Our Man made some changes to the portfolio, with most of the theses discussed in the recent portfolio updates.

- Uranium: Our Man rejigged his uranium exposure largely exiting single names and reinvesting the capital into the two ETFs (URNM and URNJ) that cover the miners and junior miners in the space. The introduction of URNJ just over a year ago means that OM can hold broader exposure to junior miners, including to those listed globally.

- Shipping/Tankers: OM continues to slowly prune the position, trimming the position in TNK.

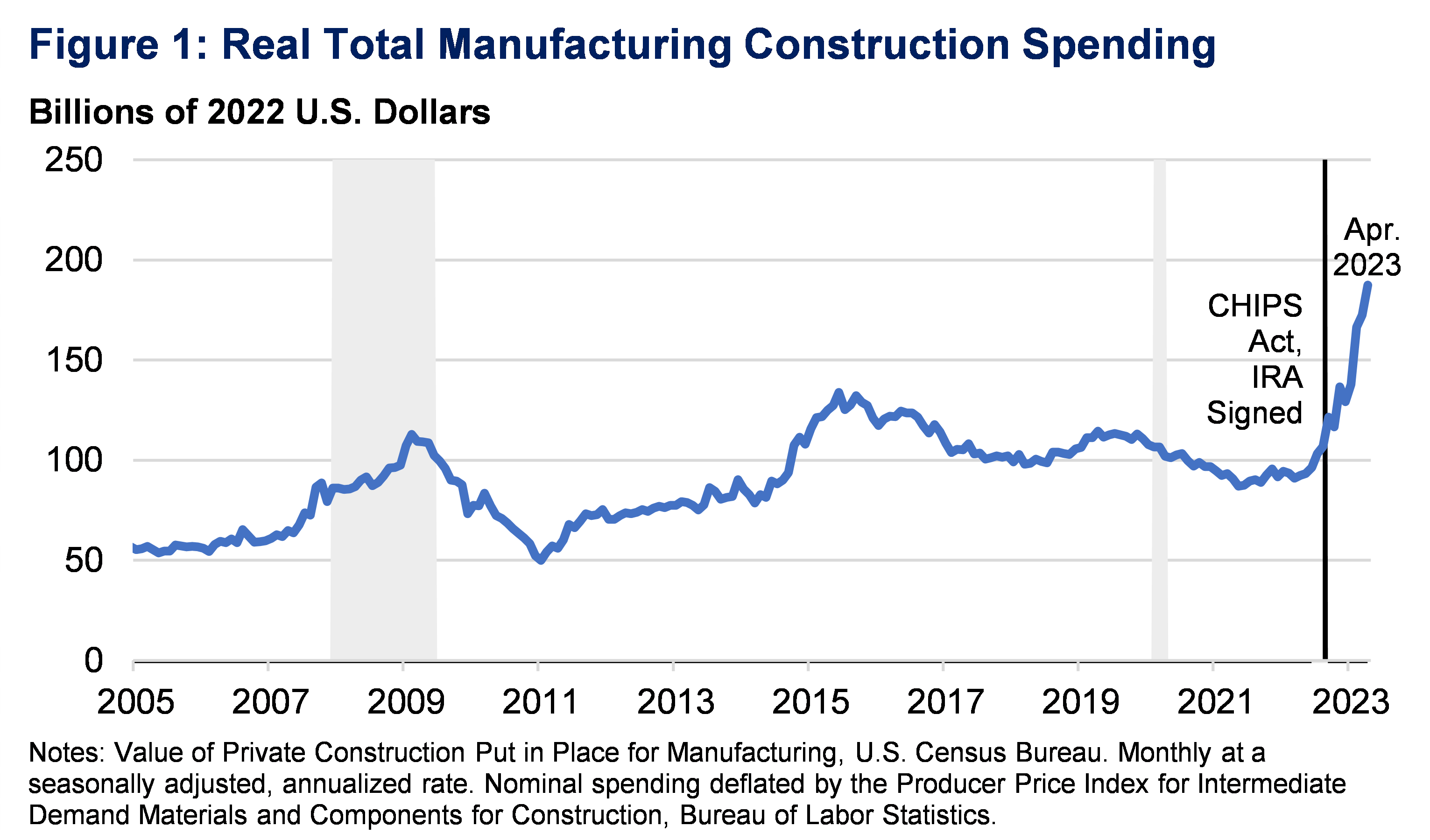

- US Re-industrialization: As noted in the recent portfolio update, OM believes that the broad theme of US re-industrialization is significantly overly looked and added additional exposure (AIRR).

