Energy Efficiency (AXPW)

<-0.1% - China-Related Thesis (6bps premium in FCX put)

-1.1% - Hedges/Put Options (14bps premium in S&P Dec-11 puts, 17bps in IWM Jan-12 puts, and 17bps SLV Jan-12 puts)

-6.7% - Currencies (EUO – Short Euro)

28.0% - Cash

<-0.1% - China-Related Thesis (6bps premium in FCX put)

-1.1% - Hedges/Put Options (14bps premium in S&P Dec-11 puts, 17bps in IWM Jan-12 puts, and 17bps SLV Jan-12 puts)

-6.7% - Currencies (EUO – Short Euro)

28.0% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (Aug-29 Treasury Bond, TLT, TBT puts, VBIIX, DLTNX, HSTRX, THRX, DRWI, NWS, CMTL, SOAP, AXPW, FCX puts, SPY puts, IWM puts, SLV puts and EUO). He also holds some cash.

Friday, July 29

The Lion Sleeps Tonight

- "Mbube", by Solomon Linda and the Evening Birds (the original)

As you may have noticed, there’s a bit of bother over the US debt ceiling, which if not increased is likely to lead to all kinds of uncertainty and seemingly anything ranging from a complete government shut-down, to downgrades of US debt, to default, and perhaps even to intergalactic warfare (okay, I might have made that last one up). Not only that but the same people who’re in-charge of coming up with the budget also set the debt ceiling (at a completely different time), which makes one wonder how they’re all “shocked” that the results of the budget they set 6months ago broke through the arbitrary debt limit they set 18months ago. Pretty much moronic all around, and the spectacle of recent weeks only adds to that.

Our Man was chatting with Mrs. OM this week, and the fact that not much has changed in the portfolio over recent weeks (a figurative lion sleeping?), despite the book’s largest position being in US Treasury bonds, came up. What better time (or possibly more foolish, depending on how things pan out) to share his thoughts with you. The short-answer is things are very uncertain and it depends on what happens, when and how: will the US actually full-on default, or prioritise payments/shut-down parts of the government (which I suspect is most likely), or will it merely miss/delay some interest payments and then see a compromise reached, etc). Clearly though, this isn’t much help in understanding how (or indeed, if) Our Man is thinking, so let’s break it down a little.

Equity books: Doing nothing here is relatively easy as the total Long Equity exposure across the equity-orientated books (NCAV, Value Equities, Other Equities & Energy Efficiency) is a mere 11.1% NAV. Thus even a substantial decline fails to produce a sizeable impact (>500bps) on performance. This is before we even consider the positive impact that fall in markets would have on the put/hedge book (51bps of premium at risk), and the manner in which this exposure (currently a mere 1.3% short) would increase as the markets fell. As such, it’s pretty clear that the equity book wouldn’t drive any major losses and that the worst possible result for it would be a market fall of ‘only’ 10-30%.

Fixed Income books (L Treasury Bonds and L Bond Funds, c58.5% NAV): In the short-run, I’d expect these to suffer should the US miss interest payments (remember new debt can be issued to meet principal payments, as the total level of debt doesn’t change) but am comfortable underwriting these short-term losses in the portfolio in all but the most extreme of scenarios (the US government saying we’ll never payback any bonds ever) and thus am comfortable with the existing position sizes. The longer-term is harder to predict, and while some expect that it’s just a continuation in the US’ path to hyperinflation, I (unsurprisingly) suspect that it won’t. More likely, any prolonged cut-back in government services will help threaten to push the US into negative GDP growth territory (after <2% GDP in Q1, and I dare say something similar or worse in Q2) and make deflation the more likely scenario. If there is eventually a debt-ceiling deal (involving cutting government spending) that sees creditors made whole (for the delayed interest payments), I believe this would be good for Treasuries! In the case of no default but a downgrade of US debt (from AAA to AA) then I’d be a buyer of US 10-Yr Treasuries on any noticeably widening of yields (i.e. the 10-Yr moving from c2.90% to 3.25-3.50%), since the headline rating is irrelevant (as seen in Japan) when compared to factors like inflation.

