As some of you may have noticed, despite the attempted rallies, the markets have not been a pretty sight this month! No doubt, if you’ve had the misfortune of watching the terrible talking heads you’ve no doubt heard it’s all the politicians fault (debt-ceiling muppetry), or S&P’s (how dare they downgrade the US from AAA), or the Europeans (call that a plan for dealing with Greece, Ireland and Portugal and Spain and err Italy), or companies (how dare they say things aren’t as rosy as the talking heads would like) or just the whole world (damn the whole globe for a global slow-down!). As you know, Our Man believes that markets are far more of a Bak-Tang-Wisenfeld sandpile and when they’re in a “critical state” it only takes one stray grain of sand landing in the wrong spot to bring it all down; thus, there’s little point blaming the particular grain of sand whether it’s European, Global, political, economic or company fundamentals!

Given that, here’s some graphs showing you why (or perhaps, that) we’re in a critical state!

1) Valuation

Look, the CAPE (or Shiller PE10) isn’t perfect and certainly isn’t useful as a timing device but it does provide the single best (and historically tested) look at valuation on a long-term basis. Forget what you hear about markets being cheap (especially when it’s drivel like based on analyst-projected operating earnings) and suck it up…equity markets have been expensive by historical standards for well over a decade! If CAPE isn’t your long-term valuation measure of choice, how about Tobin’s Q or Market Cap-to-GDP (Buffet's favourite, apparently).

2) Corporate Fundamentals

(Graph courtesy of Bill Hester, Hussman Funds)

If you want to buy stocks that are not only expensive but whose profit margins are close to their all time highs, then that’s your prerogative. It’s certainly possible that margins improve and we see record highs, but is that really something you want to bet on.

3) Signs of Economic Slowdown

Sure, this is just a PMI graph for China and it’s barely crossed into the recessionary (<50) readings but pick a major economy, and this and the leading indicators all look the same. So far that’s over-valued stocks, with near peak margins and signs of global economies cooling…doesn’t exactly sound like a recipe for success.

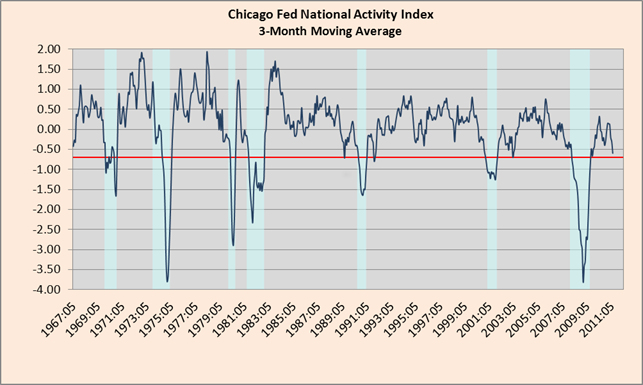

4) US Economic Data is pretty either

There’s no great way of telling how the economy is doing in real-time, but the Chicago Fed’s National Activity Index is a good start (I’d also point you in the direction of the Philly Fed’s ADS Index . You’ll notice that they’re not telling a happy tale at the moment with both so far above, but flirting with, recession-like levels (and noticeably worse than 2010’s dalliances).

5) Italian yields have seen better days

The ECB's buying of Italian and Spanish bonds this week has clearly helped lower their yields from the danger levels seen last week, but the risk is that it's coming at the cost of putting France into the firing line. With the Italian’s having 120% Debt-to-GDP, will France and Germany risk their AAA status (which is vital to the EFSF) to buy Italy time for reform and austerity? Perhaps, will it work out as well(!) as buying Greece time by bailing it out last year has? Probably, and that's what should worry you!

6) The Charts

(Courtesy of OEW/Elliott Wave lives on)

Look, Our Man will never profess to be a technical analyst, or to fully appreciate its wares, but he does have a small crush on Objective Elliot Wave analysis, what with its relation to behavioural theory and market psychology and all. It’s not perfect but given OEW's track record, when it flips from a bull market to bear market (and vice versa) then Our Man thinks you should at least listen (especially since they’ve been suggesting the bull market might be ending since May, with increasing conviction through July).

In conclusion, these are the little things that make a market interesting. They have been on the brink of a “critical state” for a while now so blaming any one thing is foolish. Our Man didn’t own much equity before and he sure as hell won’t be using this correction to load-up, and instead will only be nibbling at the odd thing that becomes exceptionally cheap under the security blanket that his puts offer. What'd it take for OM to load-up? Well, a good starting point to thinking about having a reasonable equity position would be when valuations were cheap (i.e. CAPE under historical mean) and margins were small; and Our Man would "fill his boots" should he ever see a CAPE near its historical lows and margins near theirs (but we're talking an S&P of c400 for that to happen, so don't hold your breath). As for everyone else (in the whole wide world), they make their own decisions and that’s what makes a market!

