Brazil: 25.8% (International Book) as of 9/30/17

The long-term argument is simple; Brazil’s long recession, and the equity bear market that lasted from 2011 to 2016 which saw an almost 80% loss (in USD-terms) is over. The market bottomed in Jan-16 and a new cyclical (possibly event secular) bull market is beginning. Furthermore, the public discourse around Brazil and investor sentiment reached a nadir in Q2-16 as the ‘Carwash Scandal’ enveloped the ‘elite’ business and political class culminating in the successful impeachment of President Rousseff.

So why invest? Well, the highest return potential is when a situation improves from one that is terrible and completely ignored by investors, to one that’s ‘okay’ and attracts curious interest. There were clear signs of this in Brazil during the middle of 2016 across a range of areas;

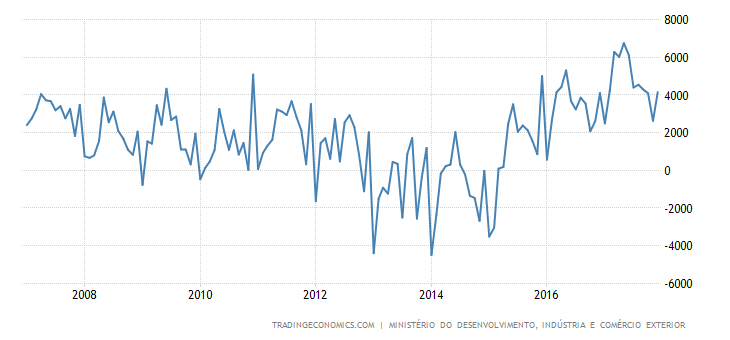

- At a macro level the balance of trade turned positive

(historically a very good sign for Brazilian equity markets).

- President Temer, the new President was viewed as a

short-term President, and with politicians already held in contempt by the

populace they were ironically more amenable to taking actions (i.e. economic

and pension reforms) that they normally tried to avoid.

- At a corporate level, both friends and professional

contacts of OM said similar things; that companies, irrespective of sector, had

to cuts costs to the bone to survive the last 5-years. Many only survived as a result of competitors

going out of business. Or in layman’s

terms, if there were any growth in demand these firms have a better competitive

position and operating leverage!

- While speaking with numerous Brazil-focused portfolio

managers, Our Man kept hearing that fundamentally stocks (especially outside

the most liquid names) were exceptionally attractive but…

The phrases after the “but” always represented the various

constraints - self-confidence after a bear market, market concerns, what

clients would think, potential business risk, etc. - that prevented the

portfolio manager from participating (for now, in OM’s view).

- Finally, after a seemingly continuous fall the

Brazilian market (in USD-terms) finally started to turn around, impulsing

higher in early and mid-2016 and leaving the lows well behind.

With this mix of promising signals, and the opportunity

created by a short-sharp pullback in the wake of the US election, Our Man began

his Brazilian position split between large-caps (EWZ) and small-caps (EWZS) in

late-2016.

The data over 2017 has largely started to confirm many of

the original premises.

- As noted, in the Q2-review, President Temer’s

probability of being a short-term President increased after he was allegedly caught on tape discussing hush-money payments to jailed powerbroker Eduardo

Cunha. The entire process, which ended with him

surviving an impeachment vote, ensured the public’s low esteem of politicians remained

unchanged. Yet, the probability of

reforms passing increased with him surviving impeachment.

- Temer’s troubles led to a 20% pull back in May, which

saw a subsequent bounce before retesting the May lows before rallying once

more. This created the technical sign

for Our Man to add to his position, before adding once more as the rally went

through the highs seen in May.

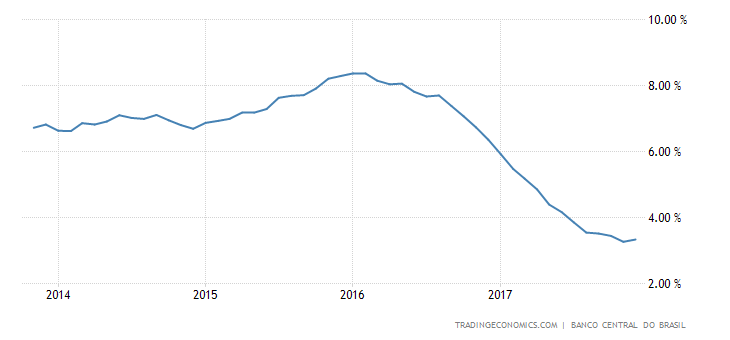

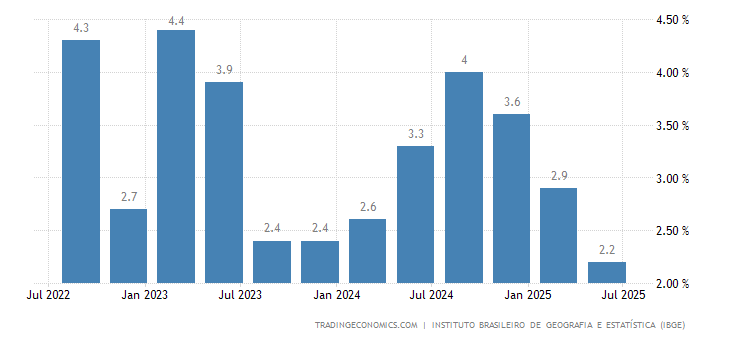

- The economy continues to improve on multiple fronts, be

it GDP finally turning positive

or inflation falling dramatically

or the balance of trade looking the healthiest in years.

In summation, to Our Man’s mind, Brazil is setting up as

a perfectly positive storm of fundamentals and technicals meaning OM sees a

de-risked (for example, versus 12mos ago) situation that is getting ready to continue its sharp rise. Unless he’s horribly wrong and the Q2 lows are tested, OM hopes that despite the inevitable volatility he won't even be trimming his positions back till they're significantly higher or Brazil’s 2018 election is in he

headlights.

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take the above that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take the above that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.

)