Portfolio Update

OM made some portfolio sales near the very start of the quarter:

- Uranium: OM trimmed his Uranium positon by approximately 1/5, reducing the positions in URNM, CCJ, NXE and URG. Though OM felt that the launch of SPUT (see below) would have a positive impact, he expected it to come largely after SPUT’s NYSE listing in the US – it came much more quickly. These positions were in the most established Uranium miners in OM’s portfolio, with the smaller more speculative positions in the theme unchanged. As a result, the risk in the Uranium theme fell by less than 20%.

- Energy: OM exited the position in Antero Resources (AR), as it reached his fair value target after tripling from his initial purchase price in October 2020. Unfortunately, it proved too early as the natural gas crisis in Europe saw AR rise rapidly at the end of Q3.

- Tankers: OM trimmed his tankers position, through reducing STNG and EURN. The medium-to-long term prospects continue to look good for tankers on both the demand and supply side. Demand for oil/oil products is slowly/steadily returning as COVID wanes globally, and the supply book remains tight – owners are finally starting to scrap ships, and the strength in other shipping segments means there will be little room in shipyards for any new tanker orders till after 2025! However, until demand hasn’t recovered sufficiently for tankers to receive the hockey stick pricing seen in other shipping segments, and after strong performance YTD the stocks were well ahead of rates.

Before making some purchases at the start of September

- Idiosyncratic: OM added to his position in JOE.

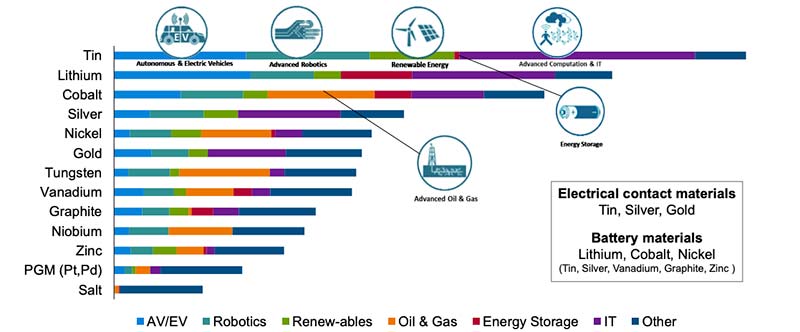

- Tin: OM added a position in Cornish Metals (SBWFF) – a junior Tin miner - to the portfolio after it continued to post encouraging results. Fundamentally, Tin remains OM's highest conviction idea though it lacks Uranium's reflexivity and has limited investment options.

- India: OM added to his India exposure through adding the MSCI India Small Cap ETF (SMIN), reflecting increased willingness to build the position following the delta variant.

Performance and Review

The start of the second quarter of 2021 saw the portfolio continue to outperform markets, though this reversed meaningfully in June. OM’s portfolio ended the quarter rising +6.3%, and trailed both the S&P 500 Total Return (+0.6%) and the MSCI World (Net, +0.6%). For the year, this leaves OM’s portfolio up +38.0%, with the S&P 500 TR (+15.9%) and the MSCI World (Net, +14.8%).

(OM: Performance numbers updated. Apparently automating something is only good if you remember to check it works!)

Third Quarter Attribution

The portfolio continued to benefit from its exposure to Uranium (+495bps), which remains the largest position. The moves in uranium were catalyzed by Sprott completing its transaction for the renamed

Sprott Physical Uranium Trust (“SPUT”). In mid-August, SPUT activated its at-the-money financing facility, which allows it to raise capital (at market prices) when SPUT is trading at a premium to NAV. This new capital is then used to purchase more physical uranium! In the back half of the quarter, SPUT raised over $450million and used it to buy almost 11 million pounds of Uranium. These purchases helped drive the spot price up to almost $50, ensuring full reflexivity as this was reflected in SPUT’s NAV and price, which helped draw further interest (and investment) in SPUT and the Uranium equity ETFs. Perhaps, even more importantly the long-term contract price also rose materially for the first time in years, to over $40! OM continues to believe it’s relatively early in the uranium bull market, and the current energy issues are further highlighting nuclear’s importance. While SPUT continues to raise capital (and a potential Q1-22 NYSE listing will further help) and with

seasonal impacts helping uranium, the reflexivity is likely to continue. OM remains quite content to run an over-sized position and weather the volatility that comes with.

OM’s exposure to other commodities was also beneficial. While the exposure to Tin (+63bps) wasn’t a massive driver, the thesis continues to strengthen, is entirely underappreciated, and the stocks are now reflecting but lagging the strong price action in the physical commodity. With Alphamin Resources (AFMJF) set to announce drilling results as well as become debt free in Q4, it remains the position that OM is most comfortable in. The small Energy exposure (+185bps) came from Sandridge (SD), which benefited from its fundamental improvements, as well as the sharp run-up in natural gas prices following its decision to remove hedges earlier in the year. Finally, while not a commodity, OM’s Blockchain positions – especially in Bitcoin (GBTC) and Ethereum (ETHE) – are benefitting from many of the same factors. In what seems to be a time of rolling bubbles, OM wouldn’t be surprised if cryptos reinflated over the next six months.

