Our Man can hear y’all shouting “Don’t do it” at him!!!

This piece started out just over a month ago, as a half-baked idea, but the collapse in cryptocurrency prices and a unique stock-specific situation meant OM did some more work and has started a blockchain theme. As such, this piece is now much longer than originally intended.

Some Scary Finance Terms Made Simpler

Before we dive into the blockchain, a side note on binaries, loss aversion, agency risk/problem, optionality and convexity. Those of us in finance throw around these terms which sound complex but really cover simple concepts.

Most public market investors avoid binary situations – ones where the probabilistic outcomes are bimodal and split, or in plain English where the result it likely either terrible or awesome with very little in between. The most common example is a single drug biotech company where the drug trial result is the difference between commercializing a multi-billion blockbuster drug and losing everything. This avoidance of binaries is not an irrational decision but reflects the traits of as loss aversion and the agency problem. Research has found that the pain of losing a dollar is vastly greater than the joy of making one, and so people understandably seek to avoid that loss, hence “loss aversion”. The agency problem arises since investors are largely managing other people’s money, which influences their decision making. What do I mean? Do you want to go to your boss with an idea that will lose everything if you’re wrong? Do you want to sit with clients and say we lost X% last quarter due to this one position, but that’s okay we knew there was a 40-50% chance of that happening? For almost all, the answer is no… they would invest their money in that idea but they won’t invest client money.

While this avoidance of binaries is a facet of public market investing, this is not the case elsewhere. Studies suggest up to 40% of venture-funded businesses fail and a similar number don’t generate the targeted returns, yet venture capital is a thriving industry. The reason is convexity; an investment is convex if the payoff is unbalanced for equally opposite outcomes – for example, if you can make 10 on that hypothetical drug being a success, while only losing 1 if it fails. It’s why venture capitalists focus on metrics like Total Addressable Market (TAM) for their start-ups – it helps to frame the company’s potential size, and is a proxy for the investment’s convexity. OM uses optionality to express the same concept, just with an acknowledgement that if he’s wrong the downside is losing the capital invested in the position (i.e. like an option!).

Crypto/Blockchain as Optionality

OM is fascinated by blockchain (and yes, cryptocurrencies) but as friends know, is exceptionally reticent to talk about anything to do with investing in it. It’s so early in its lifecycle that any investments are akin to venture capital – it’s almost impossible to accurately value and there’s a significant probability you will lose your money. Thus OM’s sole advice is do your homework and invest as much as you’re willing to mentally write off not matter how fascinating and misunderstood it is.

With that said, OM is going to share just a little of his thinking on the blockchain as its convexity is part of the thesis. However, to avoid diving down rabbit holes, the following should be considered a gross simplification (some links are embedded for those who want to dig deeper).

There are two broad views of blockchain technology (and the related cryptocurrencies).

1. It will disrupt the Federal Reserve and/or become a store of value/money. That’s cool, and could be very valuable, but frankly OM isn’t really that interested in it. Yes, bitcoin *could* become a mix of digital gold and “money” and there will be profits to be made as in that journey, but it’s not for OM.

2. The potential for creating Web 3.0. This came to life with the creation of Ethereum and is what fascinates OM.

• Web 1.0 was the Internet of OM’s young adulthood (the 90s and early noughties, baby!!), where anyone could start a website as services were built on open internet protocols (points to the https at the start of website addresses, or the smtp protocol that allowed this email to reach you) that were ‘controlled’ by the Internet community.

• Web 2.0 is the Internet as we know it over the last 10-15 years, where major software companies have become centralized hubs of data and information. The historical resolution that occurs whenever an industry sees this type of extreme centralization, aka a monopoly, has been regulation.

• Web 3.0 could be the return of decentralization through blockchains, which use consensus mechanisms and cryptocurrencies to better align incentives. OM will spare you all the long explanations, but heartily recommends reading this piece (and everything else) by Chris Dixon.

The arguments for Web 3.0 are manifold but two that intrigue Our Man are:

(i) That you can build more advanced protocols – they’re decentralized and have fixed rules (like Web 1.0), but with greater functionality and better aligned incentives.

(ii) USV’s Fat Protocol Thesis. In Web 1.0 working groups and non-profits created protocols that produced massive value, which was predominantly captured by the applications (e.g. Google, Facebook, etc.). In the blockchain, this is reversed with the value flowing to the protocols (and, if well structured, their cryptocurrencies) rather than the applications built on top of them.