As an aside, when thinking about defaulting/etc there’s a subtle difference between Japan/US and Greece/Italy/Spain that’s frequently overlooked. Both Japan and the US issue debt in their own currency and are the monopolist supplier of their currency; thus, they ALWAYS have the ability to pay back the debt (through printing money) and thus should they default it’s because of their willingness to do so (see US Debt-Ceiling muppetry!). In the case of Greece/Italy/Spain they’re not the monopolist supplier of their currency and as such default is solely a question of their ability (or perceived ability) to pay off this debt. The same is true for countries that issue their debt in foreign currencies (e.g. Germany’s reparations post-WWI, or large tracts of Iceland’s debt before the Financial Crisis) as they are (by definition) not the monopolist supplier of these currencies.

Currencies: This discussion leads us nicely onto Greece, and the most recent bailout mechanism. Much like the (2 or is it 3 or 4) previous bailouts of Greece, the current one doesn’t offer any solution merely another effort to buy more time. In the end, basic arithmetic is working against Greece as even with generous assumptions it is likely that 23%+ of Greek government revenues** are needed to pay interest on their debt (no principal) before they even get around to providing any services. Clearly, that’s not a sustainable! So what does it require for Greece to go bankrupt and default? I actually think that’s simple; you need the French/Germans to not want to give/transfer their taxpayer money to Greece, and that requires France/Germany to be suffering enough economic pain, such that the political will to bail out Greece ranks behind the desire to help out French/German voters. Thus, it’s most likely Greece goes bankrupt when there’s the next bear market/recession (and Greece going late in that). Why’s Our Man still happy to be S the Euro…well, currencies are a relative value game and the for all the US’ faults, Europe is still uglier.

* Yes, the title was a gratuitous lead-in to bask in some of Mrs. OM’s photography from our recent holiday!

** How did Our Man come up with this number:

By generously assuming things haven’t got worse since 2010 (i.e. Debt/GDP stays constant) and using 144% Public Debt to GDP, a 6% interest rate on debt (vs. 16% 5-Year yield, currently), and Government Revenue of $114.5bn on a $305.4bn economy (thus revenue = 37.5% of GDP). Which gives us 144% * 6% = 8.64% of GDP spent on interest payments, or 23.05% of government revenue used solely for interest payments.

Saturday, July 16

June Review

Portfolio Update

Our Man is back from his vacation, so a brief but late update on June, which saw changes to the portfolio.

Performance Review

June was a thoroughly disappointing month, with the portfolio falling into negative territory on the 2nd and never managing to clamber back into the black. For the vast majority of the month, until the final few days, the book was down in the 25-75bps range but the book suffered as the market rallied strongly in the final days and ended up -2.1% (-1.5% YTD). However, this sharp negative performance late in the month should not disguise the portfolio’s weakness, with pretty much every book contributing to the poor performance.

The Treasury Bond book (-63bps) and the Bond Funds (-16bps) were the main contributors to the end of the month swoon, giving up their gains, as the fears over the ongoing problems in Greece after the country’s parliament approved another austerity program.

The Value Equities book (-87bps), as both THRX and DRWI fell heavily during the month and was the largest negative contributor. DRWI suffered from continued uncertainty over its short-term outlook after management reduced their guidance for their fiscal Q1 (May-end). While this hurt the stock, the long-termstory is largely unchanged and the position is well-sized to cope with the interim volatility. Theravance (THRX) had a larger impact on the portfolio, despite announcing reasonable Phase II trials together with Glaxo; the company is still developmental and has limited current revenues and thus suffered as market risk aversion rose and investors moved towards less risky companies. The NCAV equities (-22bps), which consists of 9 micro-cap companies, also suffered from the increased risk aversion. The Other Equities (-5bps), Energy Efficiency (-5bps) and China (-2bps) all hampered performance, with the Puts/Hedges book (+2bps) offering the only (and minimal) respite.

The Currencies book (-7bps) was up for most of the month as concerns surrounding Greece’s fiscal problems affected the Euro, but ending up costing money after the Euro rallied once the Greek Parliament approved further austerity measures.

Portfolio (as at 5/31 - all delta and leverage adjusted, as appropriate)

36.0% - Treasury Bonds (Aug-29 Bond & TLT, and 60bps premium in TBT Jan-13 puts)

22.0% - Bond Funds (VBIIX, DLTNX and HSTRX)

5.5% - Value Idea Equities (THRX, and DRWI)

3.0% - NCAV Equities

2.6% - Other Equities (NWS, CMTL and SOAP)

36.0% - Treasury Bonds (Aug-29 Bond & TLT, and 60bps premium in TBT Jan-13 puts)

22.0% - Bond Funds (VBIIX, DLTNX and HSTRX)

5.5% - Value Idea Equities (THRX, and DRWI)

3.0% - NCAV Equities

2.6% - Other Equities (NWS, CMTL and SOAP)

0.4% - Energy Efficiency (AXPW)

-0.1% - China-Related Thesis (7bps premium in FCX put)

-1.3% - Hedges/Put Options (13bps premium in S&P Dec-11 puts, 16bps in IWM Jan-12 puts, and 33bps SLV Jan-12 puts)

-1.3% - Hedges/Put Options (13bps premium in S&P Dec-11 puts, 16bps in IWM Jan-12 puts, and 33bps SLV Jan-12 puts)

-6.7% - Currencies (EUO – Short Euro)

27.7% - Cash

27.7% - Cash

Tuesday, June 28

How long does it take to create a financial religion?

Since Our Man is heading off (with Mrs OM) on his holidays tomorrow, he thought he’d leave with you with something to ponder in his absence. Sadly, it’s not some bright new revelation that he’s going to ask you to ponder…but one strongly related to something he discussed in this blog’s early days.

How long does it take for the financial patterns to become so culturally ingrained, that investors can’t help but slavishly adhere to them?

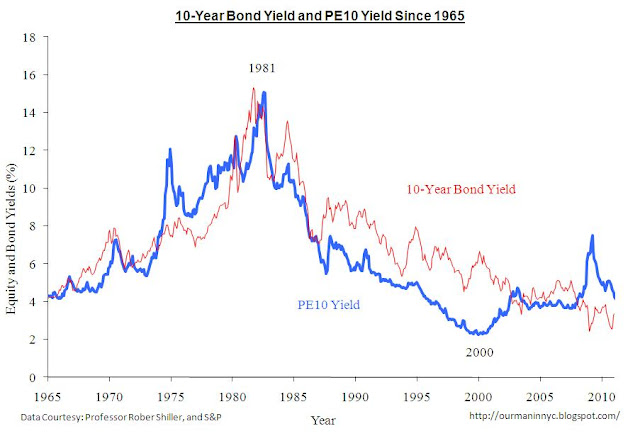

Well, if Our Man had to guess (and he does, else this post wouldn’t be much use otherwise), he would wager a maximum of 30-40years. Why? Well, that seems to be the length of time it takes for a full financial cycle to run its course. The graph below shows the most recent full cycle for bond and equity yields.

Bond and equity yields moved largely in lock-step between the mid-60’s and the end of the tech bubble (in 2000). This lead to the traditional bond yields fall and equity prices rise (i.e. equity yields fall) argument that has become a mantra, and underpins the “given where the 10yr is equities are cheap” argument. However, over recent years they’ve started to diverge. What if this religious belief in the lock-step move of bond & equity yield has ill-prepared the equities are cheap crowd? After all, their rationale makes logical sense (equities and bonds compete for a share of the investment portfolio) and the historical data, especially since the bull market of 1981-200, seems to back up their case.

And what if the sharp bond yield rises of the 70’s have ill-prepared the bond vigilantes for what comes next? They know what happens when inflation gets out of control – and it must do with the FED printing like crazy, right?

Why would they both be getting misled – as with everything, perhaps we should look at the whole picture…

Will the relationship exist should using interest rates loses its primary role (due to a zero-interest rate policy) and effectiveness as monetary tool. What if bond and equity yields decouple like we’ve seen in Japan? (Our Man does have certain expectations…)

What of the carefully nurtured “bond yields down, stock prices up” financial religion then?

Sunday, June 26

What to do about China?

In the past, Our Man has opined a lot on the difference between opinion and execution, and how it is vital to consider this difference whenever you hear someone stating an opinion (especially when it’s on a disreputable source, like CNBC) on financial markets.

