A small note on the current environment and market; economic conditions are uncertain and are being impacted by a cross-current of conflicting short and longer-term trends. These include the consequences of the COVID-19 lockdowns and the subsequent multi-speed re-openings, the varying amounts of fiscal and monetary support provided during COVID, a decade+ of loose monetary policy, and rising inflation caused in part due to supply constraints and as a result underinvestment in commodities that have been exacerbated by the Ukraine/Russia conflict. As a result, there has been contradictory signals across countries and within different parts of the economy and markets, meaning there are a broad range of outcomes for both growth and inflation and there is data to support almost any view.

Market wise this has led to increased uncertainty and higher rates, which have been bad for stocks and credit. It has also seen a tendency for the market to extrapolate limited datasets to smooth the uncertainty but then have sharp reversals when contradictory data comes out. This is further compounded by the uncertainty over the Fed’s preference function due to the absence of inflation over a prolonged period. What matters most to the Fed between inflation, financial sector stability, economic growth/unemployment, currency strength/stability, etc. and by how much?

OM’s market view can be summed up as 🤷 with reasonable cases able to be made for almost any stance. However, Our Man made several changes to the portfolio in early September. These largely reflected some structural things that OM has been pondering a while with the most notable being profit-taking in Shipping/Tankers and the elimination of the Funds bucket of the portfolio.

For a broader round-up, and thoughts on the various buckets, please see below:

Uranium: 25.4% NAV

Marginal change, through the reduction in the Paladin Energy (PALAF) position

Since its inception, the uranium position has primarily been about the supply deficit and how higher prices would be needed to encourage greater supply. While there have been signs of changes in the perception of nuclear generation and potentially increased demand (i.e. new power plants) over the last couple of years, the conflict in the Ukraine and resulting energy issues have acted as a catalyst and brought things to the fore. So far in 2022, we have seen the UK lay out a strategy to build 8 nuclear power plants, Japan signal a return to nuclear power, the US further support its nuclear plants including the Inflation Reduction Act and California trying to u-turn on closing the Diablo Canyon nuclear plant, not to mention a spate of plans for small-modular reactors in Europe. This unexpected increase in future demand merely underscores the supply deficit and potential upside for uranium.

Shipping/Tankers: 12.6% NAV

Major change through sale of ~40% of the position across all names

The decision to trim the position was relatively easy as OM the Shipping/Tankers position is up 100%+ in 2022. Tankers have been a significant beneficiaries of the energy market turmoil caused by the Ukraine/Russia crisis. As simple example, pre-conflict a small Aframax tankers would fill-up in Russia make the short run to Europe (Rotterdam) and then head back to refill. Due to the conflict this has become something akin to a couple of Aframaxes fill up in Russia, head out to sea to a ship-to-ship transfer to a larger VLCC, which then travels all the way to India or China (and back again), while other tankers service Europe with oil from the US or Middle East. While this is a massive simplification it’s a good demonstration of how inefficient today’s reality is compared to pre-conflict! Tankers are traveling a lot of extra miles and with fixed supply, unsurprisingly price is the variable that has changed.

So why keep the position (and in larger size vs. end-2021). The tanker fleet is getting old and the order book is the lowest since 1996 so supply will be constrained for a long time. Furthermore, while Tankers will be hurt if/when there’s a resolution in Ukraine and/or a recession, we’re also unlikely to revert to the pre-crisis trade routes. This is especially the case when we look at where the oil is being exported (US oil production/exports near all time highs), where the refineries are and where the end consumers are.

Given the above, OM leans to the view that the dislocation phase of the tanker trade is over, and the tanker market super cycle is finally beginning. To reflect this, OM will move Tankers from dislocation to thematic at year-end. The operating and financial leverage (and shady management) in the businesses means it won’t be smooth sailing and the position sizing reflects that and the thematic nature.