To be clear, it will take a long time. Progress will definitely not be linear and it is far from obvious which protocols and blockchains will ‘win’. However, if – and it is a huge if – blockchains do help engender Web 3.0 and we start to see applications that are native to blockchain (rather than mere copies of what exists elsewhere today), then the related protocols/blockchains will be worth substantially more than they are today. This is the type of convexity that intrigues OM and is drawing software engineers and venture capitalists into the industry.

So what does OM own?

Overstock (OSTK)! The crappy e-commerce stock, what does that have to do with Blockchain?

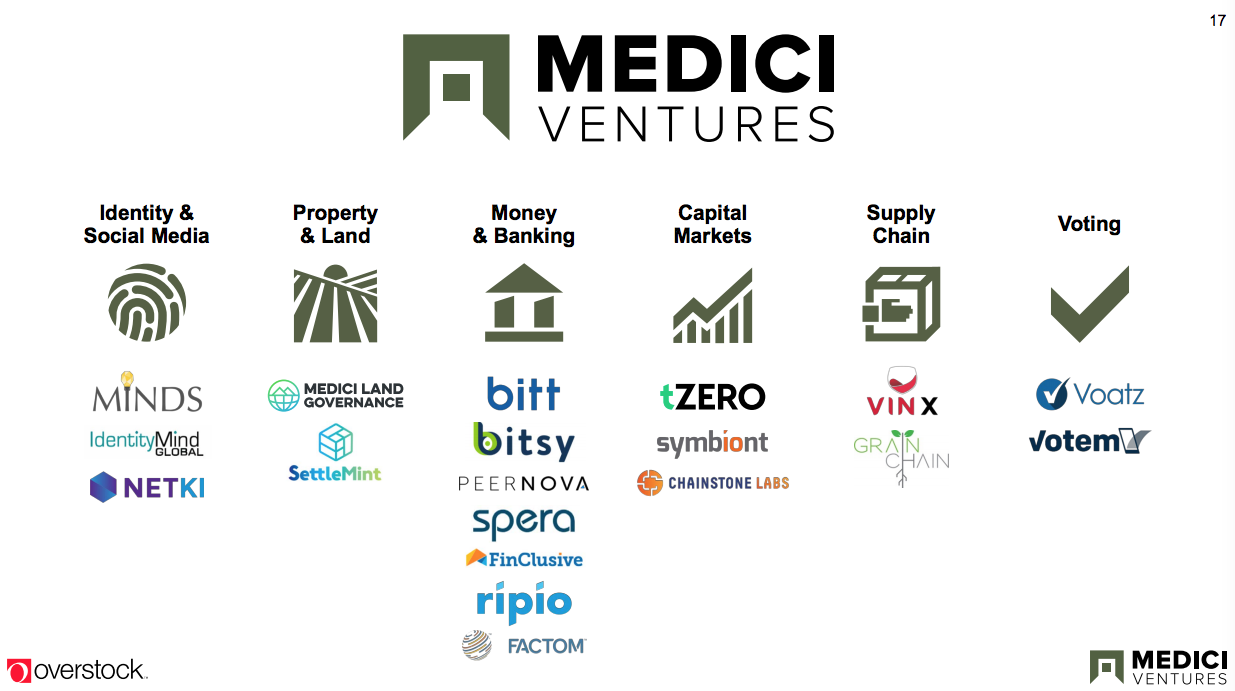

Well, largely unknown to most OSTK has slowly been turning itself into a blockchain VC firm. Four years ago, Overstock was the first retailer to accept bitcoin and over the last 4-years it has been putting capital into blockchain technology through its Medici Ventures subsidiary. Medici has invested in a dozen start-ups focused on six areas of blockchain adoption; capital markets, money and banking, property, voting and underlying technologies supporting blockchain.

The price over the last 18 months has started to reflect this transformation

This piece started out just over a month ago, as a half-baked idea, but the collapse in cryptocurrency prices and a unique stock-specific situation meant OM did some more work and has started a blockchain theme. As such, this piece is now much longer than originally intended.

Some Scary Finance Terms Made Simpler

Before we dive into the blockchain, a side note on binaries, loss aversion, agency risk/problem, optionality and convexity. Those of us in finance throw around these terms which sound complex but really cover simple concepts.