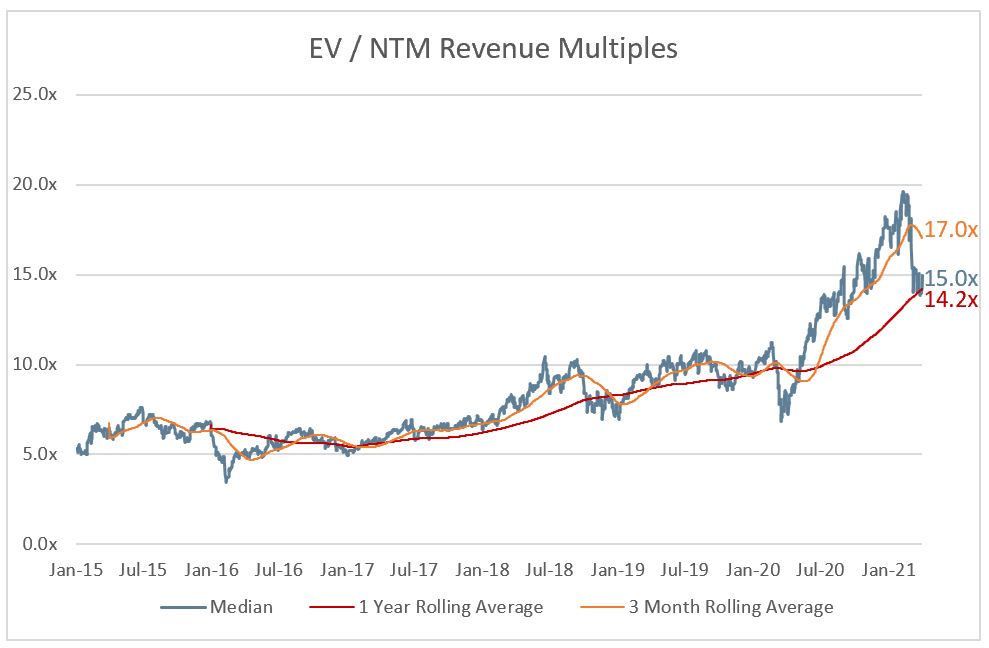

OM managed to lose money in just about every other position in the portfolio, though most were largely immaterial. The Technology - 4th Industrial revolution (-3bps) and Biotech (-15bps) are both longer duration strategies, and have both struggled this year. OM’s position in Oil and Product Tankers (-40bps) continues to bounce around, as oil demand slowly recovers. While the short-term turn seems no closer, the long-term prospects continue to improve. The scrapping of older vessels is increasing and new supply continues to dwindle. The strength in other shipping markets, has resulted in orders for those segments and means that shipyards are being booked into the mid-2020s. OM’s broad international exposure posted small losses – Vietnam (-29bps), Brazil (-11bps) and Greece (-4bps) – though this was partially offset by the increased India (+27bps) exposure.

The largest loss came in the Idiosyncratic bucket (-75bps), with both St Joe Company (JOE) and Texas Pacific Land Company (TPL) detracting from performance. Though both companies own significant amounts of land in Florida (JOE) and Texas (TPL) there was no specific reason that drove the stocks negative performance. Finally, the Funds (+15bps) produced a mild positive contribution.

Portfolio (as at 09/30/21 - all delta and leverage adjusted, as appropriate)

Dislocations: 44.4%

26.2% - Uranium (URNM, CCJ, NXE, PALAF, DNN, BNNLF and URG)

10.7% - Shipping/Tankers (STNG, INSW, EURN, TNK and DHT)

4.1% - Greece (GREK & ALBKY)

3.4% - Energy (SD)

Thematic: 30.7%

9.3% - Blockchain/Crypto (GBTC, ETHE, and OSTK)

5.0% - Tin (AFMJF, MLXEF and SBWFF)

4.6% - Tech: 4th Industrial Revolution (JD & WCLD)

4.4% - India (INDA and SMIN)

3.5% - Vietnam (VNM)

3.4% - Biotech: 4th Industrial Revolution (IBB & XLB)

0.4% - Brazil (EWZ)

Technical: 0.0%

0.0% - OEW Technical positions (DDM, SSO, and QLD)

Idiosyncratic: 15.8%

11.5% - Funds (ARTTX, CWS, GVAL, and CAPE)

4.4% - Equities (TPL & JOE)

Shorts/Hedges: 0.0%

Cash: 9.2%

Disclaimer: Nothing above represents a recommendation in any way, shape or form so please don’t even think of trying to take it that way. For added clarity, while Our Man is invested in all of the securities mentioned that’s a terrible reason for anyone else to do so. Our Man also holds some cash and a few other securities (of negligible value). You should not buy any of these securities because Our Man has mentioned them, but should do your own work and decide what’s best for you given your own circumstances/risk tolerance/etc.