- 4th Industrial Revolution/Software: OM exited the position in Software names, in part since the below positions have similar underlying properties/exposures.

- Blockchain: OM entered a position in one of the new Bitcoin ETFs, around the time of Bitcoin’s halving (which reduces future supply). As recently noted, “while the Bitcoin halving slows future supply, OM suspects that this 12-month post-halving cycle will be driven by Institutional FOMO (vs. prior halvings’ retail FOMO) now that exposure can be more easily obtained via ETFs.”

- China: OM entered positions in both a broad China ETF (FXI) and Chinese Technology Company ETF (KWEB). The thesis for this dislocation position can be found here.

- Greece: Finally, OM exited most of the position in Greece (GREK). While Greece remains a reasonable opportunity, there are other more attractive opportunities and it lost out in competition for capital.

The portfolio rose broadly in line with equity markets during the quarter with its +3.97% increase placing it between the S&P 500 TR (+4.28%) and the MSCI World (+3.03%). Overall, this leaves it marginally ahead of the indices year-to-date at +15.44% (versus S&P 500 TR at +15.29% and MSCI World at +13.43%).

Second Quarter Attribution

The portfolio continued to benefit from its exposure to European/UK Financials (+173bps), Argentina (+140bps) and Shipping/Tankers (+159bps). The UK Financials continued the trend of the last 6-12 months; increasing earnings and improved visibility on futures earnings as they reset interest rate hedges at higher rates. While the market slowly adjusts to this, the stocks continue to trade at significant discounts to book value and single digit PEs. The positions in Argentina benefited as President Milei’s initial reforms continue apace, including receiving Congressional approval. It is early days for President Milei, and while things have started well economically there will inevitably be bumps in the road and the Argentina positions will be volatile. The Shipping/Tankers positions continue to benefit from global uncertainty, with both the Russia/Ukraine and Israel/Hamas conflicts effectively tightening supply due to ships leaving the market (to transport Russian oil) or having to take longer routes to reach destinations (due to Houthi targeting of ships).

Elsewhere, Tin (+85bps) was a healthy contributor on the back of positive expectations for semiconductors (Tin’s primary use is acting as the ‘glue’ in semiconductors) and reduced supply after a scandal in Indonesia (one of the largest suppliers) limited exports. The positions in India (+60bps) also helped - stocks initially dropped following Modi’s re-election in India before recovering as it became clear that he & his coalition partners would retain a working majority despite the opposition’s improved performance.

The primary detractors were positions in the Blockchain (-139bps), Brazil (-81bps) and China (-55bps). The Blockchain positions were hurt by a pull-back in BYON as it reorganizes its retail businesses, and by the decline in Bitcoin/Ethereum from near their highs at the end of Q1. While both Brazil and China are attractive fundamentally, both have continued to struggle and remain at/near their lows. Elsewhere OM had small losses in Technology-4th Industrial Revolution/Software (-6bps, in part due to timing of exit and reallocating cash), Biotech (-6bps) and Carbon Credit Allowances (-11bps).

The remainder of the portfolio were small positive contributors, led by Uranium (+29bps), Greece (+18bps), Idiosyncratic (+15bps), US Re-industrialization (+9bps) and Commodities (+6bps).

Portfolio (as at 06/30/24 - all delta and leverage adjusted, as appropriate)

Dislocations: 50.5%

23.3% - Uranium (URNM, URNMJ, NXE, and SMR)

11.5% - European/UK Financials (BCS, LYG, NWG)

7.0% - Argentina (BMA, GGAL, SUPV)

4.6% - China (KWEB, FXI and JD)

4.2% - Brazil (EWZ)

Thematic: 42.6%

12.3% - Shipping/Tankers (STNG, INSW, TNK, DHT and FRO)

6.9% - Tin (AFMJF, MLXEF and SBWFF)

5.8% - India (IBN, INDA and SMIN)

5.2% - Biotech: 4th Industrial Revolution (IBB & XBI)

4.3% - Blockchain/Crypto (ETHE and OSTK)

4.2% - US Re-industrialization (AIRR)

1.9% - Carbon Credit Allowances (KCCA)

1.4% - Commodities/Mining (FLMMF)

0.7% - Greece (ALBKY)

Idiosyncratic: 5.1%

5.1% - Equities (TPL & JOE)

Shorts/Hedges: 0.0%

Cash: 1.8%

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take it that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.