Most public market investors avoid binary situations – ones where the probabilistic outcomes are bimodal and split, or in plain English where the result it likely either terrible or awesome with very little in between. The most common example is a single drug biotech company where the drug trial result is the difference between commercializing a multi-billion blockbuster drug and losing everything. This avoidance of binaries is not an irrational decision but reflects the traits of as loss aversion and the agency problem. Research has found that the pain of losing a dollar is vastly greater than the joy of making one, and so people understandably seek to avoid that loss, hence “loss aversion”. The agency problem arises since investors are largely managing other people’s money, which influences their decision making. What do I mean? Do you want to go to your boss with an idea that will lose everything if you’re wrong? Do you want to sit with clients and say we lost X% last quarter due to this one position, but that’s okay we knew there was a 40-50% chance of that happening? For almost all, the answer is no… they would invest their money in that idea but they won’t invest client money.

While this avoidance of binaries is a facet of public market investing, this is not the case elsewhere. Studies suggest up to 40% of venture-funded businesses fail and a similar number don’t generate the targeted returns, yet venture capital is a thriving industry. The reason is convexity; an investment is convex if the payoff is unbalanced for equally opposite outcomes – for example, if you can make 10 on that hypothetical drug being a success, while only losing 1 if it fails. It’s why venture capitalists focus on metrics like Total Addressable Market (TAM) for their start-ups – it helps to frame the company’s potential size, and is a proxy for the investment’s convexity. OM uses optionality to express the same concept, just with an acknowledgement that if he’s wrong the downside is losing the capital invested in the position (i.e. like an option!).

Crypto/Blockchain as Optionality

OM is fascinated by blockchain (and yes, cryptocurrencies) but as friends know, is exceptionally reticent to talk about anything to do with investing in it. It’s so early in its lifecycle that any investments are akin to venture capital – it’s almost impossible to accurately value and there’s a significant probability you will lose your money. Thus OM’s sole advice is do your homework and invest as much as you’re willing to mentally write off not matter how fascinating and misunderstood it is.

With that said, OM is going to share just a little of his thinking on the blockchain as its convexity is part of the thesis. However, to avoid diving down rabbit holes, the following should be considered a gross simplification (some links are embedded for those who want to dig deeper).

There are two broad views of blockchain technology (and the related cryptocurrencies).

1. It will disrupt the Federal Reserve and/or become a store of value/money. That’s cool, and could be very valuable, but frankly OM isn’t really that interested in it. Yes, bitcoin *could* become a mix of digital gold and “money” and there will be profits to be made as in that journey, but it’s not for OM.

2. The potential for creating Web 3.0. This came to life with the creation of Ethereum and is what fascinates OM.

• Web 1.0 was the Internet of OM’s young adulthood (the 90s and early noughties, baby!!), where anyone could start a website as services were built on open internet protocols (points to the https at the start of website addresses, or the smtp protocol that allowed this email to reach you) that were ‘controlled’ by the Internet community.

• Web 2.0 is the Internet as we know it over the last 10-15 years, where major software companies have become centralized hubs of data and information. The historical resolution that occurs whenever an industry sees this type of extreme centralization, aka a monopoly, has been regulation.

• Web 3.0 could be the return of decentralization through blockchains, which use consensus mechanisms and cryptocurrencies to better align incentives. OM will spare you all the long explanations, but heartily recommends reading this piece (and everything else) by Chris Dixon.

The arguments for Web 3.0 are manifold but two that intrigue Our Man are:

(i) That you can build more advanced protocols – they’re decentralized and have fixed rules (like Web 1.0), but with greater functionality and better aligned incentives.

(ii) USV’s Fat Protocol Thesis. In Web 1.0 working groups and non-profits created protocols that produced massive value, which was predominantly captured by the applications (e.g. Google, Facebook, etc.). In the blockchain, this is reversed with the value flowing to the protocols (and, if well structured, their cryptocurrencies) rather than the applications built on top of them.

To be clear, it will take a long time. Progress will definitely not be linear and it is far from obvious which protocols and blockchains will ‘win’. However, if – and it is a huge if – blockchains do help engender Web 3.0 and we start to see applications that are native to blockchain (rather than mere copies of what exists elsewhere today), then the related protocols/blockchains will be worth substantially more than they are today. This is the type of convexity that intrigues OM and is drawing software engineers and venture capitalists into the industry.