Tin: 8.3% NAV

Minor change through increasing the position in Alphamin Resources (AFMJF)

The tin price has been very volatile over the last year; the current $21K price is down over 50% from its 2022 peak yet also near historical pre-COVID highs. However, there’s been little change to the long-term outlook and the same demand-supply dynamics remain (https://ourmaninnyc.blogspot.com/2021/05/the-adventures-of-tintin.html). OM took the opportunity to add to the Alphamin position; it is a largely debt free company that’s profitable at these prices as the lowest cost major producer, and it also has the largest untapped tin deposit adjacent to its existing mine.

International: India (6.7% NAV), Greece (3.5% NAV) and Brazil (2.2% NAV)

Minor change, exiting Vietnam but adding to Brazil

The position in Vietnam was exited – while Vietnam will benefit from supply chains being diversified from China, it’s more likely that many of these supply chains will be brought back to Americas than prior to COVID/Ukraine.

OM added to the position in Brazil – it’s a commodity rich country, with a cheap market, where interest rates (at 13.75%, from 2020 lows of 2.00%) are nearer the end of their cycle and with a pivotal election later this year. It’s something OM continues to spend more time on, and if it’s going to be sized up meaningfully then OM will write in greater depth. OM is additionally looking at Turkey, as a potential investment idea.

Equities/Funds: 5.6% NAV

Major change: exited all of the Funds’ positions (GVAL, CWS, ARTTX, and CAPD) and added marginally to JOE.

The biggest change to the portfolio was OM exited the Funds’ positions. This is something that OM has been toying with for much of the last year – the positions were introduced a while ago to provide some consistent equity exposure as OM was chronically underinvested. Today, OM has vastly more ideas, greater conviction in them, and a better understanding of his own investment style. As such, there’s somewhat less need for the Funds positions and their capital will be allocated elsewhere.

Software/Tech (2.8% NAV) and Biotech (5.0% NAV)