Special Bonus Chart: That downgrade…

It didn’t seem to cause any immediate spike in Japanese yields! Interestingly, US yields have also collapsed post-downgrade…not exactly what the talking heads had in mind! Apparently, inflation (and inflation expectations) & GDP growth (and growth expectations) have more impact on what bond investors do and where yields trade than an S&P rating. Colour me shocked!

Thursday, August 11

Wednesday, August 3

July Review

Portfolio Update

There were no changes to the portfolio during July.

Performance Review

After positive performance on each of the first 8 trading days of July had safely ensconced the book well into positive territory, the portfolio bounced around to ultimately end near the mid-point between its intra-month high and low. The result was a strong July, with the portfolio finishing +1.4% for the month bringing the year-to-date performance (-0.1%) to the brink of flat.

After positive performance on each of the first 8 trading days of July had safely ensconced the book well into positive territory, the portfolio bounced around to ultimately end near the mid-point between its intra-month high and low. The result was a strong July, with the portfolio finishing +1.4% for the month bringing the year-to-date performance (-0.1%) to the brink of flat.

With all the words spent discussing US default as the debt-ceiling debate intensified into month-end, it would be reasonable to think that the L Treasury Bonds book would have suffered. This thought would have been mistaken, as the book drove performance (+159bps) largely on the back of a seemingly continual stream of disappointing economic data. The Bond Funds book (+42bps) also contributed strongly.

The Equity books were somewhat disappointing. The NCAV book (+2bps), which has underperformed so far this year, largely weathered the storm while the limited size of the Short China (-1bp) and Energy Efficiency (-1bp) books meaning that they had no real impact on the portfolio. Disappointingly, both the Other Equities (-17bps) and the Put/Hedges (-13bps) books suffered more than might have been expected, with the Silver puts largely responsible for the latter’s performance. The Value Equity book (-37bps) was again the worst performing book, with both positions suffering from their longer-term thesis as risk aversion increased. While we remain in a risk-off period both THRX and DRWI are likely to continue their struggles in the coming months, with neither likely to have a major catalyst till late-2011/early-2012. Given their limited size in the portfolio, while the volatility makes for uncomfortable month-to-month performance, it is a risk that the portfolio can comfortably underwrite and there are likely to be opportunities to add to both names at attractive prices in the days and weeks ahead.

The portfolio’s Currency exposure (+4bps) was positive, despite the latest European bailout. My opinion is largely unchanged; today’s situation bears a certain analogue to the failure of Credit-Anstalt (in 1931) and the dominoes that subsequently toppled due to the poor handling of the issues of the day. I believe that we are continuing to witness the slow-motion toppling of dominoes, resulting from too much debt (i.e. debt beyond a level that can realistically expect to be repaid). It was started by the US subprime crisis but has now spread its epicenter to European sovereigns fanned by a global unwillingness to accept failure (especially of banks), to force bondholders to accept their investment risk (i.e. default), and a refusal to treat the source of the crisis (too much debt which means more debt is not the solution) rather than the symptoms (liquidity issues). Europe’s single currency experiment (removing the option of devaluation, for the weak) and its bureaucratic structure are amongst the reasons that the ricochet has bounced there first.

Portfolio (as at 6/30 - all delta and leverage adjusted, as appropriate)

36.9% - Treasury Bonds (Aug-29 Bond & TLT, and 76bps premium in TBT Jan-13 puts)

22.1% - Bond Funds (VBIIX, DLTNX and HSTRX)

5.0% - Value Idea Equities (THRX, and DRWI)

3.0% - NCAV Equities

2.4% - Other Equities (NWS, CMTL and SOAP)

36.9% - Treasury Bonds (Aug-29 Bond & TLT, and 76bps premium in TBT Jan-13 puts)

22.1% - Bond Funds (VBIIX, DLTNX and HSTRX)

5.0% - Value Idea Equities (THRX, and DRWI)

3.0% - NCAV Equities

2.4% - Other Equities (NWS, CMTL and SOAP)

0.3% - Energy Efficiency (AXPW)

<-0.1% - China-Related Thesis (6bps premium in FCX put)

-1.1% - Hedges/Put Options (14bps premium in S&P Dec-11 puts, 17bps in IWM Jan-12 puts, and 17bps SLV Jan-12 puts)

-6.7% - Currencies (EUO – Short Euro)

28.0% - Cash

<-0.1% - China-Related Thesis (6bps premium in FCX put)

-1.1% - Hedges/Put Options (14bps premium in S&P Dec-11 puts, 17bps in IWM Jan-12 puts, and 17bps SLV Jan-12 puts)

-6.7% - Currencies (EUO – Short Euro)

28.0% - Cash

Disclaimer: For added clarity, Our Man is invested in all of the securities mentioned (Aug-29 Treasury Bond, TLT, TBT puts, VBIIX, DLTNX, HSTRX, THRX, DRWI, NWS, CMTL, SOAP, AXPW, FCX puts, SPY puts, IWM puts, SLV puts and EUO). He also holds some cash.

Subscribe to:

Posts (Atom)