So what does OM own?

Overstock (OSTK)! The crappy e-commerce stock, what does that have to do with Blockchain?

Well, largely unknown to most OSTK has slowly been turning itself into a blockchain VC firm. Four years ago, Overstock was the first retailer to accept bitcoin and over the last 4-years it has been putting capital into blockchain technology through its Medici Ventures subsidiary. Medici has invested in a dozen start-ups focused on six areas of blockchain adoption; capital markets, money and banking, property, voting and underlying technologies supporting blockchain.

The price over the last 18 months has started to reflect this transformation

So, why invest?

Convexity, of course! In addition to the convexity in the entire blockchain theme, discussed above, the collection of circumstances around Overstock has created meaningful convexity in the stock.

Some facts and figures on Overstock; it’s a ~$550mn market capitalization company with ~$180mn in cash on its balance sheet with no debt (~$3mn) and very limited liabilities. Patrick Byrne, the CEO, is exceptionally controversial with opinions running the gamut from genius to insane. He’s also a “true believer” in blockchain technology, with Overstock being the first retailer to accept bitcoin back in 2014. Finally, as noted it has two businesses; the online retail one that you likely recognize, and the blockchain venture capital one.

Retail Business

- The big news in November was that Overstock announced it was looking to sell its retail business in 2019.

- The retail business is a $1.8bn revenue business that has been slightly loss-making over the last decade, though losses accelerated in early 2018 before tempering.

- Since announcing it was looking to sell its retail business, Wall Street’s analyst’s valuation ranges on the business have been between $400mn and $1bn+. Our Man suspects the top-end is unrealistic; Overstock has never traded at the kind of valuation offered to similar e-commerce businesses (e.g. Wayfair). However, astute readers will note that even the low-end means that you get the blockchain business for free.

- The key will be execution, Overstock selling the business and for a decent price.

Blockchain Business

- Overstock’s blockchain business is through its wholly-owned subsidiary, Medici Ventures, a blockchain VC company.

- Overstock has invested $175mn in blockchain ventures through Medici, and its holdings can be seen below.

Convexity, of course! In addition to the convexity in the entire blockchain theme, discussed above, the collection of circumstances around Overstock has created meaningful convexity in the stock.

Some facts and figures on Overstock; it’s a ~$550mn market capitalization company with ~$180mn in cash on its balance sheet with no debt (~$3mn) and very limited liabilities. Patrick Byrne, the CEO, is exceptionally controversial with opinions running the gamut from genius to insane. He’s also a “true believer” in blockchain technology, with Overstock being the first retailer to accept bitcoin back in 2014. Finally, as noted it has two businesses; the online retail one that you likely recognize, and the blockchain venture capital one.

Retail Business

- The big news in November was that Overstock announced it was looking to sell its retail business in 2019.

- The retail business is a $1.8bn revenue business that has been slightly loss-making over the last decade, though losses accelerated in early 2018 before tempering.

- Since announcing it was looking to sell its retail business, Wall Street’s analyst’s valuation ranges on the business have been between $400mn and $1bn+. Our Man suspects the top-end is unrealistic; Overstock has never traded at the kind of valuation offered to similar e-commerce businesses (e.g. Wayfair). However, astute readers will note that even the low-end means that you get the blockchain business for free.

- The key will be execution, Overstock selling the business and for a decent price.

Blockchain Business

- Overstock’s blockchain business is through its wholly-owned subsidiary, Medici Ventures, a blockchain VC company.

- Overstock has invested $175mn in blockchain ventures through Medici, and its holdings can be seen below.

- The most promising Medici asset is tZero, which is an alternative trading system. Initially, it’s looking to transform the trading in ICOs, by making them compliant with SEC and FINRA regulations.

- Overstock is in talks with GSR (a Chinese PE firm) who completed their legal due diligence in Q3. The deal involves taking a stake in tZero equity and a purchase of Overstock equity, in addition to GSR’s position in the recently completed tZero ICO.

- The key again is execution; the market doesn't believe the deal gets done, and definitely not at the $1bn+ valuation that’s been mooted for tZero.

