The positions in European/UK Banks (11.5% position) and Argentina (7.0%) represent classic dislocations, where investors have been disappointed by so much and for so long that they have given up. The result is an attractively valued opportunity, with prices having bottomed, at a time when material changes are happening.

The European/UK Banks’ (11.5%) 2023 year-end results finally led to sharp moves in the stocks, but it’s telling that even after rising ~40% year-to-date that Barclays still trades at ‘only’ 6.6x analysts’ 2025 Earnings and at 0.5x Tangible Book Value. It doesn’t take a vivid imagination to see the possibility that things continue to improve from here and OM expects the UK banks to continue to surprise investors. One of the counterarguments has been that the post-Brexit, the UK has been a hot mess encapsulated by Liz Truss’ short Prime Ministership. The recent election campaign did little to dissuade this but today’s massive ‘centrist’ Labour majority means that the UK looks politically stable for the foreseeable future in sharp contrast to the uncertainty engulfing France, Germany and the US!

In Argentina (7.0%) it has quickly become clear that President Milei is seeking to make major changes very quickly. While many will feel it is too fast, Milei has learned from Macri’s failed attempt at gradual reform a decade ago. The reforms are broadly things that have been discussed for years including liberalizing the exchange rate regime, shrinking the money supply (including running down the central bank notes, LELIQs, which were held by the banks), balancing the budget and the start of structural reforms. The reforms will be imperfect, and their passage into law and implementation will be complicated, but the direction remains positive. So far, Milei has played his political hand well.

The new position in China (4.6%) bears the dislocation traits; China has fallen from being THE place to invest for much of the last two decades to being described as ‘uninvestable’. There are very good reasons for this, most prominently China’s actions reminding the world that it is not a capitalist country and it has a very different approach to the rule of law. Unsurprisingly, stocks have fallen substantially with large cap China (FXI) bottoming early this year down 55-60%, and China Tech names (KWEB) down ~75%, from their respective February 2021 peaks. This leads to two natural questions – when is the downside priced in and why now? The answers are unfulfilling; it’s near impossible to tell when things are priced in, especially given a large part of the issue is structural. However, the risk/reward is interesting – for example, Chinese Tech stocks trade at half the valuation of US ‘peers’ and the Chinese government has made incremental equity-positive steps (e.g. approving buybacks, etc.). Though OM has started a position, he fully recognizes that China operates under a non-capitalist framework, and thus the size is smaller and the holding period will be shorter than otherwise.

The balance of OM’s portfolio is spread across a handful of themes; India (5.8%), Biotech (5.2%) and US Reindustrialization (4.2%). The first two represent long-term themes that have been in the portfolio a while, and OM expects to outperform broader markets.