To this point, just last week, Our Man shared his strongly-held skepticism about China’s economic miracle. This skepticism hasn’t done much for the portfolio, with the China thesis being a consistent negative contributor since it was added to the book in mid-10. Fortunately, the execution has been somewhat better; despite the persistent losses, the thesis has cost a mere 50bps since its inception. This is a result of the small amount of capital that’s been allocated to the trade due to Our Man’s acceptance that the timing factors haven’t fully aligned, yet…

However, there are some signs that the timing signals are finally coming around. As you will no doubt recall, a couple of the key timing signals that Our Man was waiting for were the arrival of inflation and some signs of Bank/Credit tightening (see he said it, right here). Well, as the pretty little graph (from The Economist) down below shows these elements certainly seem to showing up, with both inflation and the banks’ reserve ratio steadily climbing!

Given this, you won’t be surprised that Our Man is starting to look to increase his exposure to the China thesis and here’s a recap of the ways he’d consider doing so. As a brief reminder, Our Man can only go Short through longer-term put options (12mths+ for companies, 3-6mths+ for various ETFs) and is limited to solely investing in US-listed ETFs and companies. This eliminates a number of the more esoteric positions, which have far better risk-reward, out there in fixed income world (I’m talking Australian interest rate swaptions, CDS on Japanese industrials, etc). This inability to execute as efficiently as Our Man would like is also why the China thesis, despite Our Man’s strong opinion, will never be as large a position as it could be (given that strong opinion).

- Commodity (and Commodity-related) Companies

The argument for betting against these names is simple; China is both the major and the marginal buyer of their products. For example, China represents over 40% of the global demand for copper, or over ½ of global demand for Steel (and thus directly and indirectly Iron ore). Furthermore, much of the shenanigans to circumvent the credit tightening at the banks is through the use of commodities (originally copper, now it has allegedly progressed to other commodities following a government crackdown on using copper) as collateral, meaning the behavior of real demand is less clear than it appears. As such, should a slow-down happen in China… the likely impact will be larger on commodities and related companies than people expect.

- Australia

Not much has changed in Australia, since Our Man talked about it at length a year ago. The economy continues to benefit from its large supply of raw materials and households continue to pile on more (largely mortgage) debt. Much like the rest of the China thesis the timing factors have improved, most notably home prices have started to slide, which has resulted in an increase in the number of homes for sale. This has a certain similarity to the 2006-7 period in the US, and we’ll see if the Australian Banks’ claims that they have been better at underwriting mortgage risk than their US peers holds true. Unfortunately, the only real way Our Man can play Australia remains EWA (an ETF) and some Australian-listed commodity companies that have US ADRs.

- Brazil

The one region that has become vastly more interesting as a potential short over the last year is Brazil. Brazil has a similar underlying story to Australia; it’s a vast producer of raw materials (especially iron ore and soy products) and thus exports a great deal of this to China (though it lacks Australia’s proximity). However, despite these large exports to China the country remains a net importer overall. What’s more (and spot the trend here) there are signs of potential credit issues looming, after a strong period of credit growth (credit doubled between 2002 and 2010) and an infrastructure that’s not yet developed for such credit growth (i.e. Banks can’t see a customer’s total credit outstanding, just their credit outstanding with the bank). What’s yet more interesting, is that the timing factors are also lining up well, with the Brazilian yield curve becoming inverted (see here) – while this is no guarantor of recession, it’s typically a sign that the market expects one in the coming year or so (e.g. the US yield curve became inverted in mid-07). The final benefit of a potential Brazilian position is the ETF, which is large and liquid and largely consists of commodity-related and financial firms.

Sunday, June 19

Some More Observations on China...

Our Man has long been skeptical of the “China story” and the seemingly commonly held view that China is the panacea, since GDP growth there will never slow down. So in this glance at China, rather than give you a regurgitation of his earlier posts (in case you wanted to know, here’s why Our Man is skeptical), Our Man thought he’d just blithely refer you to various bits in them as he meanders through some observations of the last few months.

A few months ago, Our Man motioned in the direction of the weakening Chinese PMI’s which suggested that the pace of Chinese growth was slowing and this trend continues with the PMI’s preliminary reading for May falling to 51.1 (from 51.8 in April). Our Man also mentioned the various shenanigans that were going on in the copper market (where copper was being used as collateral to help obtain financing, i.e. as a way around credit constraints).

The last few months have seen a whole new spate of shenanigans featuring Chinese companies that are listed in the US. No fewer than a dozen Chinese-based companies currently have seen their shares suspended or halted from trading in US, predominantly as a result of accusations of fraud. There are a lot of companies listed in the US, yet the vast majority of those whose shares are suspended are Chinese. What is more surprising is that many of these companies were ‘supposedly’ blue-chip names like China Media Express, which reached c$1bn market cap, before allegations of fraud led to its CFO and auditor to resign. Or Longtop Financial, a multi-billion dollar darling of the hedge fund crowd, whose auditors resigned saying their previous audits weren’t to be trusted as management and the local banks were complicit in the fraud after the firm was exposed in the impressive Citron Research blog. The most recent example is Sino-Forrest, a $4bn+ market cap company that has lost 80% of its value since a report by research firm Muddy Waters alleging fraud came out. Muddy Waters aren’t the only ones who have been skeptical and now even the mainstream media are cottoning on to the various issues surrounding Sino-Forest. Now, Our Man’s not saying that everything you hear from China and every company there is a lying crock of ****, but hopefully if you’re a believer in the China story you have got your eyes wide-open.

Now, Our Man was pointing this out to a Sinophile friend of his, when the friend very politely suggested that these were private companies and hence while there were shenanigans, the private Chinese companies were merely suckering naive or lazy American investors who bought into their story. Lest that you fall for such clap-trap, Our Man thought it only fair to point you in the direction of some public-sector shenanigans. Remember when everyone was so impressed by China’s high-speed rail? Well, unfortunately, the man-in-charge Liu Zhijun was arrested for embezzlement and that his ministry managed to rack up $271mn of debt (or 5% of Chinese GDP!) and that numerous others are being investigated after safety concerns cropped up (the result of using low quality concrete and other materials). That said, needing to bail out high-speed rail links isn’t unique to China (see Japan’s bullet train, Taiwan’s high speed trains and the lack of profitability of France’s various high-speed lines as examples) though it’s normally takes longer before you need to quietly shutter high-speed lines because no one wants, or perhaps it's can afford, to travel on them.

However, this wasn’t the public issue that caught Our Man’s eye over the last few months. Imagine there were a bail-out of local state debt that represented >10% of GDP (i.e. we’re talking bigger than California or Greece)…that would make major news, right? Well, apparently if it’s a US state or a European country it’s good for 24/7 coverage…but not if it’s China bailing out its local governments. Interestingly, most people thing that the Chinese government tackling this problem head-on is a good thing and certainly acknowledging and quantifying the problem is. However, what matters is who eventually has to pay the bill not who carries the liability. The Chinese have some form with determining who pays from their banking crisis in the 90’s which was a glorified version of extend and pretend. Back then government-backed Asset Management companies bought the impaired bonds from the Banks, issued the Banks new ones and made the interest payments by liquidating the impaired bonds over time. Obviously, when the principal came due the Asset Management cos didn’t have the capital and so rolled the bonds into a new bond backed solely by…a Ministry of Finance letter! Hence the eventual cost was borne by the household sector which through taxation and negative real interest rates helped provide this subsidies to the banks. Don’t be shocked to see a similar thing happen this time. There are of course other ways for the State to pay for this debt that it's taken on; perhaps the state will sell-off some assets to meet these debts, or they will confiscate wealth from the wealthy/SME’s/etc but Our Man suspects that they will continue to rely on the household sector to bear the burden as they’ve done for the last 20years+. The identity of the ultimate payer matters, especially if it's to be the household sector, since one of the primary aims of China’s much lauded latest 5-year plan is the aim of increasing consumption by 2-3% of GDP…and thus starting to reverse the trend of the last 20years.

All very interesting, I’m sure you’ll agree, but the real question is what is Our Man doing with all this information and data that he’s seeing. For that, you shall have to wait till next time.

Subscribe to:

Posts (Atom)