Again, the mathematically astute reader will notice that *if* the GSR deal can be completed, Overstock’s holding in tZero will be worth more than the current valuation. This of course, places no value on the rest of Medici’s blockchain ventures. This, together with the potential from selling the retail business starts to create the convexity, and that’s without tZero or the blockchain businesses becoming something in the long-term.

Technical Accelerant

While OM believes the blockchain theme creates some long-term convexity, and the particulars of Overstock’s fundamental story creates short-term opportunity, it’s the technical factors that have the potential to act as accelerant to really drive the convexity.

A little backstory; Overstock came to Our Man’s attention after speaking with some short-sellers who having been short the name previously, were now long it. That is very rare! One, Marc Cohodes, was involved in litigation with Patrick Byrne (Overstock’s CEO) a decade+ ago. The pair recently settled their differences and Cohodes’ long position and strong views are well known.

While the presence of shorts-turned-longs is interesting, the accelerant is in the amount of short interest and the associated technical dynamics. At October-end, around ~1/3 of Overstock’s shares were short. This in a tightly held stock; Byrne and his family own around 1/3 of the stock, and that’s before you get to any other long-term holders. Accounting for this, 50%+ of the available float is currently short.

Should Overstock manage to execute well, then OM thinks the shorts scrambling to cover their positions will likely help create meaningful additional convexity. For the older financial folks amongst you, think a much scaled down version of Porsche/VW from 2008 as being the best case scenario.

Sizing

Our Man thinks that Overstock offers convexity in multiple ways, but he’s quite aware that (i) both the Blockchain theme and Overstock are potentially binary outcomes, and (ii) he could be 100% right on Blockchain and still lose all his $ in Overstock. As such, you should expect the Blockchain theme and the individual positions to be small, on a cost basis. Over the next couple of years, until either the stocks or the theme become less binary, OM will be biased towards taking profits rather than aggressively letting the position run. Overstock, and the Blockchain theme, are a ~2% position.

Disclaimer: OM is long Overstock (OSTK), as noted above.

- Overstock is in talks with GSR (a Chinese PE firm) who completed their legal due diligence in Q3. The deal involves taking a stake in tZero equity and a purchase of Overstock equity, in addition to GSR’s position in the recently completed tZero ICO.

- The key again is execution; the market doesn't believe the deal gets done, and definitely not at the $1bn+ valuation that’s been mooted for tZero.

Again, the mathematically astute reader will notice that *if* the GSR deal can be completed, Overstock’s holding in tZero will be worth more than the current valuation. This of course, places no value on the rest of Medici’s blockchain ventures. This, together with the potential from selling the retail business starts to create the convexity, and that’s without tZero or the blockchain businesses becoming something in the long-term.

Technical Accelerant

While OM believes the blockchain theme creates some long-term convexity, and the particulars of Overstock’s fundamental story creates short-term opportunity, it’s the technical factors that have the potential to act as accelerant to really drive the convexity.

A little backstory; Overstock came to Our Man’s attention after speaking with some short-sellers who having been short the name previously, were now long it. That is very rare! One, Marc Cohodes, was involved in litigation with Patrick Byrne (Overstock’s CEO) a decade+ ago. The pair recently settled their differences and Cohodes’ long position and strong views are well known.

While the presence of shorts-turned-longs is interesting, the accelerant is in the amount of short interest and the associated technical dynamics. At October-end, around ~1/3 of Overstock’s shares were short. This in a tightly held stock; Byrne and his family own around 1/3 of the stock, and that’s before you get to any other long-term holders. Accounting for this, 50%+ of the available float is currently short.

Should Overstock manage to execute well, then OM thinks the shorts scrambling to cover their positions will likely help create meaningful additional convexity. For the older financial folks amongst you, think a much scaled down version of Porsche/VW from 2008 as being the best case scenario.

Sizing

Our Man thinks that Overstock offers convexity in multiple ways, but he’s quite aware that (i) both the Blockchain theme and Overstock are potentially binary outcomes, and (ii) he could be 100% right on Blockchain and still lose all his $ in Overstock. As such, you should expect the Blockchain theme and the individual positions to be small, on a cost basis. Over the next couple of years, until either the stocks or the theme become less binary, OM will be biased towards taking profits rather than aggressively letting the position run. Overstock, and the Blockchain theme, are a ~2% position.

Disclaimer: OM is long Overstock (OSTK), as noted above.

No comments:

Post a Comment