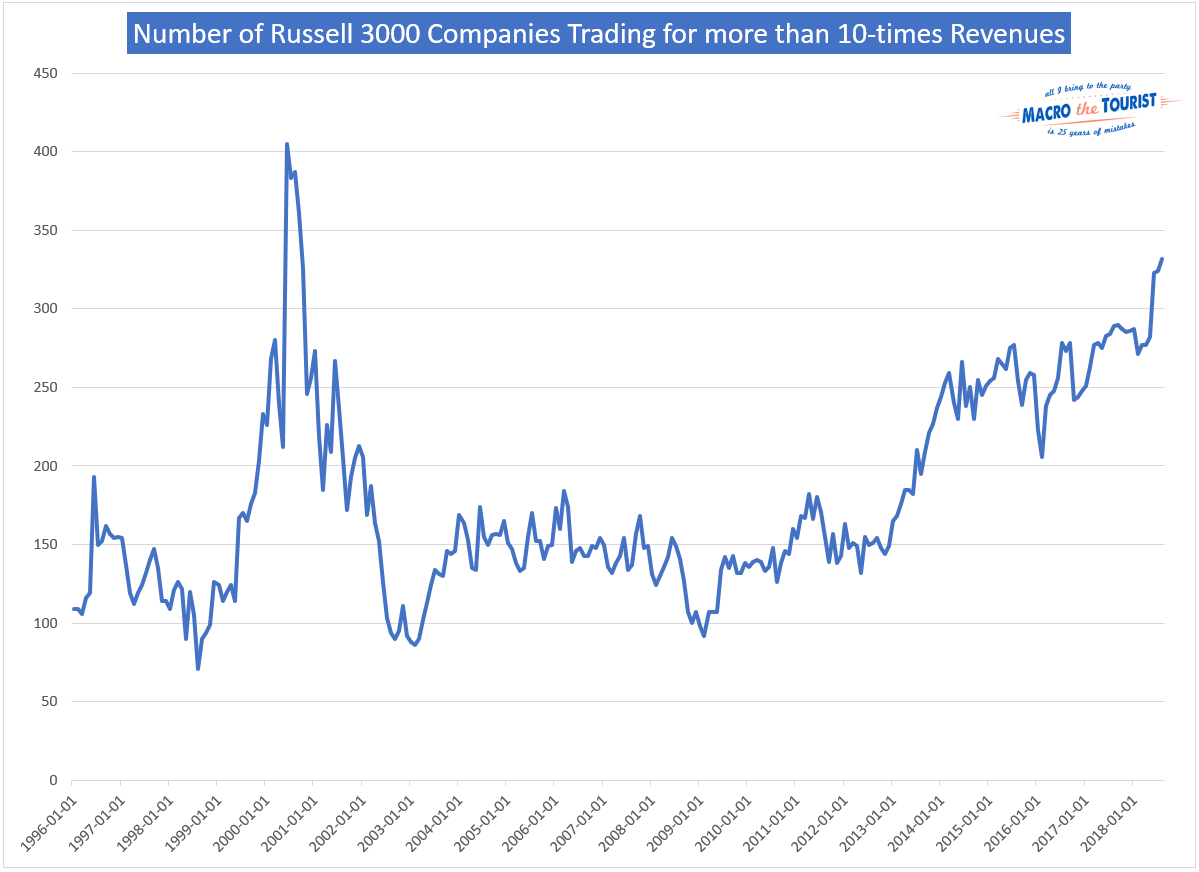

No changes, though both Software and Biotech are approaching levels that are beginning to get attractive.

Carbon Credits: 0.0% NAV

OM exited the position in Global Carbon Credits (KRBN)

While OM is intrigued by the Carbon Credits space, in part because it would take a material event to push Europe and California away from believing their carbon cap-and-trade systems were part of a green solution. Unfortunately, the Ukraine conflict and its impact on energy and electricity prices in Europe is such a material event. With Europe representing 50-60% of KRBN and a debate beginning to emerge (https://www.euractiv.com/section/emissions-trading-scheme/news/eus-von-der-leyen-rebuffs-polish-call-to-suspend-carbon-market/) over pausing Europe’s cap-and-trade system, OM decided to exit the position. However, you should expect to see it back in the portfolio in the future though it may be expressed differently (e.g. KCCA, which just reflects California’s Carbon Allowance system and is trading much more attractively).

Blockchain: 4.1% NAV

Marginal Change; exited Bitcoin (GBTC) but added to position in Overstock (OSTK)

OM was long overdue in exiting the Bitcoin investment, which turned a great profit into a healthy one. The capital was largely reallocated to the position in Overstock (OSTK). The broad outline of the case for OSTK is largely unchanged since OM’s original write-up. The developments include the Founder/CEO departing and Overstock moving its blockchain assets into a vehicle that’s managed by a professional VC. The most prominent of these blockchain investments – tZERO Group – is a blockchain based exchange that is regulated by the SEC and FINRA. It received a strategic investment from Intercontinental Exchange (ICE, who run the New York Stock Exchange) earlier this year, which saw David Goone (a long-time ICE executive) become tZERO’s CEO.

Commodities: 1.5% NAV

No changes.

OM is tentatively interested in increasing the size of this bucket, especially if recession fears increase and prices become more attractive. After a decade of underinvestment there are supply/demand imbalances across many commodities, which are a core component of electric vehicles and the buildout of renewable energy. However, OM is cognizant of the strong correlation of this bucket with a number of others in the portfolio (e.g. Uranium!), especially when markets are stressed or recession fears increase.

Shorts/Hedges: 5.7% NAV

Marginal change; added to OM’s position in PFIX

OM expects that future interest rates over the next 5-7 years will be higher than historical ones over the last 5-7 years. For simplicity, PFIX invests ~50% of its capital into a US Treasury Bond (5-year) and uses the balance to purchase put options at 4.25% on the 20-year rate, expiring in May 2028. In essence, with the value of the Treasury Bond providing a floor for PFIX should OM be wrong, the option provides substantial upside should medium term rates move beyond 4.25%.

Cash: 16.8% NAV

As a result of the portfolio changes, especially the liquidation of the Funds and reduction in Shipping/Tankers, OM is holding substantially more cash. This cash level reflects OM’s view of the uncertainty in the economy and markets but expect OM to slowly start to invest it as either this fades or prices become more attractive.

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take it that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.