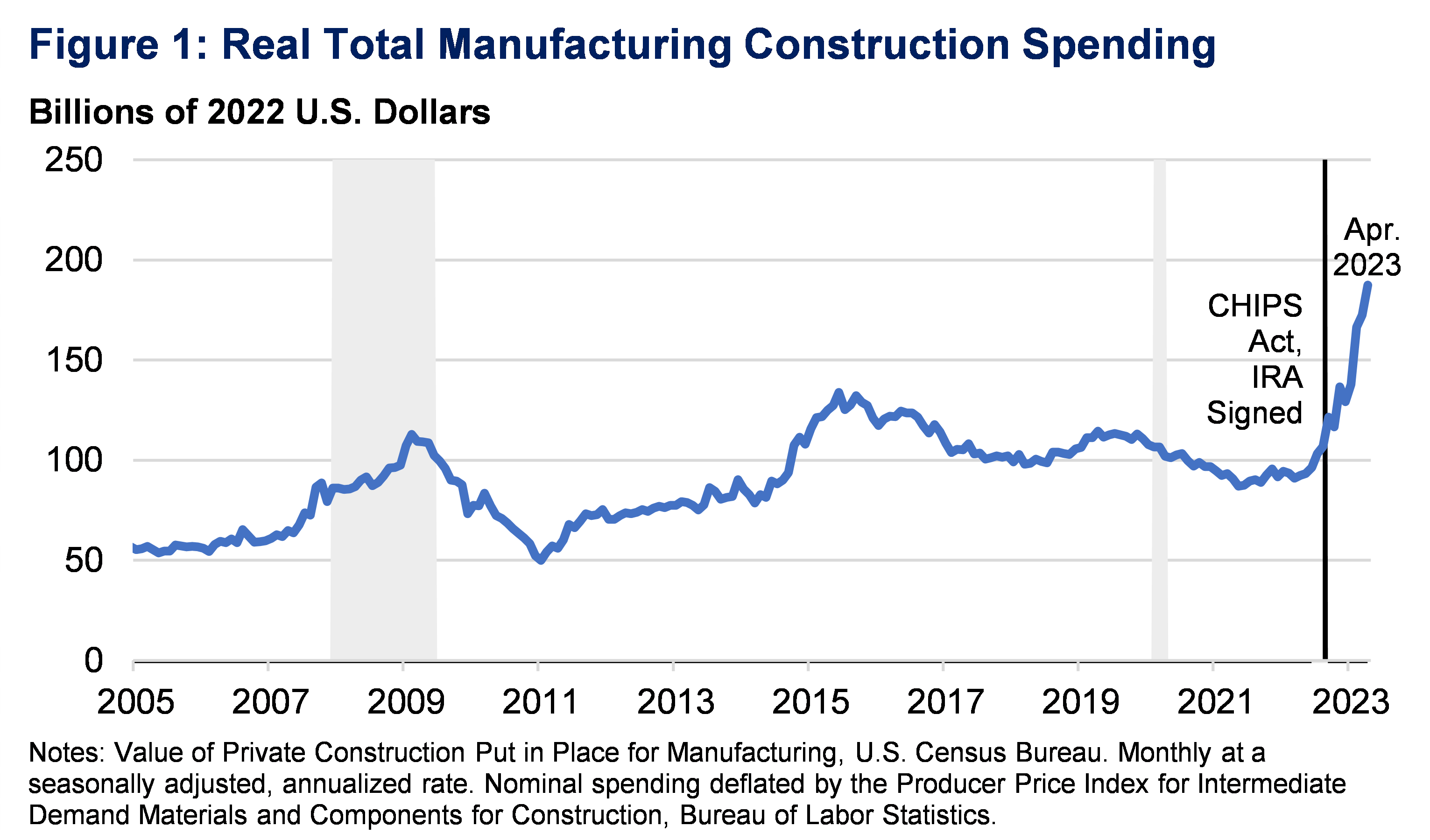

The US Reindustrialization (4.2%) theme is newer to the portfolio and is the one most ‘missed’ long-term theme by professional investors. What is the reindustrialization of the US? Well it’s electrification (EVs), energy transition (renewables), the second order effects of digitisation and AI, coupled with the reshoring trend and massive multi-year fiscal stimulus programs (CHIPS Act, and especially Inflation Reduction Act, which changes the ROE on industrial capex).

While investors are aware of the above chart and boom in manufacturing capex it is largely viewed as a one-off spike rather than the early innings of a multi-year surge. The problem is that it’s driven by a combination of numerous trends and lots of companies are seeing their own little part of these. These companies can explain how they’re benefiting, but there is an inability to clearly articulate the scale of what’s happening and thus the longevity and size of the opportunity. Well this is true except for 1 company; megacap Eaton, who are seeing it all, explaining it to the market, and have been handsomely rewarded for it (ETN: +60% over 1-year, +160% over 3 years). OM’s belief is that in the coming years, as the market better understands the scale and scope of US Reindustrialization the collection of smaller companies that are facilitating the different parts of it will be rewarded.

Friday, July 5

Portfolio Update – Part II – Everything Else

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment